Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

February 14, 2017

|

The Indian travel and tourism sector has emerged as one of the key sectors, contributing handsomely to our GDP. It has been one of those sectors that has been driving the growth of the services sector of India. However, its success or failure has always been linked to the prospects of growth in the hospitality industry on the outer level and the maturation of the hotel industry on the inner level. The hotel industry, being one of the most ignored industries in the lot, is still expected to generate more than 2.3 million jobs in India. Have a look at our outlook for the sector:

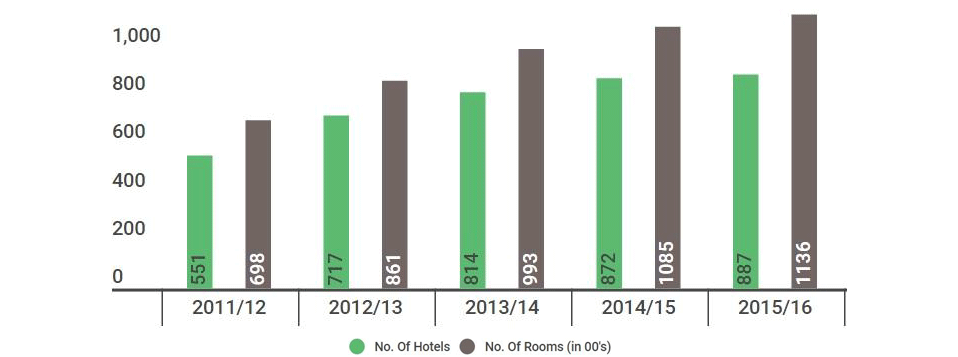

As you can see, on a CAGR basis, the number of hotels in increased by a pleasing 9.99% where as the number of rooms increased by 10.23%, from 69800 rooms to 113600 rooms in a span of 5 years.

| Occupancy | ADR | Rev PAR |

|---|---|---|

| 59.3% | Rs. 6032 | Rs. 3575 |

| 57.8% (-2.53%) | Rs. 5779 (-4.19%) | Rs. 3343 (-6.49%) |

| 58.4% (+1.04%) | Rs. 5611 (-2.91%) | Rs. 3275 (-2.03%) |

| 59.8% (+2.40%) | Rs. 5532 (-1.41%) | Rs. 3310 (+1.07%) |

| 63.4% (+6.02%) | Rs. 5541 (+0.16%) | Rs. 3512 (+6.10%) |

As you can see, with the occupancy increasing from the past 3 years and the ADR remaining almost constant, RevPAR has witnessed a healthy growth of 7.24% in the past 3 years. Although many reasons can be attributed to this increase, demand triumphing over supply has been the kingmaker.