Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

October 30, 2015

|

Now that we have got a sneak peek into what multibaggers are and how to look at them, it’s time to focus on how will they make up your portfolio. To start with, let’s be clear that there is no secret recipe to guide you into deciding how many and what kind of stocks you may need to own, to create a so called ‘Diversified Portfolio’. Proper diversification makes sure that the positive performance of some scrips will neutralize the negative performance of the others. So does that mean that your portfolio is diversified if you are a proud owner of say 40 - 50 scrips? The answer is a NO in most cases! Let us understand why…

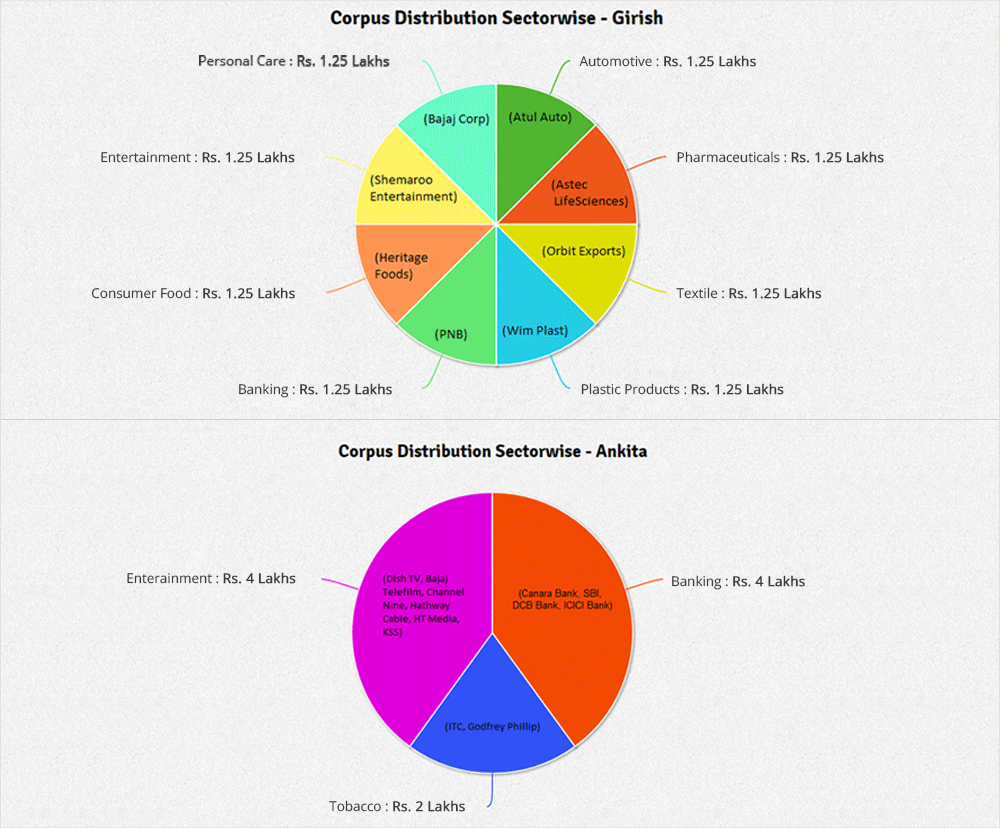

Consider portfolios of two people; say Ankita and Girish, both of them having an equivalent corpus (Rs. 10 lakhs). Following are the stocks which they own:

(Kindly note that the above given corpus allotments to each sector as well as the sector selection is for understanding purpose. We will learn more about it below.)

Now comes the age old saying – “Don’t put all your eggs in one basket…”; Well, it’s a good advice, when some of your stocks are lagging, others may be gaining. This way, you won't feel pressure to sell your fundamentally strong picks during times of panic. Let us understand how is it applied in our example. Say the RBI unexpectedly hikes the repo rate due to some reasons. This will cause a slide in the banking shares. Repo rate is the rate of interest that banks pay when they borrow money from the RBI to meet their short-term fund requirements. So, who will tend to lose more, Ankita or Girish? Well the answer is obvious – Ankita as a major chunk of her corpus is into the banking sector. On the other hand Girish will tend to lose a small amount as he has spread his investment smartly. Don’t forget that a lot of sectors are affected indirectly due to a repo rate hike but, I suppose you got the point. Just for your knowledge, most debt ridden companies are affected when there is a rate hike.

Broadly, there are four steps into building a diversified portfolio:

Starting with Sector Selection, see below are some multibagger recommendations given by StockAxis in the last 24 months.

| Scrip Name | Sector | Reco. Price (INR) | Reco. Date | Peak Price after our Reco. (INR) | Peak Price Date | % Profit |

| Atul Auto Ltd. | Auto - 2 & 3 Wheelers | 84.00 | 03-Sep-13 | 721.80 | 19-Jan-15 | 759% |

| Amara Raja Batteries Ltd. | Auto Ancillaries | 316.00 | 09-Oct-13 | 948.00 | 28-Jan-15 | 200% |

| Cera Sanitaryware Ltd. | Ceramics & Granite | 603.00 | 21-Oct-13 | 2,960.90 | 15-Apr-15 | 391% |

| MPS Ltd. | Printing & Stationery | 187.00 | 20-Nov-13 | 1,095.00 | 20-Apr-15 | 486% |

| Aurobindo Pharma Ltd. | Pharmaceuticals | 185.00 | 18-Dec-13 | 716.00 | 17-Apr-15 | 287% |

| Granules India Ltd. | Pharmaceuticals | 26.10 | 06-Feb-14 | 121.60 | 30-Jul-15 | 366% |

| Natco Pharma Ltd. | Pharmaceuticals | 803.00 | 25-Feb-14 | 2,709.00 | 07-Apr-15 | 237% |

| JB Chemicals & Pharmaceuticals Ltd. | Pharmaceuticals | 141.00 | 17-Apr-14 | 297.40 | 05-Aug-15 | 111% |

| Kitex Garments Ltd. | Textiles - Readymade Apparels | 118.00 | 30-Apr-14 | 1,070.00 | 03-Jul-15 | 807% |

| JBM Auto Ltd. | Auto Ancillaries | 87.90 | 16-Jul-14 | 309.90 | 13-Nov-14 | 253% |

| Capital First Ltd. | Finance - General | 250.00 | 18-Jul-14 | 464.80 | 15-Apr-15 | 86% |

| Plastiblends India Ltd. | Plastics | 216.00 | 22-Jul-14 | 399.00 | 11-Aug-15 | 85% |

| Astec LifeSciences Ltd. | Pharmaceuticals | 61.70 | 30-Jul-14 | 304.00 | 21-Jul-15 | 393% |

| Control Print Ltd. | Trading | 159.00 | 19-Aug-14 | 389.90 | 06-Aug-15 | 145% |

| Jenburkt Pharmaceuticals Ltd. | Pharmaceuticals | 220.00 | 20-Aug-14 | 542.80 | 05-Aug-15 | 147% |

| Ahmednagar Forgings Ltd. | Castings & Forgings | 290.00 | 20-Aug-14 | 519.80 | 24-Nov-14 | 79% |

| Mold-Tek Packaging Ltd. | Plastics | 150.00 | 10-Sep-14 | 260.00 | 05-Dec-14 | 73% |

| Orbit Exports Ltd. | Textiles - Weaving | 280.00 | 28-Oct-14 | 494.80 | 17-Jul-15 | 77% |

| Fiem Industries Ltd. | Auto Ancillaries | 925.00 | 15-Jan-15 | 945.30 | 15-Jan-15 | 2% |

| Indian Toners & Developers Ltd. | Dyes & Pigments | 90.50 | 15-Jan-15 | 130.00 | 05-Aug-15 | 44% |

| Heritage Foods Ltd. | Food Processing | 310.50 | 19-Mar-15 | 472.00 | 22-Jul-15 | 52% |

| JBF Industries Ltd. | Textiles - Manmade | 191.50 | 24-Mar-15 | 318.40 | 31-Jul-15 | 66% |

| Wim Plast Ltd. | Plastics | 1,272.00 | 28-Apr-15 | 2,499.00 | 10-Aug-15 | 96% |

| Indo Count Industries Ltd. | Textiles - Spinning - Cotton Blended | 605.00 | 10-Jun-15 | 1,036.25 | 06-Aug-15 | 71% |

| Acrysil Ltd. | Plastics | 490.00 | 12-Jun-15 | 799.00 | 07-Aug-15 | 63% |

| Cox & Kings Ltd. | Miscellaneous | 270.00 | 07-Jul-15 | 317.00 | 05-Aug-15 | 17% |

As one can see, the period was dominated by the pharmaceuticals, plastics and the textiles sector majorly followed by auto and a few others. So what can we learn from this? Firstly, understand the fact that a sector does not boom or collapse overnight. It takes time for a sector to pick up and time to sink as well. The real talent is identifying when it is going to take off. As in our recommendations, you can observe that from the end of 2013 till August 2015, the average gain amongst the pharma recommendations is close to 250%, which is a significant number taking just 24 months into consideration. Similar observations can be made for other sectors as well!

Now that we have learnt some things about the stock selection, particularly multibaggers in the previous article, let’s understand ‘corpus allocation’. Before going ahead, you need to digest the fact that the stocks follow the sector they belong to, so make sure you pick the right sector first.

Moving on, in addition to knowing how many stocks to own in your portfolio and which stocks to buy, the percentage of your portfolio occupied by each stock i.e. corpus allocation is just as important.

Corpus Allocation revolves around Sector Selection. Conventionally, dedicate almost the same amount to each stock but make sure that the stocks that you own belong to the sector in demand and hence you end up investing majorly in the right sector. Considering the above given 26 recommendations spread across 12 sectors, 6 of them were of pharmaceuticals i.e. more than 26% of the total calls. This means that the other 11 sectors should ideally get the remaining 74% and further divisions happen accordingly. Talking numbers, the investor should not allocate more than 10% - 12% of the corpus to one scrip and not less than 2% also. Underallocation shows lack of confidence. Let us understand the concept with an example: If a stock has 10% occupancy in your portfolio corpus, then a 20% change in its price will move your overall portfolio just by 2%. Eg., say your portfolio size is Rs. 2lakhs and 10% i.e. Rs. 20,000 is allocated to ITC. So even if ITC moves by 20% i.e. its value in your portfolio becomes Rs. 24000, the overall portfolio gain is just Rs. 4000 i.e. a mere 2%. If ITC would have been allocated 2% i.e. Rs. 4000, a 20% surge means ITC is now worth Rs. 4800 in your portfolio which is eventually a marginal 0.4% gain in your portfolio. Hope it is now clear to you that, rather than underallocating, rather not make the buy and instead divert the money to a scrip you feel confident in.

We have seen that great investors have a thing for investing a bigger chunk of their money into stocks that do well and a lesser amount in their bad picks. So how do they do it? The answer is their confidence in the stock. If you have a lot of confidence in the fundamentals of a stock, dedicate a major proportion of your corpus in that stock. So, weigh your preferences wisely.

Lastly, coming on to the monitoring part of the process, make sure do don’t check your portfolio 10 times a day if you are into multibaggers. It will do nothing but make you anxious. Multibaggers require patience. Check the movement during the quarterly results and accordingly position yourself.

One other question that might arise in is what is the ideal number of stocks to have in a portfolio to call it diversified? Well, there is no single correct answer to this question. A number of factors like your risk tolerance, your economy, your age, etc. Simply put, a 10 portfolio stock is better than a 2 portfolio stock if you are looking to minimize risk. As a general rule of thumb, most investors hold 15-20 stocks at the very least in their portfolios. Having a huge number of scrips in your portfolio is also very tedious if you don’t have a fund manager to take care of it whose fees in turn might eat up your profits. Over diversification also shows that you have no appetite for risk and you are low on confidence.

Keep in mind, diversifying your stock portfolio is a smart way to reduce risk, but not eliminate it. It spreads your investments so no one scrip will be deadly to your portfolio if it fails. It is no rocket science to build a good portfolio, but is no cake walk either. A high risk investor may have great confidence in a scrip and may allocate a big chunk of his investment in that one scrip, regardless of the arguments for diversification. He would be able to afford total loss in a worst case scenario but the profit potential is also large.

Modern portfolio theory has been built on the assumption that you can't beat the stock market and hence the best you can do is to match its performance. But StockAxis has a totally different perspective, our objective is to outperform the market and hence we believe in holding a stock and not trading for small profits.