Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

February 26, 2020

|

Have you ever heard that mutual funds can help you prepay your housing loan? You probably haven’t. Let us present a strategy, which will not only help you prepay your home loan, but also generate wealth for you at the same time.

Home loan rates have fallen over the last few quarters due to RBI’s policies and are currently hovering at around 8 to 8.5%.

The first hurdle an individual faces when he considers prepaying his home loan is losing the tax benefit available under section 24 for interest payment on the home loan and under section 80C on the principal repayment of the home loan. So, the question is, why you would want to prepay the home loan through mutual funds? Rather, you can keep the loan running and take the tax benefits, while you can still invest in mutual funds separately to grow your portfolio. Right? True, but what happens when you see stock markets fall and your investments lose value? On hindsight, you would wish you had exited your investments to prepay your home loan so that you could have had a dual benefit – prepay your loan and avoid the loss in investments. Besides, in any case, Indians are not comfortable with loans and would prefer to pay them off at the earliest. However, here is a back-tested strategy which will not only help you prepay your home loan, but also grow your wealth by investing in mutual funds.

Before discussing the strategy, let us put some basic assumptions which are used as a general rule of thumb.

As a general rule, your EMI should not exceed 35% of your monthly net income.

For example, if your net income is Rs. 1 lakh per month, then your EMI should not be much more than Rs. 35,000 as per the principals of risk management. This strategy requires investing 1/3rd amount of your EMI into mutual funds SIPs over and above your EMI amount.

So, let’s get started and understand how this strategy works.

We have considered returns from the stock markets from 1990 to May 2007 (about 17 years). Returns have been computed on a monthly rolling basis. Rolling returns are the average annualized returns taken for a specified period on every day/week/month and taken till the last day of the duration. So, it measures the fund’s absolute and relative performance over a period of time at regular intervals.

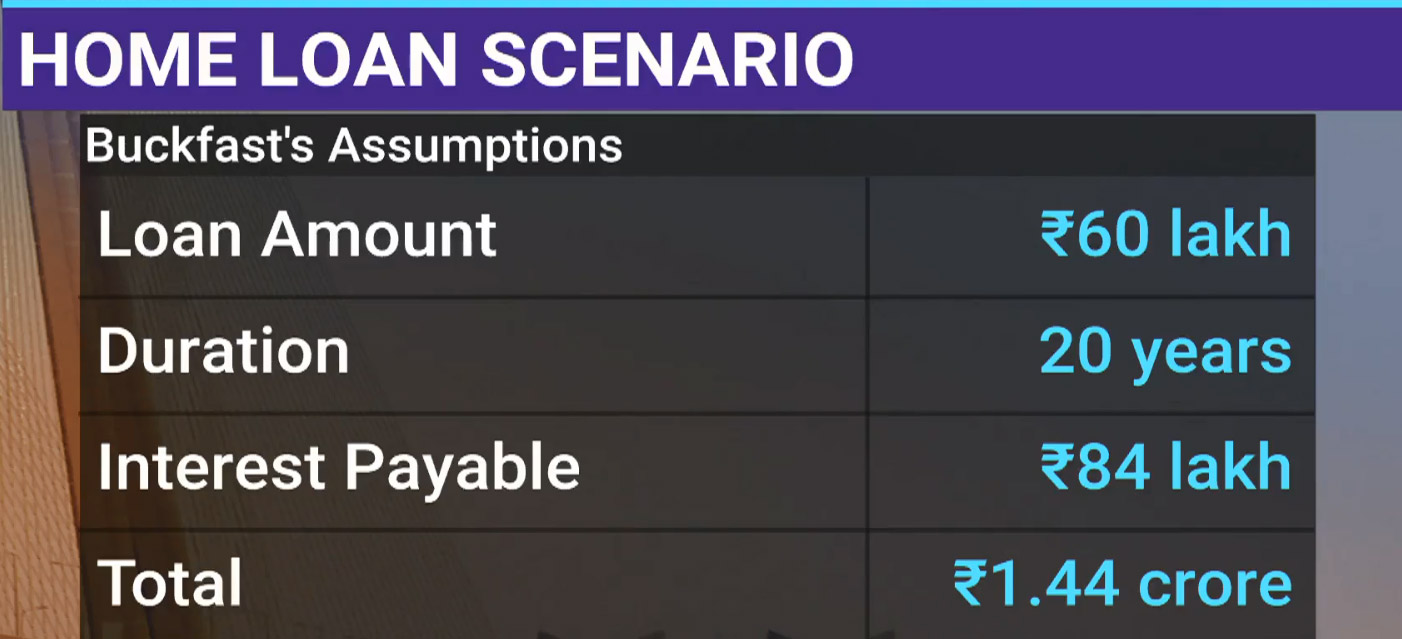

Home loan rates have been about 10.5% over the last 20 years and are currently around 8%, so an average of these rates has been considered in this example. In the above image, you can see that in 20 years, interest payable exceeds the loan amount; you pay a whopping Rs. 1.44 crores to the housing finance company on a loan of just Rs. 60 lakhs. For a housing loan of Rs. 60 lakhs, EMI is about Rs. 60,000 per month.

Now let’s see step by step how this strategy works.

You have an EMI of Rs. 60,000. Now you start a SIP in Nifty (In Nifty ETF or preferably in any Mid or Smallcap fund as mentioned earlier) for Rs. 20,000 per month. You also pay your EMI of Rs. 60,000.

Keep a target return on investment of 15%. This is 15% IRR (Internal rate of return -Annualized returns on your total investment value through SIP). When you achieve this 15% target, sell your investments, including entire gains, but retain your SIP investments for the last 12 months to avoid tax hassles. Note: this 15% target can be achieved in 36 months, or 48 months or even after 60 months. Let’s say you achieve 15% in the 48th month. Sell your investments equivalent to 36 months of SIP (including all gains) and retain SIP of the last 12 months. Use these funds to prepay your home loan (partly or fully depending on the amount of loan and amount you have in hand). In other words, pull your profits out of the markets by

While selling your investments, keep in mind that you must not stop your SIP investments. Continue with your monthly SIP of Rs. 20,000.

Analyzing historical data, we have found that on an average, you will achieve this 15% target about two or three times in the span of 20 years.

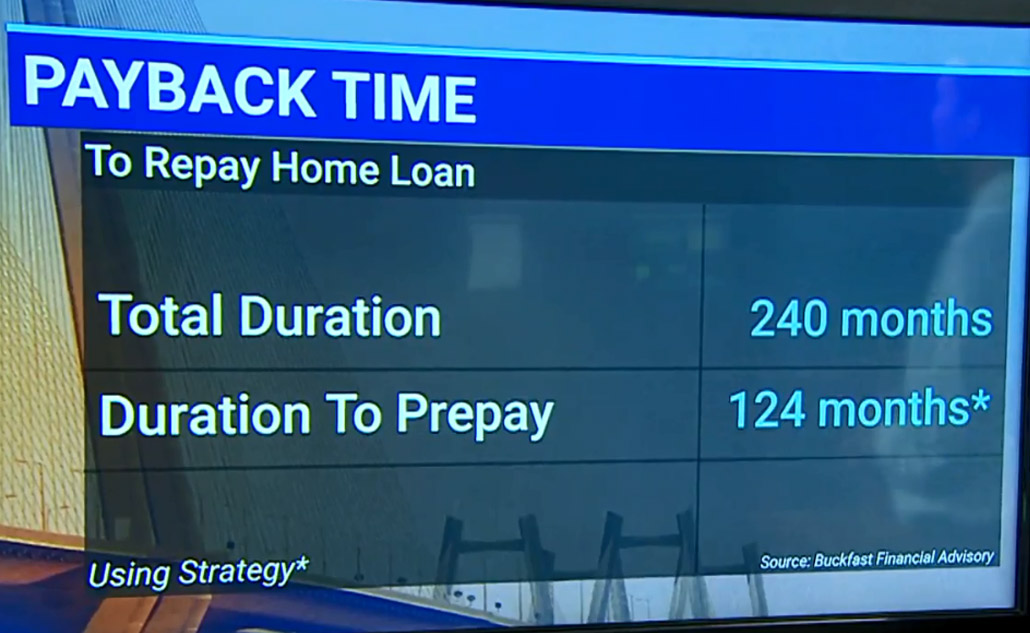

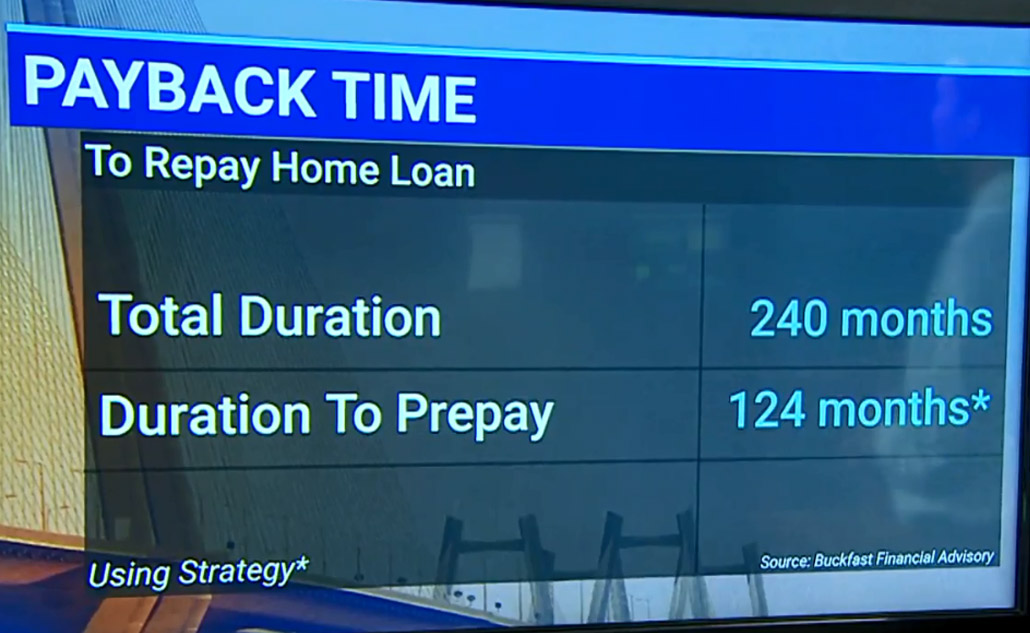

In this example, we have considered only topline Nifty returns without dividend yield which is 1.4% p.a. for the last 20 years. Even if we ignore the dividend yield and only consider topline Nifty returns (which we did in this case), we would have reduced our home loan repayment tenure from 20 years to less than 11 years as seen in the above image! Tremendous, isn’t it?

By this, you have not only used your SIP investments smartly to prepay your housing loan earlier than the scheduled 20 years, but you have also continued building wealth with your Rs. 20,000 SIP investments. Once you have prepaid your housing loan, you’re now investing Rs. 80,000 in SIP, which will then exponentially grow your wealth.

Let’s consider the market returns going forward from May 2007 (which is the last month till which we have considered rolling returns in our example since 1990, the loan initiation year). Let’s say you had taken a housing loan in May 2007 and followed this strategy. In this 12-year period (2007 to 2019), your loan would have been completely paid off. Clearly, history indicates that it takes on an average 11 years to prepay a 20-year housing loan.

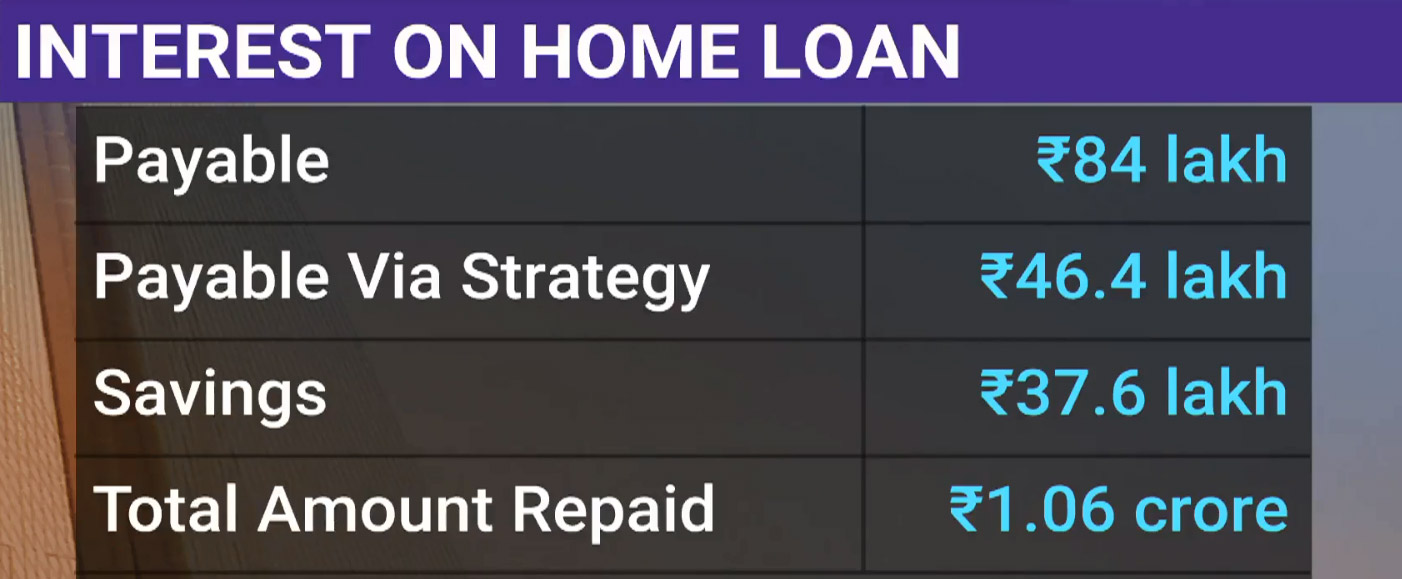

Following this strategy would have resulted in a huge saving in your home loan interest. By prepaying your home loan, your EMI on the remaining amount of loan stands reduced, which in turn, will reduce the amount of interest payable. In the previous example, you would have had to pay Rs. 84 lakhs as interest (which is higher than the loan amount itself).

By following this strategy, you would have saved Rs. 38 lakhs in interest payments on your housing loan. In other words, you have saved almost half of the total interest payable! Not only have you reduced your housing loan payments due to lower interest payments, by investing the amount you saved, you will be able to grow your wealth exponentially.

Let’s consider our first example of loan taken in the year 1990. You would have prepaid your 20-year loan in just 11 years (i.e. by 2011). After that, if you had invested as per Step 4. (i.e. continuing Rs. 20,000 SIP for the remaining original tenure of loan + converting the EMI of Rs. 60,000 per month for remaining original tenure of the loan into SIP as you no longer have an outstanding loan).

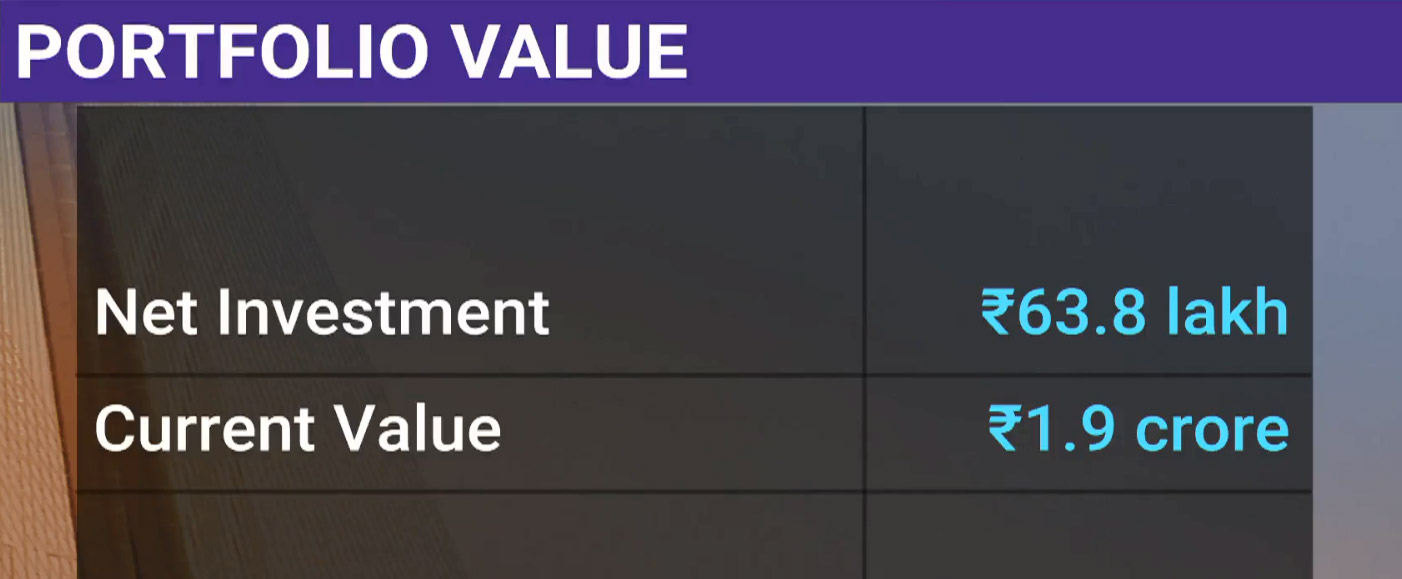

Take a look at how much that money would have grown to, by 2019:

Net investment = EMI that converted into SIP after prepaying home loan after 11 years (Conservatively we have taken 12 years for complete prepayment) + SIP of Rs. 20,000 for 20 years – Interest of Rs. 37.6 lakhs that you saved by prepaying your loan using this strategy.

Your total investments of Rs. 63.8 lakhs would have grown to a whopping Rs.1.9 crores! Using this strategy, you would have not only paid off your entire loan in nearly half of the total tenure, but you also have Rs. 1.9 crores in your portfolio as wealth as on date. So effectively, you have also grown your investments threefold.

This was the case if you had let your invested money stay in the markets till 2019. But let’s say for some reason, even if you had sold your investments after completion of original loan period of 20 years (i.e. by 2010), and not remained invested till 2019, your wealth in 2010 would have grown to Rs. 1.4 crores. This is also 2.25 times of your investment amount.

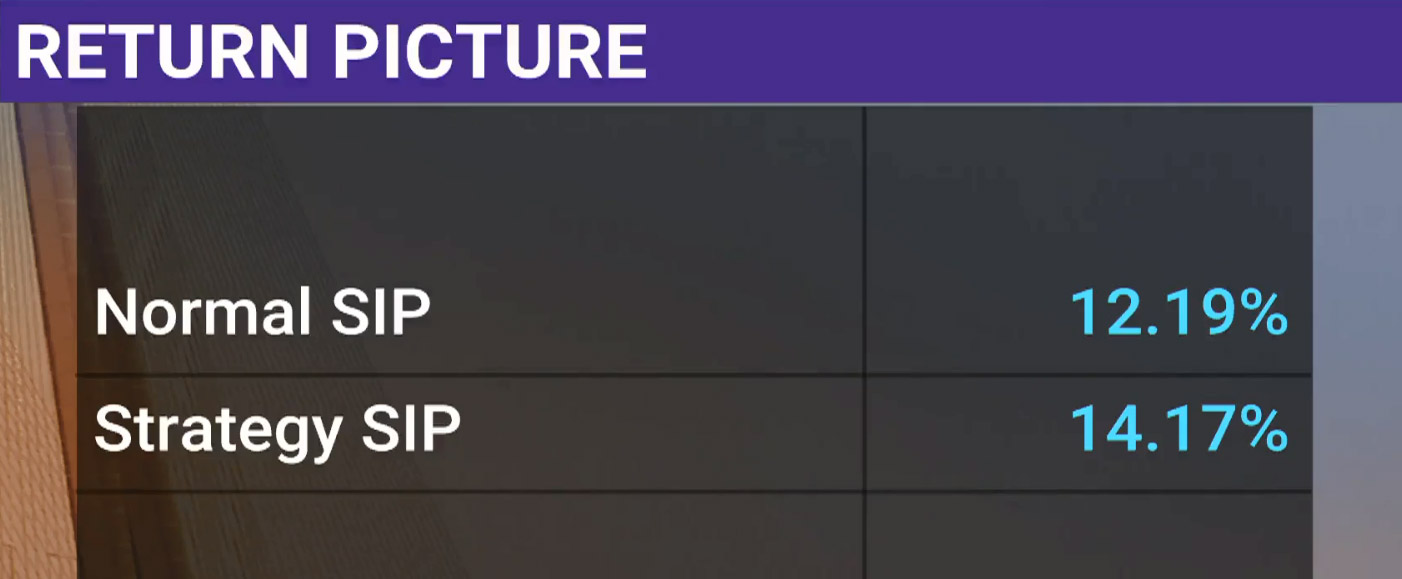

Clearly, returns through SIP from this strategy are better than the normal SIP.

Let’s take a look at the returns of this SIP strategy.

As evident in the above image, the returns from our SIP strategy beats the returns of normal SIP by close to 2%. This data has been back-tested since 1990. Had we considered dividend yield on Nifty, the returns would have been much higher.

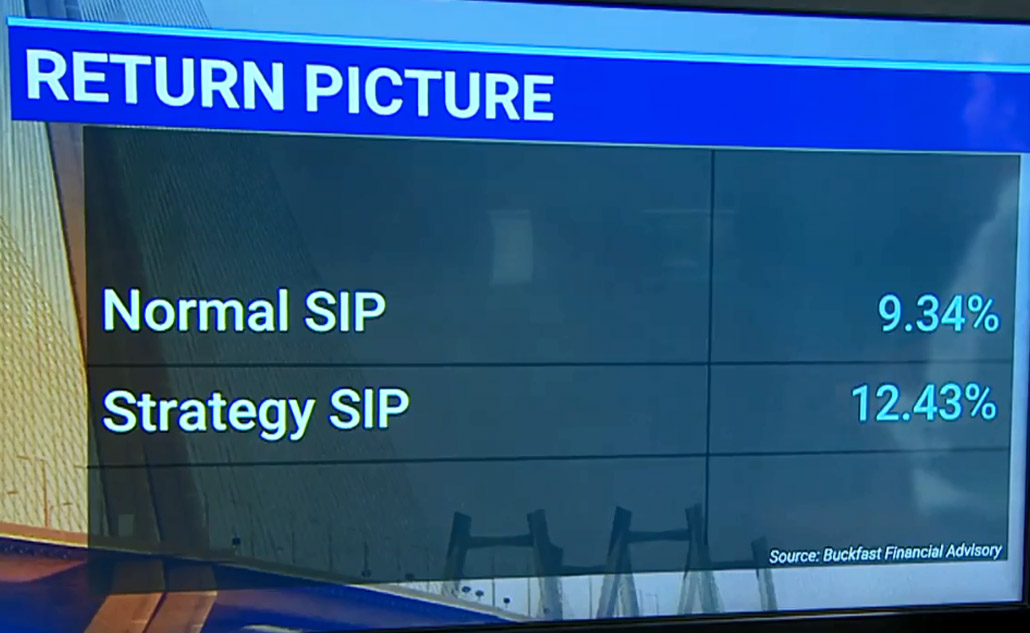

Now, let’s consider a case where we did SIP in a mid or small cap mutual fund as suggested earlier, rather than in Nifty ETF, for a comparison.

A general rule of thumb is that the mutual fund should beat its benchmark index (Nifty in our example). However, the question which strikes the mind immediately is, what if that mutual fund does not perform well over a period and significantly underperforms the Nifty? Would your entire planning and execution over the years to prepay your housing loan go in vain? To test this worst case scenario, we have assumed SIP over the course of your loan tenure in one of the worst performing funds – LIC Multicap Fund.

The case of LIC Multicap Fund.

This fund gave a modest return of about 5.2% CAGR over 25 years. If you had invested in this fund, you would have still beaten the normal SIP in terms of returns. This back-tested data indicates that you would have taken 124 months (a little more than 10 years) to prepay your housing loan even in this under-performing fund against the total tenure of 240 months (20 years). Recall that Nifty ETF took 130 months to prepay as against 124 months by this fund.

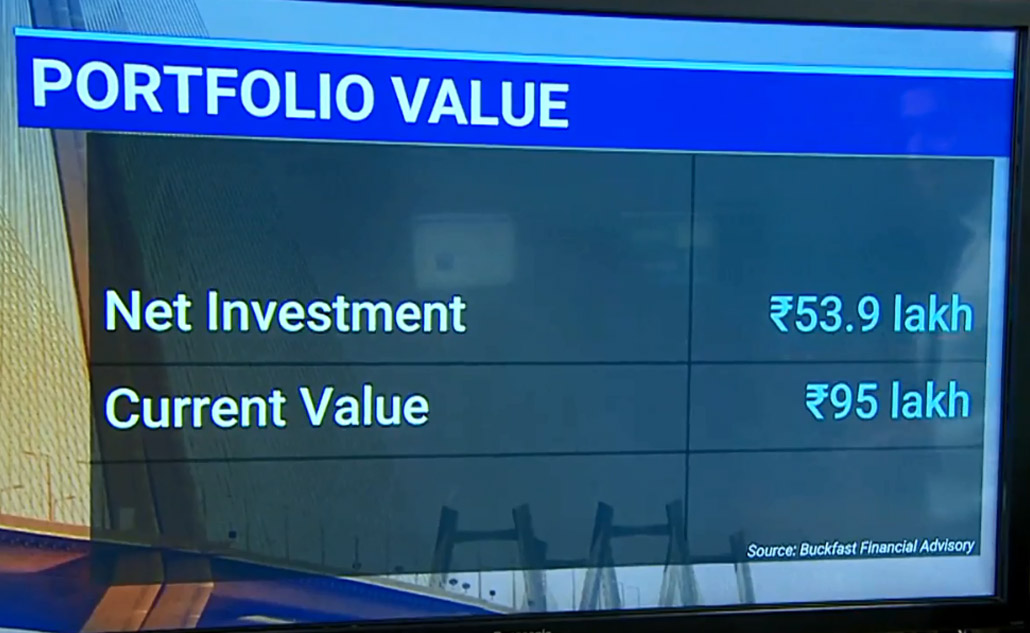

As we can see, despite investing in the worst performing fund, you can prepay your loan in a little more than half the entire home loan tenure. Assuming you continue your SIP investment and add on the EMI amount to your SIP for the balance tenure of the loan period (i.e. about 9 years), take a look at the amount of wealth you would have accumulated by investing through SIP in LIC MF.

Amount grown in LIC MF

You would have accumulated nearly Rs. 1 crore if you let your investments of Rs. 54 lakhs remain (till 2019) after completion of the 20-year tenure in 2010.

Using this strategy for SIP, even though you invested in an under-performing fund, you ended up generating higher returns than the normal SIP returns by more than 3% per annum. This shows that this SIP strategy works in an underperforming fund too. While SIP returns are staggered over time, this strategy enhances what SIP really does by generating that extra alpha on a yearly basis.

In a nutshell, even if you accidently invest in a poorly performing fund, staying invested using this SIP strategy for the long term can help you successfully prepay your loan.

In fact, riskier the fund, the better this strategy works. This is because you are taking the money out when the markets are rising. If you choose a midcap or smallcap fund, then the result would be much more impactful.