Hawkins Cookers Ltd

Quarterly Result - Q1YFY23

Hawkins Cookers Ltd

Consumer Durables - Domestic Appliances

Current

Previous

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. in Crores) | Q1FY23 | Q1FY22 | YoY | Q4FY22 | QoQ |

|---|---|---|---|---|---|

| Revenue from Operations | 197.74 | 151.45 | 30.60% | 271.83 | -27.30% |

| EBITDA | 33.33 | 24.25 | 37.40% | 31.02 | 7.40% |

| EBITDA Margin (%) | 16.90% | 16.00% | 11.40% | ||

| Profit After Tax | 23.07 | 17.13 | 34.70% | 21.37 | 8.00% |

| Net Profit Margin (%) | 11.70% | 11.30% | 7.90% | ||

| Earnings Per Share | 43.62 | 32.39 | 34.70% | 40.42 | 7.90% |

Source: Company Filings; StockAxis Research

Highlights for the quarter ended June 2022

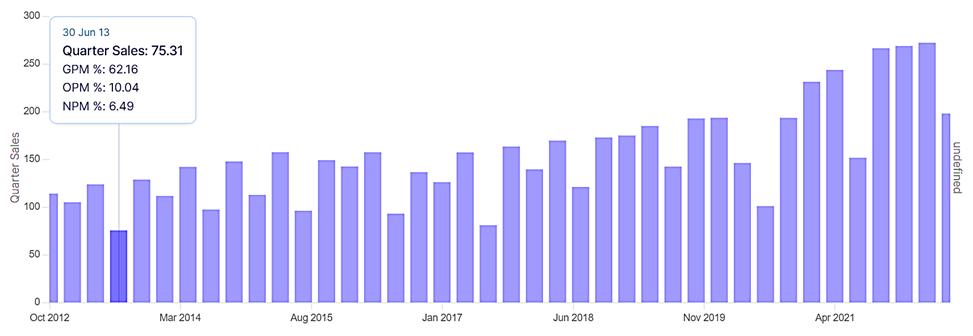

The company posted decent set of numbers in Q1FY23, where year-on-year revenue was

higher by 30.6% to ~Rs. 198 crores, however, quarter-on-quarter basis, the topline

was lower by 27.3%. This historic trend suggests that the Q1 had always been lower

than Q4; Q2 and Q4 had always been strong (refer the 10Y quarterly trend below).

The cost of material seems to have cooled off compared to Q4FY22, which aided the gross margins to jump by 718 bps to 52.1%, however, the cost remained elevated on Y-o-Y basis which weighed on the gross margins by 608bps YoY. EBITDA was higher by 37.4% YoY and 7.4% QoQ due to higher operating leverage and lower other cost, respectively. The bottom line was higher by 34.7% Y-o-Yr and 8% Q-o-Q to ~Rs. 23 crores.

Outlook & valuation

With a strong brand recognition and vast management experience, Hawkins is one of the leaders in the growing industry. It has managed to mitigate the geographic risk and ensured a wider reach by its strong, pan-India distribution network. The company's strong financial risk profile is reflected in its superior RoCE and strong cash generation ability, which has resulted in net debt free status.

Further, despite competitive intensity on the rise, Hawkins has managed to deliver top-line growth. In FY22, the company reported healthy revenue growth of 25% due to increased sales volume, which was driven by strong brand recall and higher realisations.

With an expanding presence on e-commerce platforms and a pan-India distribution network, we believe the company is well positioned to deliver long-term growth. Furthermore, we continue to believe that the company will benefit greatly from an increase in consumer confidence in the consumer staples market, as well as a shift in market share from unorganised to organised players.

At CMP of 5,613, the stock trades at 17.2x of FY25E earnings.

Quarterly Financials

| Particulars (Rs. in Crores) | Q1FY23 | Q1FY22 | YoY | Q4FY22 | QoQ |

|---|---|---|---|---|---|

| Revenue from Operations | 197.74 | 151.45 | 30.60% | 271.83 | -27.30% |

| COGS | 94.74 | 63.36 | 149.76 | ||

| Gross Profit | 103.00 | 88.09 | 16.90% | 122.07 | -15.60% |

| Gross Profit Margin (%) | 52.10% | 58.20% | 44.90% | ||

| Employee Benefit Expenses | 27.17 | 25.05 | 24.85 | ||

| Other Expenses | 42.50 | 38.79 | 66.20 | ||

| EBITDA | 33.33 | 24.25 | 37.40% | 31.02 | 7.40% |

| EBITDA Margin (%) | 16.90% | 16.00% | 11.40% | ||

| Depreciation & Amortisation | 1.86 | 1.53 | 1.74 | ||

| EBIT | 31.47 | 22.72 | 38.50% | 29.28 | 7.50% |

| EBIT Margin (%) | 15.90% | 15.00% | 10.80% | ||

| Finance Cost | 1.31 | 1.77 | 1.43 | ||

| Other Income | 0.75 | 2.07 | 1.03 | ||

| Profit Before Tax | 30.91 | 23.03 | 34.20% | 28.90 | 7.00% |

| Tax Expenses | 7.85 | 5.90 | 7.53 | ||

| Effective Tax Rate (%) | 25.40% | 25.60% | 26.10% | ||

| Profit After Tax | 23.07 | 17.13 | 34.70% | 21.37 | 8.00% |

| Net Profit Margin (%) | 11.70% | 11.30% | 7.90% | ||

| Earnings Per Share | 43.62 | 32.39 | 34.70% | 40.42 | 7.90% |

Source: Company Filings; StockAxis Research

Consolidated Financial statements

Profit & Loss statement

| Year End March (Rs. in Crores) | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|

| Net Sales | 768.46 | 958.01 | 1146.05 | 1335.94 | 1527.71 |

| Expenditure | |||||

| Material Cost | 365.20 | 488.82 | 584.77 | 681.66 | 779.51 |

| Employee Cost | 100.95 | 106.19 | 114.60 | 126.91 | 145.13 |

| Other Expenses | 372.11 | 383.85 | 430.95 | 480.01 | -924.64 |

| EBITDA | 110.81 | 119.76 | 167.19 | 205.62 | 239.12 |

| EBITDA Margin | 14.42% | 12.50% | 14.59% | 15.39% | 15.65% |

| Depreciation & Amortization | 5.33 | 6.66 | 8.31 | 9.75 | 11.19 |

| EBIT | 105.48 | 113.10 | 158.88 | 195.87 | 237.09 |

| EBIT Margin % | 13.73% | 11.81% | 13.86% | 14.66% | 15.52% |

| Other Income | 7.32 | 5.86 | 6.88 | 8.02 | 9.17 |

| Interest & Finance Charges | 4.73 | 6.06 | 6.12 | 5.37 | 4.44 |

| Profit Before Tax - Before Exceptional | 108.06 | 112.91 | 159.63 | 198.51 | 232.65 |

| Profit Before Tax | 108.06 | 112.91 | 159.63 | 198.51 | 232.65 |

| Tax Expense | 27.43 | 29.02 | 41.03 | 51.02 | 59.80 |

| Effective Tax rate | 25.38% | 25.70% | 25.70% | 25.70% | 25.70% |

| Net Profit | 80.64 | 83.89 | 118.60 | 147.49 | 172.85 |

| Net Profit Margin | 10.49% | 8.76% | 10.35% | 11.04% | 11.31% |

Balance Sheet

| As of March (Rs. in Crores) | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|

| Share Capital | 5.29 | 5.29 | 5.29 | 5.29 | 5.29 |

| Total Reserves | 172.34 | 207.89 | 267.19 | 340.94 | 410.08 |

| Shareholders' Funds | 177.62 | 213.18 | 272.48 | 346.22 | 415.37 |

| Non Current Liabilities | |||||

| Long Term Burrowing | 23.06 | 34.37 | 33.13 | 28.13 | 20.63 |

| Current Liabilities | |||||

| Short Term Borrowings | 4.80 | 5.27 | 5.27 | 5.27 | 5.27 |

| Trade Payables | 76.55 | 72.12 | 80.70 | 95.20 | 109.84 |

| Total Equity & Liabilities | 391.19 | 409.39 | 472.28 | 555.52 | 631.80 |

| Assets | |||||

| Net Block | 39.01 | 51.79 | 58.49 | 63.73 | 67.54 |

| Current Assets | |||||

| Inventories | 97.18 | 178.10 | 152.76 | 204.00 | 215.75 |

| Sundry Debtors | 40.00 | 52.83 | 57.65 | 66.30 | 70.61 |

| Cash and Bank | 167.08 | 65.14 | 141.86 | 159.96 | 216.37 |

| Total Assets | 391.19 | 409.39 | 472.28 | 555.52 | 631.80 |

Cash Flow Statement

| Year End March (Rs. in Crores) | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|

| Profit After Tax | 80.64 | 83.89 | 118.60 | 147.49 | 172.85 |

| Depreciation | 5.33 | 6.66 | 8.31 | 9.75 | 11.19 |

| Changes in Working Capital | 103.57 | -141.93 | 29.11 | -45.40 | -1.43 |

| Cash From Operating Activities | 188.94 | -52.15 | 156.02 | 111.84 | 182.62 |

| Purchase of Fixed Assets | -14.07 | -20.11 | -15.00 | -15.00 | -15.00 |

| Free Cash Flows | 174.87 | -72.26 | 141.02 | 96.84 | 167.62 |

| Cash Flow from Investing Activities | -119.39 | 81.98 | -15.00 | -15.00 | -15.00 |

| Increase / (Decrease) in Loan Funds | 7.90 | 2.60 | -5.00 | -5.00 | -7.50 |

| Equity Dividend Paid | -42.42 | -47.78 | -59.30 | -73.74 | -103.71 |

| Cash from Financing Activities | -40.16 | -51.28 | -64.30 | -78.74 | -111.21 |

| Net Cash Inflow / Outflow | 29.39 | -21.45 | 76.72 | 18.10 | 56.41 |

| Opening Cash & Cash Equivalents | -8.06 | 21.34 | -0.12 | 76.60 | 94.70 |

| Closing Cash & Cash Equivalent | 21.34 | -0.12 | 76.60 | 94.70 | 151.11 |

Key Ratios

| Year End March | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|

| EPS | 152.49 | 158.64 | 224.30 | 278.92 | 326.89 |

| Cash EPS | 162.58 | 171.23 | 240.01 | 297.36 | 348.06 |

| DPS | 80.00 | 150.00 | 112.15 | 139.46 | 196.13 |

| Book value (Rs/share) | 335.91 | 403.15 | 515.30 | 654.76 | 785.52 |

| ROCE (%) Post Tax | 45.10% | 38.57% | 43.69% | 43.87% | 42.92% |

| ROE (%) | 45.40% | 39.35% | 43.53% | 42.60% | 41.61% |

| PE | 35.05 | 31.95 | 25.02 | 20.12 | 17.17 |

| P/BV | 15.91 | 12.57 | 10.89 | 8.57 | 7.15 |

| EV/EBITDA | 24.34 | 22.20 | 17.52 | 14.14 | 11.62 |

| P/Sales | 3.68 | 2.80 | 2.59 | 2.22 | 1.94 |

| Net Debt/ EBITDA | -1.17 | -0.18 | -0.23 | -0.30 | -0.80 |

| Sales/Net FA (x) | 21.55 | 21.10 | 20.78 | 21.86 | 23.28 |