Cera Sanitaryware Ltd

Quarterly Result - Q1FY23

Cera Sanitaryware Ltd

Ceramics / Marble / Granite / Sanitaryware

Current

Previous

Stock Info

Shareholding Pattern

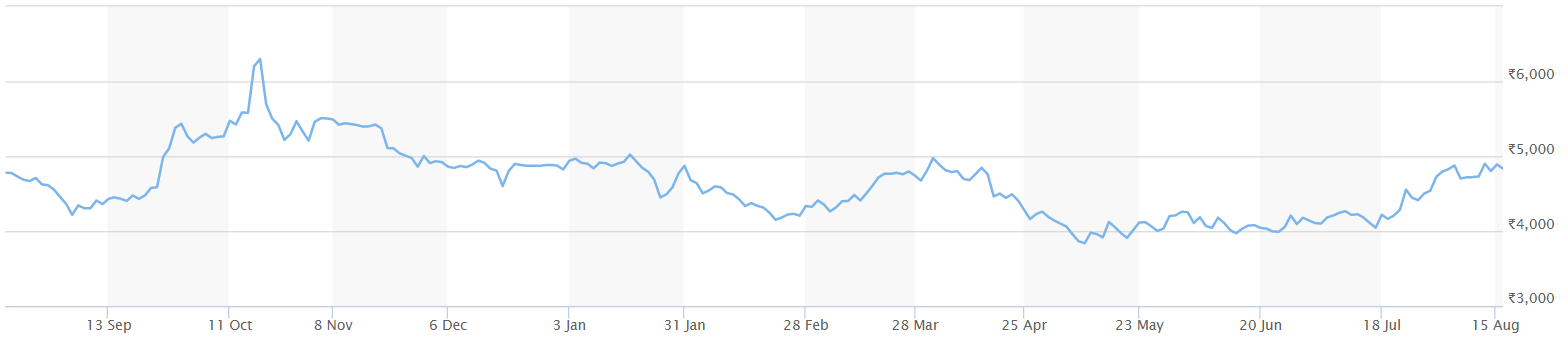

Price performance

Indexed Stock Performance

Quarterly Result Highlights

CRS’s consolidated Q1FY23 revenue increased 78% YoY (-9.8% Q-o-Q) to Rs 397 Cr owing to strong demand from home upgrades, real estate launches and price hikes of 3% in sanitaryware and 5% in faucetware by CRS during mid-May. Consolidated gross margin declined 550bps YoY to 53.5%. However, a higher revenue contribution of sanitaryware and faucetware at 89% in Q1FY23 vs. 81% in Q1FY22 had a positive bearing on operating margin. This coupled with price hike benefits and lower employee & other expenses spurred EBITDA margin gains of 670bps YoY (-360bps Q-o-Q) to 15.8%. While the company reported net profit of Rs39.8 Cr, up by 199.1% YoY.

Conference call Highlights

- In Q1FY23 capacity utilisation for Sanitaryware was 109.5% & Faucetware was 102.7%, expects to maintain it in FY23. In Faucetware the company produced 3 lac pieces which is all time high.

- Sanitaryware contributed 54%, Faucetware contributed 35%, Tiles contributed 10% & Others contributed 1%. B2C is 68% of sales. The new products contributed 22% to topline.

- Tier I sales were 30% in Q1FY23, Tier II sales were 13% in Q1FY23, Tier III sales 56% in Q1FY23 and Exports sales were 1% in Q1FY23.

- Entry/Mid/Premium Breakup: In Sanitaryware Entry products were 46.7%, Mid products were 43.1% and Premium products were 10.2% in Q1FY23 in Faucetware Entry products were 51.7%, Mid products were 30.4% and Premium products were 17.9% in Q1FY23.

- In May-22, 3% hike was taken in Sanitaryware and 5% hike was taken in Faucetware.

- The company did not see material impact of raw material cost.

- It stated China clay, feldspar and POP are 95% of Sanitaryware raw material mix and had combined impact of 2%.

- Gail supplied 49% of gas requirement and Sabarmati supplied 51% needs of gas to the plant. Transportation price increased to 2-3% and cost of corrugated boxes grew by 6%.

- In Faucetware 1st Phase of expansion is to increase capacity from 2.7lakhs SKUs per month to 4 lakhs SKUs per month at the cost of Rs 69 Cr, the expansion is expected to commence by Q1FY24.

- In Sanitaryware it is setting up new Greenfield plant which will be in 100Km range of the current manufacturing plant, the company stated few land parcels have been shortlisted. The cost would be Rs 129 Cr and the project would be completed in 24 months.

- Both the projects would be funded through internal accruals. The CAPEX excluding above mentioned projects for FY23 are Rs 24.7 Cr.

- The company launched retail engagement and loyalty program +11,500 retailers have adopted the platform in 3 months & 40% retailers are regular users of the app. This will provide insights to the company to cross sell and upsell.

- The management guided 50-75bps increase in EBITDA margins annually. In next 3.5 years it expects to double revenue.

Outlook & valuation

The building material companies are riding high on strong demand in the domestic market. We like Cera given its healthy market share in domestic sanitaryware and faucets industry, extensive distribution reach, healthy balance sheet and pedigree of management. The stock is currently trading at the PE of 22.5x on the basis of FY25E earnings.

Quarterly Financials

| Particulars (Rs. in Crores) | Q1FY23 | Q1FY22 | Y-o-Y | Q4FY22 | QoQ | FY22 | FY21 | YoY |

|---|---|---|---|---|---|---|---|---|

| Revenue from Operations | 397.00 | 223.00 | 78.00% | 441.00 | -10.00% | 1446.00 | 1224.00 | 18.00% |

| Employee Benefit Expenses | 50.00 | 44.00 | 53.00 | 194.00 | 154.00 | |||

| Other Expenses | 285.00 | 158.00 | 303.00 | 1023.00 | 913.00 | |||

| Total operating expenses | 334.00 | 202.00 | 356.00 | 1217.00 | 1066.00 | |||

| EBITDA | 63.00 | 21.00 | 197.00% | 85.00 | -26.00% | 229.00 | 158.00 | 45.00% |

| EBITDA Margin (%) | 15.80% | 9.50% | 19.20% | 15.80% | 12.90% | |||

| Depreciation and Amortization | 8.00 | 8.00 | 8.00 | 32.00 | 40.00 | |||

| EBIT | 55.00 | 13.00 | 312.00% | 76.00 | -28.00% | 196.00 | 118.00 | 66.00% |

| Other Income | -1.00 | 6.00 | 6.00 | 24.00 | 25.00 | |||

| Finance Cost | 1.00 | 1.00 | 2.00 | 5.00 | 10.00 | |||

| Profit Before Exceptional Items and Tax | 54.00 | 18.00 | 81.00 | 215.00 | 134.00 | |||

| Exceptional Items | - | -6.00 | -6.00 | |||||

| Profit Before Tax | 53.60 | 18.10 | 196.00% | 75.00 | -29.00% | 209.00 | 134.00 | 56.00% |

| Tax Expenses | 13.70 | 4.60 | 22.00 | 56.00 | 34.00 | |||

| Effective Tax Rate (%) | 25.60% | 25.50% | 29.30% | 26.80% | 25.40% | |||

| Profit After Tax | 39.90 | 13.50 | 196.00% | 53.00 | -25.00% | 153.00 | 100.00 | 53.00% |

| PAT Margin (%) | 10.00% | 6.00% | 12.10% | 10.60% | 8.20% | |||

| EPS | 30.40 | 10.20 | 199.00% | 40.70 | -25.00% | 116.00 | 77.00 | 50.00% |

Source: Company Filings; StockAxis Research

Consolidated Financial statements

Profit & Loss statement

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Net Sales | 1351.50 | 1223.70 | 1224.30 | 1445.80 | 1705.00 | 2049.00 | 2365.00 |

| Expenditure | |||||||

| Material Cost | 606.20 | 550.30 | 626.80 | 683.90 | 826.90 | 1004.00 | 1151.80 |

| Employee Cost | 165.50 | 170.70 | 153.70 | 189.40 | 208.00 | 250.00 | 288.50 |

| Other Expenses | 381.70 | 337.20 | 285.80 | 344.10 | 392.20 | 454.90 | 525.00 |

| EBITDA | 198.30 | 165.50 | 158.10 | 228.40 | 277.90 | 340.10 | 399.70 |

| EBITDA Margin | 14.70% | 13.50% | 12.90% | 15.80% | 16.30% | 16.60% | 17.00% |

| Depreciation & Amortization | 28.00 | 38.80 | 39.60 | 32.40 | 40.00 | 48.00 | 53.00 |

| EBIT | 170.30 | 126.70 | 118.50 | 196.00 | 237.90 | 292.10 | 346.70 |

| EBIT Margin % | 12.60% | 10.40% | 9.70% | 13.60% | 14.00% | 14.30% | 14.70% |

| Other Income | 18.60 | 18.20 | 25.20 | 23.60 | 25.00 | 25.00 | 26.00 |

| Interest & Finance Charges | 8.50 | 10.10 | 9.70 | 5.30 | 6.90 | 6.60 | 6.00 |

| Profit Before Tax - Before Exceptional | 180.30 | 134.90 | 133.90 | 214.40 | 256.00 | 310.50 | 366.70 |

| Profit Before Tax | 180.30 | 134.90 | 133.90 | 214.40 | 256.00 | 310.50 | 367.70 |

| Tax Expense | 65.20 | 24.30 | 34.00 | 56.00 | 64.50 | 78.20 | 92.40 |

| Effective Tax rate | 36.20% | 18.00% | 25.40% | 26.10% | 25.20% | 25.20% | 25.00% |

| Net Profit | 115.10 | 110.50 | 99.90 | 158.40 | 191.50 | 232.40 | 275.30 |

| Net Profit Margin | 8.50% | 9.00% | 8.20% | 11.00% | 11.20% | 11.30% | 12.00% |

Balance Sheet

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Share Capital | 6.50 | 6.50 | 6.50 | 6.50 | 6.50 | 6.50 | 6.50 |

| Total Reserves | 694.40 | 764.20 | 865.20 | 1008.60 | 1180.60 | 1396.70 | 1652.80 |

| Shareholders' Funds | 711.20 | 778.40 | 883.50 | 1029.40 | 1196.10 | 1412.20 | 1669.30 |

| Minority Interest | 10.30 | 7.70 | 11.70 | 14.20 | 9.00 | 9.00 | 10.00 |

| Non Current Liabilities | |||||||

| Long Term Burrowing | 39.60 | 43.40 | 42.60 | 17.50 | 72.00 | 62.00 | 54.00 |

| Deferred Tax Assets / Liabilities | 43.60 | 29.90 | 30.30 | 35.40 | 35.40 | 35.40 | 35.40 |

| Long Term Provisions | 6.70 | 10.60 | 10.30 | 9.00 | 9.00 | 9.00 | 9.00 |

| Current Liabilities | |||||||

| Short Term Borrowings | 44.70 | 41.00 | 30.30 | 27.70 | 27.70 | 27.70 | 27.70 |

| Trade Payables | 110.90 | 95.30 | 155.40 | 133.50 | 146.80 | 185.10 | 199.50 |

| Other Current Liabilities | 194.90 | 177.30 | 180.00 | 269.20 | 269.20 | 269.20 | 269.20 |

| Short Term Provisions | 16.60 | 2.90 | 6.90 | 2.40 | 2.40 | 2.40 | 2.40 |

| Total Equity & Liabilities | 1190.80 | 1219.40 | 1377.70 | 1551.20 | 1785.60 | 2030.10 | 2293.60 |

| Assets | - | ||||||

| Net Block | 385.30 | 438.50 | 415.50 | 451.50 | 541.50 | 563.50 | 570.50 |

| Non Current Investments | 20.80 | 38.80 | 40.20 | 35.00 | 35.00 | 35.00 | 35.00 |

| Long Term Loans & Advances | 16.80 | 10.70 | 9.40 | 11.00 | 11.00 | 11.00 | 11.00 |

| Current Assets | |||||||

| Currents Investments | 157.00 | 189.50 | 434.00 | 527.20 | 557.20 | 557.20 | 557.20 |

| Inventories | 215.80 | 243.00 | 199.70 | 293.70 | 267.60 | 401.10 | 380.90 |

| Sundry Debtors | 298.40 | 222.80 | 209.50 | 164.80 | 302.10 | 262.30 | 387.00 |

| Cash and Bank | 11.00 | 2.10 | 10.40 | 14.90 | 18.20 | 147.00 | 300.00 |

| Short Term Loans and Advances | 34.70 | 35.10 | 15.10 | 15.10 | 15.10 | 15.10 | 15.10 |

| Total Assets | 1190.80 | 1219.40 | 1377.70 | 1551.10 | 1785.60 | 2030.00 | 2294.50 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Profit After Tax | 115.10 | 110.50 | 99.90 | 158.40 | 191.50 | 232.40 | 275.30 |

| Depreciation | 28.00 | 38.80 | 39.60 | 32.40 | 40.00 | 48.00 | 53.00 |

| Changes in Working Capital | -21.40 | 4.70 | 131.60 | -71.30 | -97.90 | -55.30 | -89.10 |

| Cash From Operating Activities | 124.40 | 129.00 | 268.00 | 119.50 | 133.50 | 225.10 | 240.20 |

| Purchase of Fixed Assets | -57.50 | -46.30 | -14.70 | -46.80 | -130.00 | -70.00 | -60.00 |

| Free Cash Flows | 66.90 | 82.70 | 253.30 | 72.70 | 3.50 | 155.10 | 180.20 |

| Cash Flow from Investing Activities | -110.40 | -79.70 | -242.30 | -66.80 | -160.00 | -70.00 | -60.00 |

| Increase / (Decrease) in Loan Funds | -5.60 | 1.30 | -8.30 | 14.90 | 1.00 | -10.00 | -9.00 |

| Equity Dividend Paid | -15.60 | -33.80 | - | -19.50 | -19.50 | -16.30 | -19.20 |

| Cash from Financing Activities | -29.00 | -55.20 | -18.80 | -4.60 | 30.50 | -26.30 | -27.20 |

| Net Cash Inflow / Outflow | -15.00 | -5.80 | 6.80 | 48.10 | 4.00 | 128.80 | 153.00 |

| Opening Cash & Cash Equivalents | 21.70 | 6.70 | 0.80 | 7.70 | 14.10 | 18.10 | 147.00 |

| Closing Cash & Cash Equivalent | 6.70 | 0.80 | 7.70 | 14.10 | 18.10 | 147.00 | 300.00 |

Key Ratios

| Yr End March | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Basic EPS | 88.50 | 87.10 | 77.50 | 121.80 | 147.20 | 178.70 | 211.70 |

| Diluted EPS | 88.50 | 87.10 | 77.50 | 121.80 | 147.20 | 178.70 | 211.70 |

| Cash EPS (Rs) | 110.00 | 116.90 | 107.90 | 142.30 | 178.00 | 215.60 | 251.70 |

| DPS | 13.00 | 13.00 | 13.00 | 15.00 | 15.00 | 12.50 | 14.80 |

| Book value (Rs/share) | 546.90 | 598.50 | 679.30 | 791.50 | 919.70 | 1085.80 | 1283.50 |

| ROCE (%) Post Tax | 16.10% | 14.30% | 11.80% | 16.00% | 16.60% | 17.00% | 19.00% |

| ROE (%) | 16.20% | 14.50% | 11.40% | 15.40% | 16.00% | 17.80% | 18.00% |

| Inventory Days | 55.00 | 68.00 | 66.00 | 62.00 | 60.00 | 60.00 | 60.00 |

| Receivable Days | 76.00 | 78.00 | 64.00 | 47.00 | 50.00 | 50.00 | 50.00 |

| Payable Days | 28.00 | 31.00 | 37.00 | 36.00 | 30.00 | 30.00 | 30.00 |

| PE | 34.90 | 26.50 | 50.40 | 36.90 | 32.30 | 26.60 | 22.50 |

| P/BV | 5.60 | 3.90 | 5.80 | 5.70 | 5.20 | 4.40 | 3.70 |

| EV/EBITDA | 19.90 | 17.60 | 29.90 | 23.40 | 22.50 | 16.40 | 15.50 |

| Dividend Yield (%) | 0.40% | 0.60% | 0.30% | 0.30% | 0.30% | 0.30% | 0.30% |

| P/Sales | 3.00 | 2.50 | 4.20 | 4.00 | 3.60 | 3.00 | 0.00% |

| Net debt/Equity | - | - | - | - | 0.10 | - | - |

| Net Debt/ EBITDA | -0.40 | -0.60 | -2.30 | -2.20 | 0.30 | -1.80 | - |

| Sales/Net FA (x) | 3.60 | 3.00 | 2.90 | 3.30 | 3.40 | 3.70 | 4.20 |