Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

June 08, 2016

|

The year 2015 is considered to be an inflection point for the Indian Media & Entertainment (M&E) industry. It has now positioned itself on the cusp of a strong phase of growth backed by digitization and increased consumer demand. Following are the key triggers that we think will make M&E the sunrise sector of our economic growth:

| $ Billion | FY11 | FY12 | FY13 | FY14 | FY15 | FY16 | FY17E | FY18E | FY19E | FY20E | CAGR |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Television | 4.96 | 5.58 | 6.29 | 7.17 | 8.18 | 9.31 | 10.71 | 12.42 | 14.44 | 16.56 | 12.81% |

| 3.15 | 3.38 | 3.67 | 3.97 | 4.28 | 4.60 | 4.97 | 5.37 | 5.79 | 6.22 | 7.04% | |

| Films | 1.40 | 1.70 | 1.89 | 1.91 | 2.09 | 2.39 | 2.63 | 2.87 | 3.14 | 3.43 | 9.37% |

| Radio | 0.17 | 0.19 | 0.22 | 0.26 | 0.30 | 0.35 | 0.43 | 0.49 | 0.57 | 0.65 | 14.35% |

| Digital Advertising | 0.23 | 0.33 | 0.45 | 0.66 | 0.91 | 1.22 | 1.71 | 2.31 | 3.01 | 3.85 | 32.55% |

| Music | 0.14 | 0.16 | 0.14 | 0.15 | 0.16 | 0.18 | 0.21 | 0.24 | 0.28 | 0.31 | 8.27% |

| Out-Of-Home Advertising | 0.27 | 0.27 | 0.29 | 0.33 | 0.37 | 0.43 | 0.48 | 0.53 | 0.60 | 0.68 | 9.68% |

| Animation | 0.47 | 0.53 | 0.60 | 0.68 | 0.77 | 0.88 | 1.01 | 1.18 | 1.38 | 1.63 | 13.24% |

| Gaming | 0.20 | 0.23 | 0.29 | 0.35 | 0.40 | 0.46 | 0.52 | 0.59 | 0.68 | 0.76 | 14.28% |

| Total | 10.99 | 12.38 | 13.85 | 15.47 | 17.45 | 19.84 | 22.67 | 26.01 | 29.88 | 34.10 | 11.99% |

| $ Billion | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017E | 2018E | 2019E | 2020E |

|---|---|---|---|---|---|---|---|---|---|---|

| Subscription Revenue | 3.21 | 3.70 | 4.24 | 4.83 | 5.45 | 6.14 | 7.06 | 8.27 | 9.61 | 11.06 |

| Advertising Revenue | 1.75 | 1.89 | 2.05 | 2.34 | 2.73 | 3.17 | 3.65 | 4.16 | 4.83 | 5.51 |

| Total | 4.96 | 5.58 | 6.29 | 7.17 | 8.18 | 9.31 | 10.71 | 12.43 | 14.44 | 16.57 |

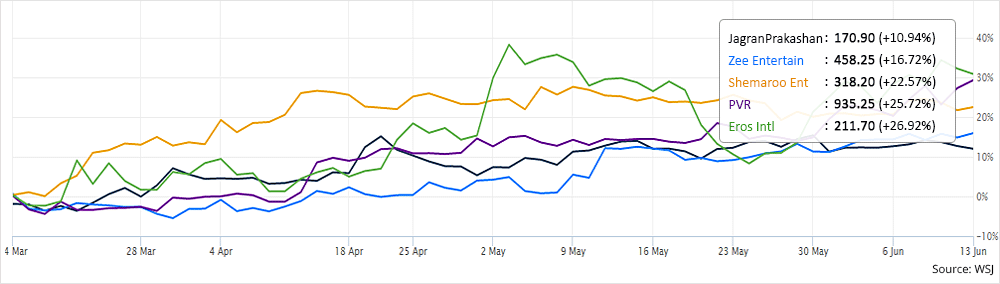

We are pleased to say that out of the above mentioned stocks, we have already recommended Shemaroo Entertainment Ltd. and PVR Ltd. to our subscribers apart from two other open calls in the M&E industry.