Avenue Supermarts Ltd

Quarterly Result - Q2FY23

Avenue Supermarts Ltd

Retailing - Supermarts

Current

Previous

Stock Info

Shareholding Pattern

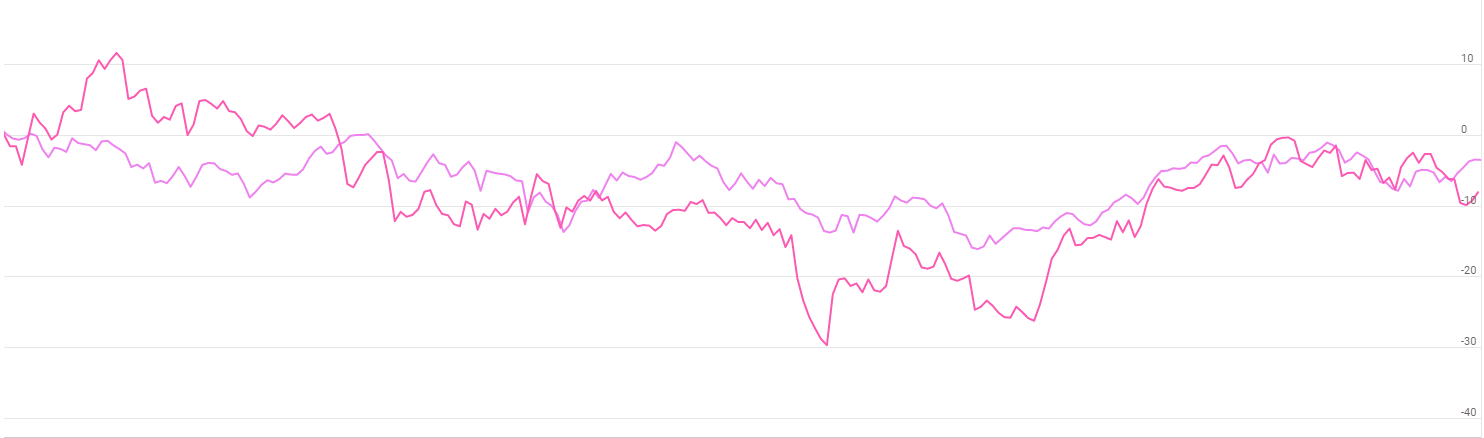

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. in Crores) | Q2FY23 | Q2FY22 | YoY | Q1FY23 | QoQ |

|---|---|---|---|---|---|

| Revenue from Operations | 10638.33 | 7788.94 | 36.58% | 10038.07 | 5.98% |

| EBITDA | 892.00 | 669.00 | 33.00% | 1008.00 | -12.00% |

| Profit After Tax | 686.00 | 418.00 | 64.00% | 643.00 | 7.00% |

| EPS | 11.00 | 6.00 | 10.00 |

Source: Company Filings; StockAxis Research

Q2FY23 Result Highlights

Avenue Supermarts (Dmart) reported strong set of earnings in Q2FY23. Consolidated

Revenues witnessed a healthy growth of 37% at Rs.10,638 cr as compared to Rs.7,789

cr in the same period last year. EBITDA in Q2FY23 stood at Rs.892 cr, as compared

to Rs.669 cr in the corresponding quarter of last year; registering a growth of

33%. EBITDA margin stood at 8.4 % in Q2FY23 as compared to 8.6% in Q2FY22. Net Profit

stood at Rs.686 cr for Q2FY23, as compared to Rs. 418 cr in the corresponding quarter

of previous fiscal; a growth of 64%. Due to one - time tax credit of Rs.141 cr,

the bottom line was boosted. Adjusting for this one-time item, adjusted PAT was

Rs.686 cr; a growth of 64% on a YoY basis.

Topline was aided by strong growth momentum in the FMCG and Staples segment of the business which continues to perform better than general merchandise and apparel segments. Discretionary items in the non-FMCG segment has recovered but still not back to pre-pandemic levels due to high inflation. According to management, as and when footfalls increase, sales of apparels/general merchandise should pick up.

DMart Ready continues to deepen its presence across 18 cities in India.

Company continues to expand its stores with 8 new stores added in Q2FY23 and total 18 stores were added in H1FY23 taking the overall store count to 302. Dmart’s older stores (five years and more), which form about half of the overall store count, posted a 21% like for like (LFL) growth in Q2FY23, compared to Q2FY20 (pre-covid), indicating a strong pick up. The company has stated that the store revenues are accelerating at a faster pace than earlier.

Outlook & valuation

Dmart posted strong earnings growth in Q2FY23, led by robust operating performance on the back of strong topline growth and stable margins. Dmart is among the quality retail companies with robust track record of earnings growth and superior return ratios, which are expected to sustain. We believe that Dmart’s earnings performance is expected to improve as footfalls pick up (currently below pre-Covid levels) and inflationary pressures recede as it would lead to a pick-up in the discretionary non-FMCG space. A higher share of discretionary non-FMCG segment would also improve profitability. Citing strong positioning in the organized retail market, ability to gain higher market share, lower inventory days, better operating margins, robust network expansion, D-Mart should continue to deliver strong earnings growth in the coming quarters. We continue to remain positive on the company’s growth prospects. At CMP of Rs. 4,306, the stock trades at ~70x of FY25E earnings.

Quarterly Financials

| Particulars (Rs. in Crores) | Q2FY23 | Q2FY22 | YoY (%) | Q1FY23 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from Operations | 10638.33 | 7788.94 | 36.58% | 10038.07 | 5.98% |

| COGS | 9029.23 | 6624.95 | 8397.57 | 7.52% | |

| Gross Profit | 1609.10 | 1163.99 | 38.24% | 1640.50 | |

| Gross Margin (%) | 15.13% | 14.94% | 16.34% | ||

| Employee Benefit Expenses | 188.62 | 146.59 | 179.40 | ||

| Other Expenses | 528.46 | 348.82 | 452.86 | ||

| EBITDA | 892.02 | 668.58 | 33.42% | 1008.24 | -11.53% |

| EBITDA (%) | 8.38% | 8.58% | 10.04% | ||

| Depreciation and Amortization Expense | 161.96 | 116.01 | 144.74 | ||

| EBIT | 730.06 | 552.57 | 32.12% | 863.50 | -15.45% |

| EBIT (%) | 6.86% | 7.09% | 8.60% | ||

| Finance Costs | 17.68 | 12.37 | 17.22 | ||

| Other Income | 35.57 | 27.50 | 29.14 | ||

| Profit Before Tax | 747.95 | 567.70 | 31.75% | 875.42 | -14.56% |

| Tax Expenses | 62.24 | 149.94 | 232.53 | ||

| Effective Tax Rate (%) | 8.32% | 26.41% | 26.56% | ||

| Profit After Tax | 685.71 | 417.76 | 64.14% | 642.89 | 6.66% |

| PAT Margin (%) | 6.45% | 5.36% | 6.40% | ||

| Basic Earnings Per Share (Rs.) | 10.58 | 6.45 | 9.93 |

Consolidated Financial statements

Profit & Loss statement

| Year End March (Rs. in Crores) | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|

| Net Sales | 24143.10 | 30976.30 | 42205.20 | 54395.70 | 68538.60 |

| Growth % | -2.90% | 28.30% | 36.30% | 28.90% | 26.00% |

| Expenditure | |||||

| Material Cost | 20554.70 | 26397.40 | 35832.20 | 46127.60 | 58052.20 |

| Employee Cost | 536.60 | 616.20 | 819.00 | 1033.50 | 1370.80 |

| Other Expenses | 1308.80 | 1464.20 | 1814.80 | 2284.60 | 2878.60 |

| EBITDA | 1743.10 | 2498.50 | 3739.20 | 4950.00 | 6237.00 |

| Growth % | -18.10% | 43.30% | 49.70% | 32.40% | 26.00% |

| EBITDA Margin | 7.20% | 8.10% | 8.90% | 9.10% | 9.10% |

| Depreciation & Amortization | 414.20 | 498.10 | 632.00 | 759.60 | 874.40 |

| EBIT | 1328.90 | 2000.40 | 3107.20 | 4190.40 | 5362.60 |

| EBIT Margin % | 5.50% | 6.50% | 7.40% | 7.70% | 7.80% |

| Other Income | 196.20 | 117.50 | 168.80 | 217.60 | 178.20 |

| Interest & Finance Charges | 41.70 | 53.80 | 56.50 | 65.00 | 70.00 |

| Profit Before Tax - Before Exceptional | 1483.50 | 2064.10 | 3219.50 | 4343.00 | 5470.80 |

| Profit Before Tax | 1483.50 | 2064.10 | 3219.50 | 4343.00 | 5470.80 |

| Tax Expense | 384.00 | 571.70 | 891.70 | 1202.90 | 1515.30 |

| Effective Tax rate | 25.90% | 27.70% | 27.70% | 27.70% | 27.70% |

| Net Profit | 1099.40 | 1492.40 | 2327.80 | 3140.10 | 3955.50 |

| Growth % | -15.50% | 35.70% | 56.00% | 34.90% | 26.00% |

| Net Profit Margin | 4.60% | 4.80% | 5.50% | 5.80% | 5.80% |

| Consolidated Net Profit | 1099.50 | 1492.40 | 2327.80 | 3140.10 | 3955.50 |

| Growth % | -15.50% | 35.70% | 56.00% | 34.90% | 26.00% |

Balance Sheet

| As of March (Rs. in Crores) | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|

| Share Capital | 647.80 | 647.80 | 647.80 | 647.80 | 647.80 |

| Total Reserves | 11502.90 | 13029.90 | 15357.60 | 18497.70 | 22453.20 |

| Shareholders' Funds | 12184.10 | 13677.90 | 16005.90 | 19145.90 | 23101.40 |

| Non Current Liabilities | |||||

| Long Term Burrowing | - | - | - | - | - |

| Deferred Tax Assets / Liabilities | 50.30 | 64.00 | 64.00 | 64.00 | 64.00 |

| Long Term Provisions | 2.50 | 4.90 | 4.90 | 4.90 | 4.90 |

| Current Liabilities | |||||

| Short Term Borrowings | - | - | - | - | - |

| Trade Payables | 578.10 | 589.20 | 611.50 | 688.10 | 757.80 |

| Other Current Liabilities | 391.20 | 481.10 | 481.10 | 481.10 | 481.10 |

| Short Term Provisions | 136.40 | 148.00 | 148.00 | 148.00 | 148.00 |

| Total Equity & Liabilities | 13655.10 | 15472.60 | 17666.40 | 20718.10 | 24573.30 |

| Assets | |||||

| Net Block | 6999.20 | 9251.00 | 11119.00 | 12859.40 | 13985.00 |

| Non Current Investments | 9.60 | 1262.70 | 1262.70 | 1262.70 | 1262.70 |

| Long Term Loans & Advances | 527.00 | - | - | - | - |

| Current Assets | |||||

| Currents Investments | 3.00 | 5.90 | 5.90 | 5.90 | 5.90 |

| Inventories | 2248.30 | 2742.70 | 2947.80 | 3891.10 | 5052.10 |

| Sundry Debtors | 43.60 | 66.90 | 65.20 | 79.40 | 109.50 |

| Cash and Bank | 1445.60 | 298.60 | 421.00 | 774.70 | 2313.20 |

| Short Term Loans and Advances | 232.10 | 127.50 | 127.50 | 127.50 | 127.50 |

| Total Assets | 13655.10 | 15472.60 | 17666.40 | 20718.10 | 24573.30 |

Cash Flow Statement

| Year End March (Rs. in Crores) | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|

| Profit After Tax | 1099.40 | 1492.40 | 2327.80 | 3140.10 | 3955.50 |

| Depreciation | 414.20 | 498.10 | 632.00 | 759.60 | 874.40 |

| Changes in Working Capital | -127.10 | -582.50 | -181.10 | -881.00 | -1121.30 |

| Cash From Operating Activities | 1375.10 | 1372.40 | 2778.70 | 3018.70 | 3708.60 |

| Purchase of Fixed Assets | -2029.40 | -2410.40 | -2500.00 | -2500.00 | -2000.00 |

| Free Cash Flows | -654.30 | -1038.10 | 278.70 | 518.70 | 1708.60 |

| Cash Flow from Investing Activities | -1110.00 | -1289.50 | -2500.00 | -2500.00 | -2000.00 |

| Increase / (Decrease) in Loan Funds | -3.70 | - | - | - | - |

| Cash from Financing Activities | -179.50 | -179.20 | -156.50 | -165.00 | -170.00 |

| Net Cash Inflow / Outflow | 85.60 | -96.40 | 122.20 | 353.70 | 1538.60 |

| Opening Cash & Cash Equivalents | 105.90 | 191.50 | 95.10 | 217.30 | 571.00 |

| Closing Cash & Cash Equivalent | 191.50 | 95.10 | 217.30 | 571.00 | 2109.60 |

Key Ratios

| Year End March | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|

| Basic EPS | 16.90 | 23.00 | 35.90 | 48.50 | 61.10 |

| Diluted EPS | 16.90 | 23.00 | 35.90 | 48.50 | 61.10 |

| Cash EPS (Rs) | 23.30 | 30.70 | 45.70 | 60.20 | 74.60 |

| Book value (Rs/share) | 187.60 | 211.20 | 247.10 | 295.60 | 356.60 |

| ROCE (%) Post Tax | 13.10% | 16.40% | 22.10% | 25.10% | 28.90% |

| ROE (%) | 9.50% | 11.50% | 15.70% | 17.90% | 18.70% |

| Inventory Days | 31.70 | 29.40 | 24.60 | 22.90 | 23.80 |

| Receivable Days | 0.50 | 0.70 | 0.60 | 0.50 | 0.50 |

| Payable Days | 7.60 | 6.90 | 5.20 | 4.40 | 3.90 |

| Working Capital Cycle | 24.50 | 23.20 | 20.00 | 19.10 | 20.50 |

| PE | 168.40 | 186.90 | 119.80 | 88.80 | 70.50 |

| P/BV | 15.20 | 20.40 | 17.40 | 14.60 | 12.10 |

| EV/EBITDA | 105.70 | 111.60 | 74.50 | 56.20 | 44.70 |

| Dividend Yield (%) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| P/Sales | 7.70 | 9.00 | 6.60 | 5.10 | 4.10 |

| Net debt/Equity | - | - | - | - | - |

| Net Debt/ EBITDA | -0.80 | 0.00 | -0.10 | -0.20 | - |