Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

October 10, 2016

|

Like we saw in one of our previous articles, on the ‘Law Of Supply & Demand – An Analyst’s Point Of View’, we should now be well versed with the fact that institutions like mutual funds, pension funds, hedge funds, insurance companies and banks generate that big demand which eventually pushes the stock price up or down, depending on the quantity and speed with which they buy or sell. So what do they have to do with the decisions that you make? Accepted, that you might have done your analysis on the earnings, revenues, peers, the industry as well as the market scenario; but the fact that most of us aren’t aware about, is that these big buyers account for the biggest slice of daily market activity. For example, last year, FIIs and DIIs traded securities worth more than Rs. 31.1 lakh crores together as against the overall Rs. 51.1 lakh crores; i.e. more than 60% of the overall traded value.

Now, the question here is, what are we going to learn? Apart from the meaning of institutional sponsorship which you have already understood, we will try to understand:

And of course, everything will be complemented by some examples.

Does a stock require a minimum number of institutional sponsors?

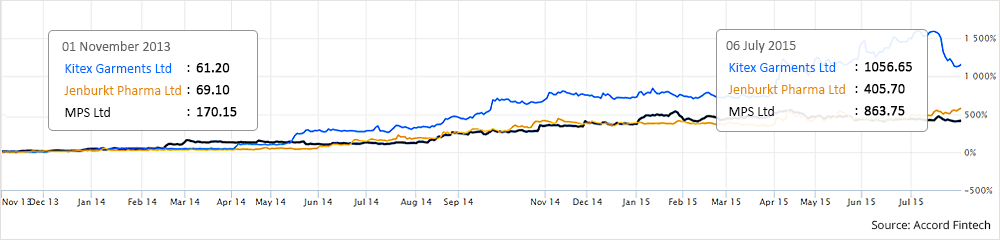

Yes, a stock having some institutional sponsors (ideally 5-10) when you discover it for the first time is a good thing to see, because it means the company’s potential has been validated at least by those sponsors and it can be worth looking into. Remember, this is applicable only after you check the quality of those buyers. But, if a stock is devoid of any sponsorship, it doesn’t mean it will turn out to be a run-of-the-mill performer. It simply means that, it either hasn’t been discovered by the right people; and by ‘right’ people, we are referring to the institutional buyers or it can even be the case that maybe they have just passed over it. For such stocks, you need to understand the company operations, analyze the earnings, meet the management, realize their vision, and buy in advance before the big buyers discover them so that you can enjoy the maximum price appreciation possible. Examples include companies like MPS Ltd., Astec Lifesciences Ltd., Kitex Garments Ltd., Orbit Exports Ltd., Jenburkt Pharmaceuticals Ltd. among others. Let’s have a look at some of their performances after we discovered them and the

change in their institutional sponsorship pattern over time:

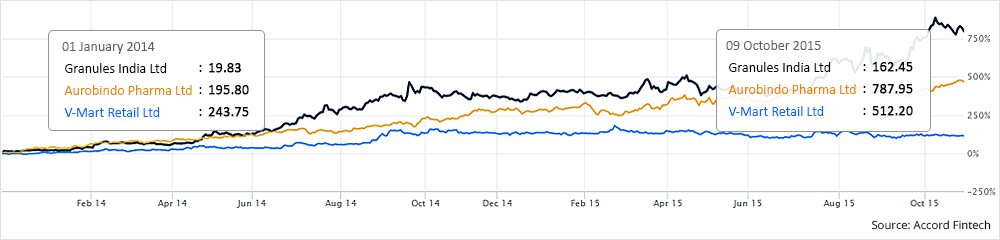

Above given are the ones which had 0 institutional sponsors, and frankly speaking, the appropriate diligence process required in these stocks is not always possible for the small retail investors. Also, we can have a look at some of the examples which had those ideal 5-10 institutional sponsors. Their performances are as follows:

Pleasing, right? In the above given graph, we have involved Aurobindo Pharma Ltd. too, as an extreme case which had 530+ institutional investors, because it was still a good buy taking the textbook research criteria into consideration. Keep in mind, that there are no rules but conventions in our stock market and you will always find examples like Aurobindo Pharma Ltd. which go against these conventions and yet turn out to be phenomenally successful.

Importance of interpreting the quality of these sponsors and how crucial their presence is, along with increasing and decreasing trends!

Moving on to the second part of this article, we will now understand the necessity and the caliber of institutional sponsors. The law of supply and demand comes into the picture for the former. It is assumed, you have understood that a rousing rally isn’t possible without an institutional sponsor and hence we need not go deeper into this topic as it is already covered in detail in our previous article. For reviewing the quality of these sponsors, punctilious investors not only want to know, how much the number is but also how well managed are those sponsors. If you want to be one of those diligent investors, you check out the past performances of the sponsors, their assets under management, their investment philosophy and the ratings by reputed agencies like CRISIL, CARE, ICRA, etc. For understanding this, let us consider the example of MPS Ltd., a StockAxis recommendation which grew from Rs. 187 in November 2013 to Rs. 1095 in April 2015 i.e. an approximate 500% increment in 18 months. An important thing to note is that, when it was recommended as a BUY, there were no institutional sponsors as against 21 (11 FIIs + 10 DIIs) which held 10.26% (4.80% FIIs + 5.46% DIIs) of the total shares when it made a high of 1095. Let us zoom in further and discern how this is relevant to the topic in discussion here:

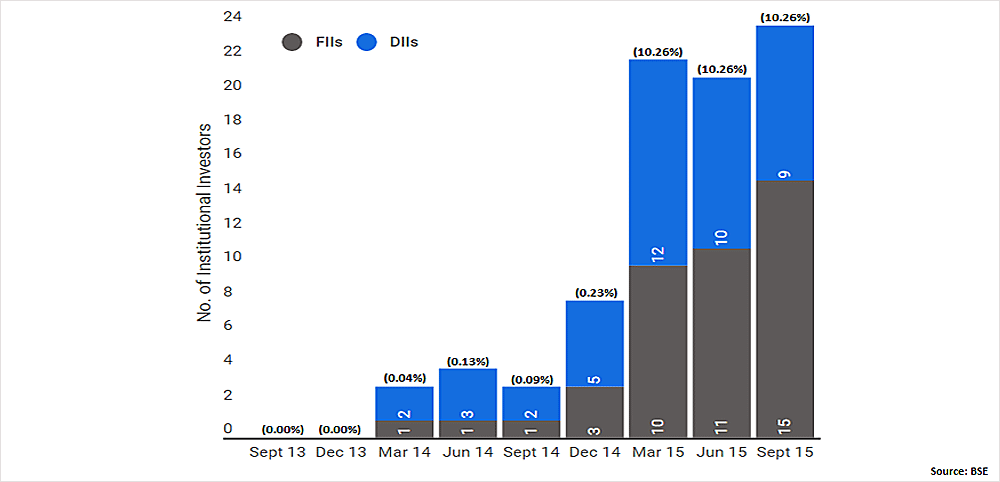

Your job as an investor here is to separate intelligent and informed institutional buying from poor and faulty buying. This is a daunting task at first, but it becomes easier as you learn to apply and follow proven rules, guidelines and principles. In our case of MPS Ltd. too, you have to find out when the institutional investors entered the company, followed by their ‘quality check’. Below given is the sponsorship pattern of MPS Ltd. from Q2FY14 i.e., a quarter prior to our recommendation till the time it made its high of Rs. 1095 i.e. till Q2FY16 and a quarter after that. It is safe to say that we can discount

doing the analysis for the first 5 quarters i.e. (Q214 to Q215) as they had a negligible institutional ownership. But what should interest you is the growth thereafter. Keeping the second part of the article into discussion, we will analyze only the investors and not the growth.

In Q3FY15 and Q4FY15 i.e. from October 2014 till end of March 2015, MPS Ltd. saw a sudden rush of institutional investors. The number spiked from a modest 3 investors which held 0.23% to a whopping 21 investors holding 10.26% of the shares and included players (mutual funds) like Goldman Sachs MF (Goldman Sachs India Equity Fund - Direct Plan (G)), HDFC MF (HDFC Prudence Fund (G)), Tata MF (Tata Dividend Yield Fund - Regular Plan (G)), L&T MF (L&T Equity Savings Fund (G), L&T India Value Fund (G), L&T Monthly Income Plan - Regular (G)), DHFL Pramerica MF, etc. Their holdings at the end of Q4FY15 and ratings are as follows:

As you can see, most of the funds that fell into the institutional investors’ category during the time were known funds with an average rating of more than 3 Stars and a positive Alpha. Thus on can satisfactorily say that those were noteworthy sponsors and the stocks that most of them invest into are worth further analysis. Also, just for your information, most of those shares were brought through a QIP issue worth Rs. 150 Cr issued by MPS Ltd., as the company intended for further acquisitions; it had acquired US-based Electronic Publishing Services (EPS) for an undisclosed amount in October 2014 and 5 months post the deal, it acquired yet another US-based publishing services company TSI Evolve for roughly Rs. 6.3 Cr.

Proceeding to changing sponsorship trends in MPS Ltd., you can see the sudden spike at the end of Q4FY15 post which the number of sponsors moved sideways. Hence, this can be attributed to one of the many reasons of why there was an appreciating growth in its stock price during the time.

What happens if the stock is over-sponsored?

Now coming to the last part of the article which is again a question that you must ask yourself, what happens if the stock you own is suddenly Over-sponsored??? The answer is quite simple; it possesses a danger that if something goes wrong at the company’s end or if it is a start of a bear market, excessive sponsorship might translate into huge selling pressure during these times. It is obvious that if a company is showing a strong growth in earnings and almost all known institutions own the stock, it is probably too late for you to take a position now. Move on and find a lesser sponsored peer. Two big examples are NYSE listed Citigroup Inc. and American International Group Inc. or AIG. Citigroup was a leading bank in New York City but at one point during the 2008 subprime loan and credit crisis, it tanked from $57 to $3 in two years. In case of AIG which had an alarming 3600 institutional owners during the 2008 period, tanked to $0.5 from the $100 mark it had sold for eight years earlier.

Remember, many funds will take their positions in companies during a bull market and pile out on the way down which can be due to any reasons including a bull market or some consistent bad quarters. This can nosedive the stock price to a great extent. Most retail investors have no clue or plan for when to sell. They just follow the sentiments that others have for the stock and a major chunk of ‘others’ are the institutional sponsors and thereby end up eroding their wealth out of panic.

Summarizing it all, if you are doing all the research by your own, go for companies that have the ideal range of institutional sponsors (5-20) with a better-than-average 3 year performance. Also, the company should be witnessing an increasing trend of the institutional owners in recent quarters. This parameter can be a very important tool apart from the hundreds of other factors including understanding the company operations and products, analyzing the earnings, meeting the management, realizing their vision, etc to analyze a stock for purchase. Just look around properly, analyze the situations and then act. For example, redemption pressure and scarcity of new fund inflows could force mutual funds to sell off their stocks. On the other hand, FIIs have their own set of problems. Any adverse financial situation in their home country could force them to flee away from the Indian markets. Plus, they have to deal with the currency risk as well. Hence make sure you always know what’s around before you take any positions. Happy Investing!