Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

May 09, 2020

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’is a quick update on the markets for the month gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

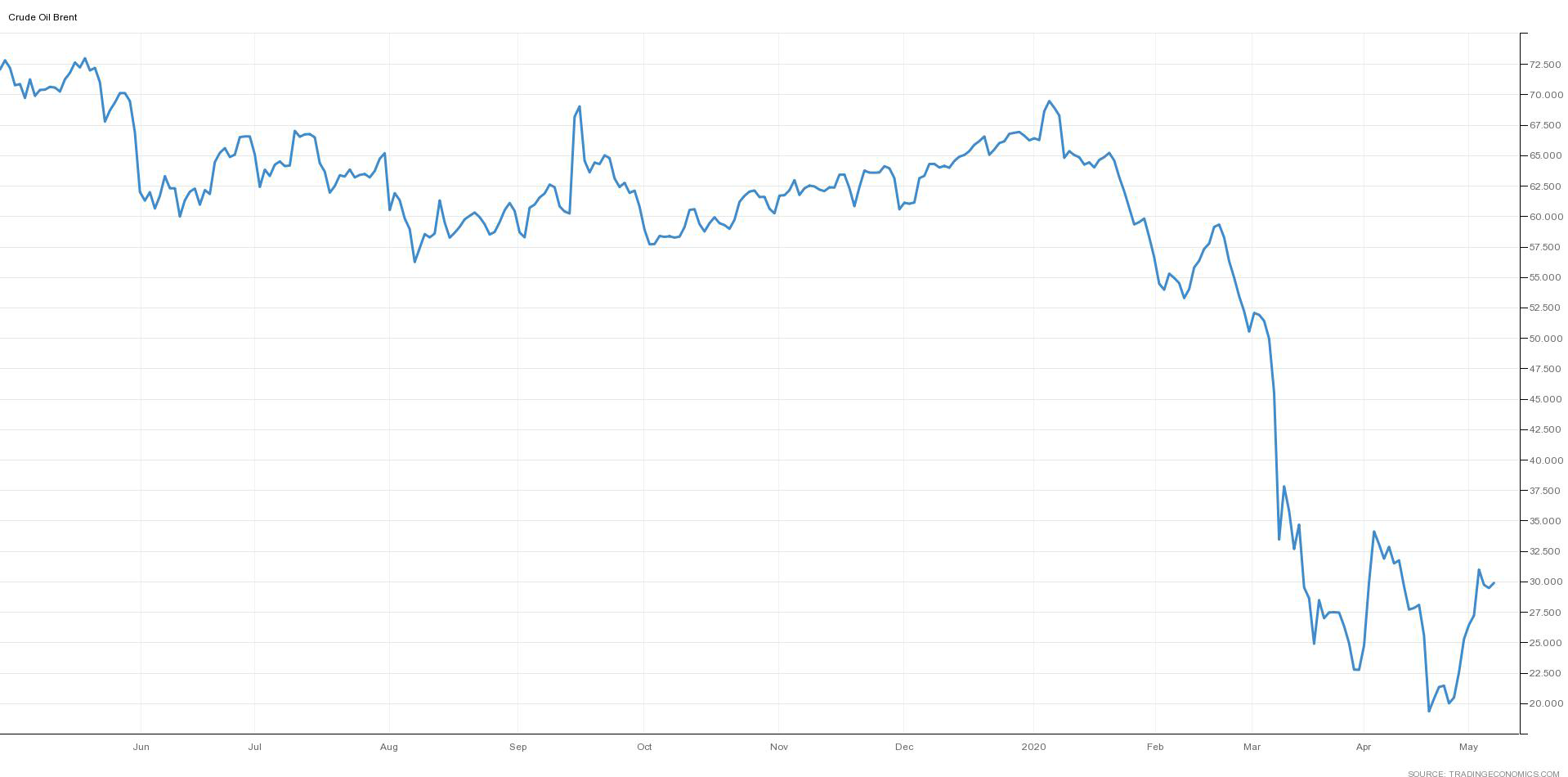

With the ongoing Covid-19 pandemic, life has come to a standstill. Flights have been grounded, vehicles are permanently parked, factories have shut down and demand has vanished. On the other side, the lifeblood of production, transport and commuting, oil, has seen supply continue at pre-Covid-19 levels. This has resulted in a supply glut and no buyers. In an unprecedented situation with excessive supplies and all the world’s oil storage capacities full to the brim, oil, which has so far been called ‘black gold’, is crying for buyers. Oil suppliers are willing to pay buyers to get rid of their oil stock (Western Texas Intermediate (WTI) sweet crude oil was quoting at (-)$37.6 a barrel on 20 April 2020; this is a 305% fall from $55.90 per barrel).

Crude oil is categorised as - Western Texas Intermediate (WTI) and Brent. India primarily imports Brent. Brent was quoting at around $20-25 a barrel, the lowest in 18 years.

India is the world’s third largest oil consumer with about 84% of its oil requirements being imported in 2018-19. Mineral fuels (including oil) imports constituted about 32% of India’s total imports with the country’s oil import bills running into billions of dollars. Most of India’s oil imports (about 80%) is from OPEC countries (Organization of the Petroleum Exporting Countries). India’s strategic petroleum reserves (SPR) (the oil it holds) constitutes about 85-90 days of the country’s crude requirement.

Falling oil prices will naturally reduce India’s import bill. This will not only reduce India’s dollar requirements, but will also lead to stability of the Indian rupee. This is an opportunity for India to stock up its oil requirements at the current low prices in order to achieve energy security and revive the economy once Covid-19 pandemic is brought under control.

To take advantage of low oil prices, India has decided to fill its strategic petroleum reserves (SPR) to their full capacity. The government has set up nearly 5 million metric tons (MMT) of strategic crude oil storages at three locations - Visakhapatnam, Mangalore, and Padur.