Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

September 06, 2016

|

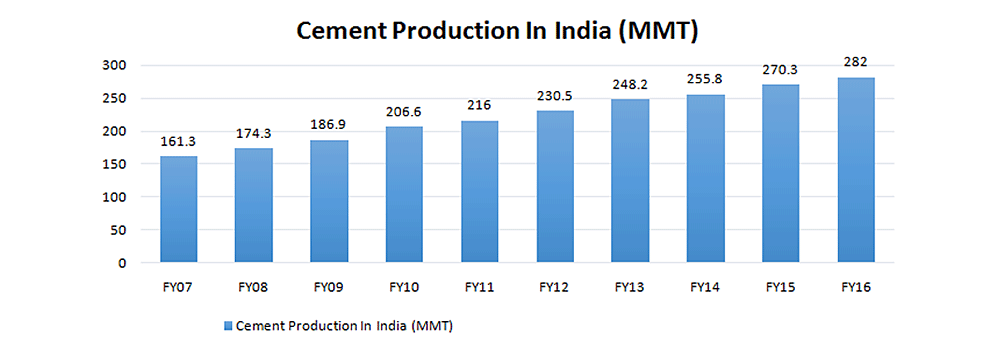

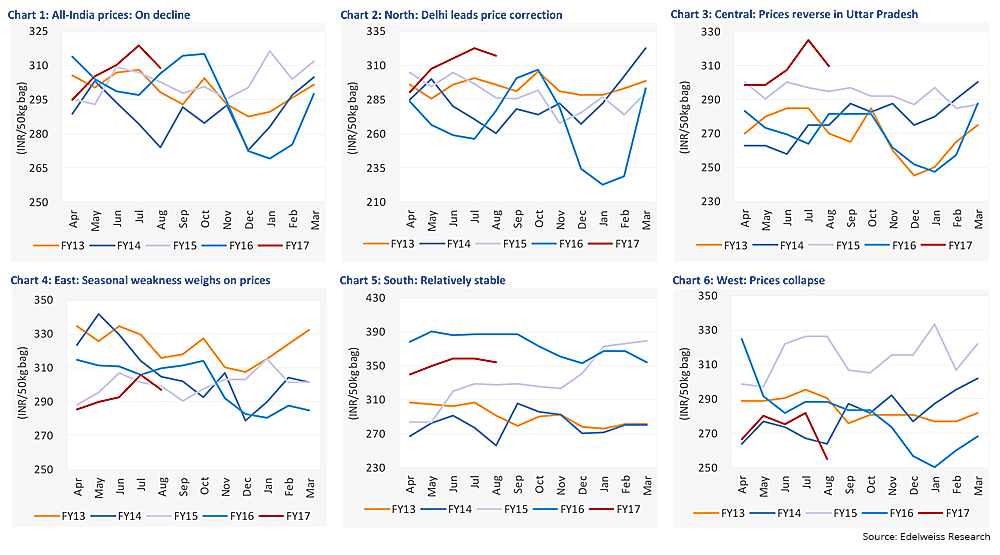

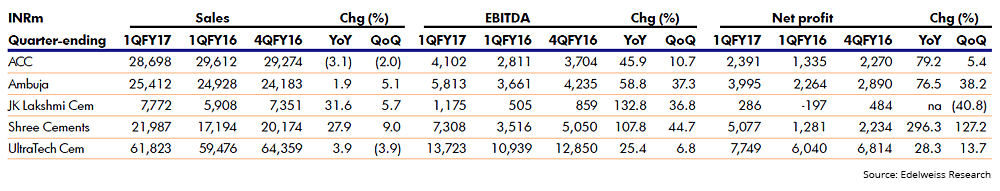

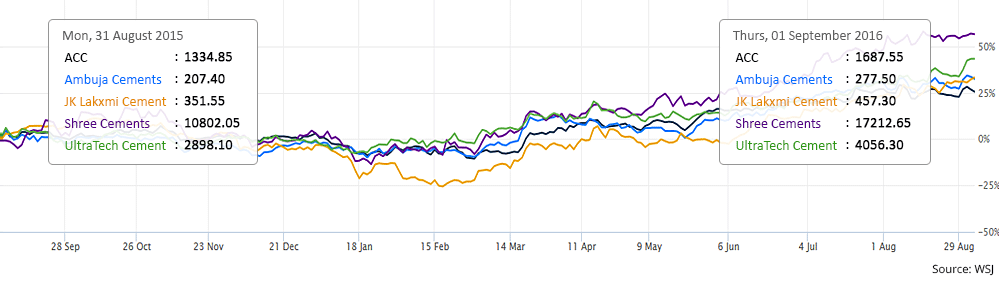

Cement is one of the core industries of India that plays a vital role in the growth and development of our country. We are the second largest producer of cement worldwide, with the industry expanding on back of increasing infrastructure activities and demand from housing sector over the past many years. However, in the recent times, muted demand, excess capacity and declining prices lead to a short term downfall. Here are some of the most important triggers that we think will help take the industry to levels like never before: