Larsen & Toubro Ltd

Quarterly Result - Q1FY23

Larsen & Toubro Ltd

Engineering - Construction

Current

Previous

Stock Info

Shareholding Pattern

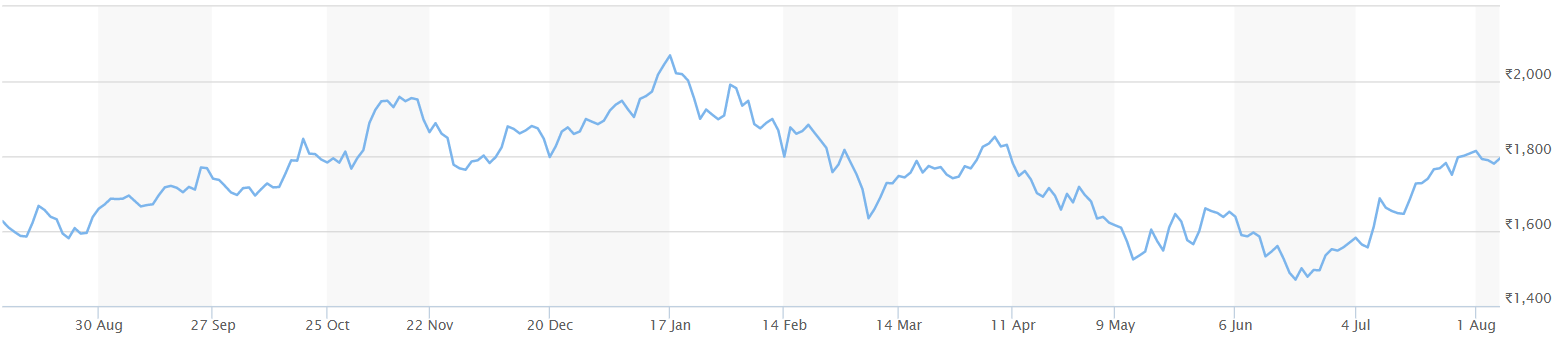

Price performance

Indexed Stock Performance

Quarterly Result Highlights

Consolidated sales came in at Rs 35850 cr (up 22.2% YoY), driven by revenue growth in segments such as Infrastructure (up 36.6% YoY), IT & Technology services (up 30.5% YoY), Development Projects (up 19.5% YoY), Hi-Tech Manufacturing (up 5.2% YoY), Energy Projects (up 2.4% YoY) and others (up 19.4% YoY). EBITDA came in at Rs 3960 cr (up 24.8% YoY) with EBITDA margins coming in at 11% vs 10.8% in Q1FY22. The consolidated Adj. PAT for Q1FY23 came in at Rs 1700 cr (up 44.9% YoY).

Concall highlights

- In Q1FY23, margins were impacted due to higher input costs and adverse job mix. FY23 guidance does not build any upside from claims

- Hydrocarbon revenue in Q1FY23 was impacted by some delays in supply chains and delays in approvals. It should normalise during the remainder of the year

- Domestic order inflows were driven by Transportation and Infrastructure segments while international order wins were aided by large order wins in Hydrocarbons and Defence segments.

- Tendering: Domestic tendering activity was in Q1FY23 at Rs 2.6tn (up 90% YoY) with higher award to tender ratio of 70% (39% in Previous Year)

- Bid pipeline: Current order prospects (for balance 9MFY23) at Rs 7.6tn (domestic at Rs6.1tn and international at Rs 1.5tn) – lower than Rs 8.5tn in Previous year as L&T is bidding selectively at desired margin levels. Conversion/order win expected to improve helping to meet guided order intake. Buildings & Factories, Hydel power, tunnels, Metro Rail, Rural water supply, Irrigation, thermal power and T&D are key areas

- Hyderabad Metro performance: Debt refinancing led to reduction in interest cost. In Q1FY23, cash loss was Rs 2.5bn with traffic ridership at 285k/day. Supplementary agreement signed with Telangana government for long term soft loan of Rs30bn (interest free) – to be disbursed over 2 years which can limit loss funding from L&T.

- Divestments: L&T is targeting divestment of its 51% stake in L&T IDPL and in Nabha power but no specific timelines have been provided. L&T’s invested capital in these businesses is Rs35bn (Rs24bn in Nabha and Rs 11bn in IDPL). Going forward, L&T will also target to bring in investors for equity infusion in Hyderabad Metro and bring down its equity stake to 51% from 100%.

- Investments in new areas: L&T has invested Rs 2bn in data centres so far. Investment in areas linked to Electrolysers, Grid batteries and green hydrogen will be firmed up subject to technology tie-ups and commercial viability.

- FY23 Guidance maintained: Revenue and order inflows: 12-15% growth, E&C margins: 9.5% (vs. 9.2% in FY22) and NWC at 20-22% of revenue (20.9% in June-22). Recent correction in commodity prices helps to meet guidance but currently not a case for increase in guidance.

Outlook & valuation

We believe that L&T is well-placed to benefit from pickup in economic activity and private capex given its financial, technical & managerial capability for sustaining, gaining market share and focus on divestment of non-core assets. Given the strong international outlook from infrastructure as well as hydrocarbon segment, prospect pipeline, continued execution momentum and reduction in borrowing costs augurs well for long-term performance. Currently the stock trades at EV/EBITDA of 11x on FY25E basis.

Quarterly Financials

| Particulars (Rs. in Crores) | Q1FY23 | Q1FY22 | Y-o-Y | Q4FY22 | QoQ | FY22 | FY21 | YoY |

|---|---|---|---|---|---|---|---|---|

| Revenue from Operations | 35853.00 | 29335.00 | 22.22% | 52851.00 | -32.16% | 156521.00 | 135979.00 | 15.11% |

| COGS | 15194.00 | 11945.00 | 29995.00 | 93796.00 | 79010.00 | |||

| Gross Profit | 20659.00 | 17389.00 | 18.80% | 22856.00 | -9.61% | 62725.00 | 56969.00 | 10.10% |

| Gross Margin (%) | 57.62% | 59.28% | 43.25% | 40.07% | 41.90% | |||

| Employee Benefit Expenses | 8556.00 | 6872.00 | 7968.00 | 29734.00 | 24751.00 | |||

| Other Expenses | 8147.00 | 7446.00 | 3595.00 | 14784.00 | 16601.00 | |||

| EBITDA | 3957.00 | 3071.00 | 28.82% | 11292.00 | -64.96% | 18207.00 | 15618.00 | 16.58% |

| EBITDA Margin (%) | 11.04% | 10.47% | 21.37% | 11.63% | 11.49% | |||

| Depreciation | 963.00 | 717.00 | 769.00 | 2948.00 | 2904.00 | |||

| EBIT | 2993.00 | 2354.00 | 27.15% | 10523.00 | -71.56% | 15259.00 | 12714.00 | 20.02% |

| EBIT Margin (%) | 8.35% | 8.02% | 19.91% | 9.75% | 9.35% | |||

| Finance Cost | 756.00 | 827.00 | 705.00 | 3126.00 | 3913.00 | |||

| Oher Income | 695.00 | 648.00 | 516.00 | 2267.00 | 3429.00 | |||

| Profit Before Exceptional Items & Tax | 2932.00 | 2250.00 | 10334.00 | 14401.00 | 12230.00 | |||

| Exceptional Items | - | - | - | - | - | |||

| Profit Before Tax | 2932.00 | 2250.00 | 30.33% | 10334.00 | -71.63% | 14401.00 | 12230.00 | 17.75% |

| Tax | 639.00 | 718.00 | 1555.00 | 4217.00 | 4011.00 | |||

| Effective Tax Rate (%) | 21.79% | 31.94% | 15.05% | 29.28% | 32.80% | |||

| Profit After Tax | 2293.00 | 1531.00 | 49.75% | 8779.00 | -73.88% | 10184.00 | 8219.00 | 23.91% |

| PAT Margin (%) | 6.40% | 5.22% | 16.61% | 6.51% | 6.04% | |||

| Earnings Per Share (Rs.) | 12.00 | 8.00 | 44.86% | 26.00 | -53.01% | 61.71 | 82.49 | -25.19% |

Source: Company Filings; StockAxis Research

Consolidated Financial statements

Profit & Loss statement

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Net Sales | 141314.00 | 151019.00 | 135979.00 | 156521.00 | 179681.00 | 200962.00 | 225596.00 |

| Expenditure | |||||||

| Material Cost | 46275.00 | 47437.00 | 79010.00 | 93795.00 | 105113.00 | 118568.00 | 133102.00 |

| Employee Cost | 17466.00 | 23114.00 | 24751.00 | 29734.00 | 34139.00 | 38183.00 | 42863.00 |

| Other Expenses | 55741.00 | 57384.00 | 15876.00 | 14785.00 | 23358.00 | 23312.00 | 24590.00 |

| EBITDA | 21832.00 | 23085.00 | 16342.00 | 18207.00 | 17070.00 | 20900.00 | 25041.00 |

| EBITDA Margin | 15.40% | 15.30% | 12.00% | 11.60% | 9.50% | 10.40% | 11.10% |

| Depreciation & Amortization | 1923.00 | 2462.00 | 2904.00 | 2948.00 | 3273.00 | 3778.00 | 4265.00 |

| EBIT | 19909.00 | 20623.00 | 13438.00 | 15259.00 | 13797.00 | 17122.00 | 20776.00 |

| EBIT Margin % | 14.10% | 13.70% | 9.90% | 9.70% | 7.70% | 8.50% | 9.20% |

| Other Income | 3925.00 | 4961.00 | 3429.00 | 2267.00 | 3428.00 | 2456.00 | 2457.00 |

| Interest & Finance Charges | 9547.00 | 11269.00 | 3913.00 | 3126.00 | 2687.00 | 2657.00 | 2658.00 |

| Profit Before Tax - Before Exceptional | 14286.00 | 14314.00 | 12954.00 | 14400.00 | 14538.00 | 16921.00 | 20575.00 |

| Profit Before Tax | 14581.00 | 14314.00 | 12954.00 | 14400.00 | 14538.00 | 16921.00 | 20576.00 |

| Tax Expense | 4343.00 | 3492.00 | 4011.00 | 4217.00 | 3659.00 | 4259.00 | 5185.00 |

| Effective Tax rate | 29.80% | 24.40% | 31.00% | 29.30% | 25.20% | 25.20% | 25.20% |

| Net Profit | 10238.00 | 10822.00 | 8943.00 | 10183.00 | 10879.00 | 12662.00 | 15391.00 |

| Net Profit Margin | 7.20% | 7.20% | 6.60% | 6.50% | 6.10% | 6.30% | 6.80% |

Balance Sheet

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Share Capital | 281.00 | 281.00 | 281.00 | 281.00 | 281.00 | 281.00 | 281.00 |

| Total Reserves | 61757.00 | 66041.00 | 75204.00 | 82127.00 | 93005.00 | 105667.00 | 121058.00 |

| Shareholders' Funds | 69201.00 | 76244.00 | 87920.00 | 96070.00 | 109397.00 | 123928.00 | 139321.00 |

| Minority Interest | 6826.00 | 9521.00 | 12052.00 | 12966.00 | 15415.00 | 17284.00 | 17285.00 |

| Non Current Liabilities | |||||||

| Long Term Burrowing | 74121.00 | 82331.00 | 82120.00 | 61618.00 | 84718.00 | 85057.00 | 85397.00 |

| Deferred Tax Assets / Liabilities | -3108.00 | -2394.00 | -1518.00 | 1039.00 | 1039.00 | 1039.00 | 1039.00 |

| Long Term Provisions | 557.00 | 709.00 | 774.00 | 818.00 | 818.00 | 818.00 | 818.00 |

| Current Liabilities | |||||||

| Short Term Borrowings | 29224.00 | 35021.00 | 27766.00 | 30477.00 | 30477.00 | 30477.00 | 30477.00 |

| Trade Payables | 42995.00 | 43644.00 | 45505.00 | 51144.00 | 52963.00 | 63614.00 | 67782.00 |

| Other Current Liabilities | 58003.00 | 61804.00 | 59968.00 | 73066.00 | 73066.00 | 73066.00 | 73066.00 |

| Short Term Provisions | 3581.00 | 4260.00 | 4170.00 | 4666.00 | 4666.00 | 4666.00 | 4666.00 |

| Total Equity & Liabilities | 274928.00 | 304294.00 | 308577.00 | 320744.00 | 358911.00 | 384432.00 | 404332.00 |

| Assets | |||||||

| Net Block | 18812.00 | 42005.00 | 43119.00 | 43433.00 | 50756.00 | 55291.00 | 58796.00 |

| Non Current Investments | 6961.00 | 7348.00 | 8615.00 | 9811.00 | 9811.00 | 9811.00 | 9811.00 |

| Long Term Loans & Advances | 64919.00 | 66653.00 | 59064.00 | 49153.00 | 49153.00 | 49153.00 | 49153.00 |

| Current Assets | |||||||

| Currents Investments | 13946.00 | 12700.00 | 31011.00 | 29793.00 | 29793.00 | 29793.00 | 29793.00 |

| Inventories | 6414.00 | 5747.00 | 5821.00 | 5943.00 | 6908.00 | 7821.00 | 8765.00 |

| Sundry Debtors | 36846.00 | 40732.00 | 42230.00 | 46139.00 | 48358.00 | 57357.00 | 61939.00 |

| Cash and Bank | 11726.00 | 15118.00 | 16242.00 | 18953.00 | 7688.00 | 16891.00 | 27763.00 |

| Short Term Loans and Advances | 50043.00 | 50675.00 | 50714.00 | 42550.00 | 42550.00 | 42550.00 | 42550.00 |

| Total Assets | 274928.00 | 304294.00 | 308577.00 | 320744.00 | 358911.00 | 384432.00 | 404332.00 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Profit After Tax | 10238.00 | 10822.00 | 8943.00 | 10183.00 | 10879.00 | 12662.00 | 15391.00 |

| Depreciation | 1923.00 | 2462.00 | 2904.00 | 2948.00 | 3273.00 | 3778.00 | 4265.00 |

| Changes in Working Capital | -15947.00 | -7784.00 | 9970.00 | 1608.00 | -1365.00 | 738.00 | -1356.00 |

| Cash From Operating Activities | -4756.00 | 6694.00 | 22844.00 | 14739.00 | 12787.00 | 17178.00 | 18301.00 |

| Purchase of Fixed Assets | -4307.00 | -3437.00 | -1808.00 | -5196.00 | -10596.00 | -8313.00 | -7770.00 |

| Free Cash Flows | -9063.00 | 3257.00 | 21036.00 | 9543.00 | 2191.00 | 8865.00 | 10531.00 |

| Cash Flow from Investing Activities | -11023.00 | -8256.00 | -5429.00 | -5196.00 | -10596.00 | -8313.00 | -7770.00 |

| Increase / (Decrease) in Loan Funds | 17865.00 | 13818.00 | -8732.00 | -9137.00 | -8273.00 | 338.00 | 339.00 |

| Cash from Financing Activities | 15440.00 | 6372.00 | -15274.00 | -9137.00 | -8273.00 | 338.00 | 340.00 |

| Net Cash Inflow / Outflow | -338.00 | 4809.00 | 2141.00 | 406.00 | -6082.00 | 9204.00 | 10871.00 |

| Opening Cash & Cash Equivalents | 6799.00 | 6460.00 | 11118.00 | 13257.00 | 13770.00 | 7688.00 | 16891.00 |

| Closing Cash & Cash Equivalent | 6460.00 | 11118.00 | 13257.00 | 18953.00 | 7688.00 | 16891.00 | 27763.00 |

Key Ratios

| Yr End March | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Basic EPS | 63.00 | 68.00 | 54.00 | 61.00 | 65.00 | 77.00 | 95.00 |

| Diluted EPS | 63.00 | 68.00 | 54.00 | 61.00 | 65.00 | 77.00 | 95.00 |

| Cash EPS (Rs) | 77.00 | 85.00 | 75.00 | 82.00 | 88.00 | 104.00 | 125.00 |

| DPS | 18.00 | 18.00 | 36.00 | - | - | - | - |

| Book value (Rs/share) | 491.00 | 540.00 | 623.00 | 684.00 | 779.00 | 882.00 | 992.00 |

| ROCE (%) Post Tax | 10.30% | 10.60% | 5.90% | 6.40% | 6.20% | 6.30% | 7.00% |

| ROE (%) | 12.90% | 12.50% | 8.70% | 8.90% | 8.40% | 10.90% | 11.70% |

| Inventory Days | 15.00 | 15.00 | 16.00 | 14.00 | 13.00 | 13.00 | 13.00 |

| Receivable Days | 90.00 | 94.00 | 111.00 | 103.00 | 96.00 | 96.00 | 97.00 |

| Payable Days | 104.00 | 105.00 | 120.00 | 113.00 | 106.00 | 106.00 | 106.00 |

| PE | 22.00 | 12.00 | 17.00 | 25.00 | 24.00 | 20.00 | 16.20 |

| P/BV | 3.00 | 1.00 | 2.00 | 2.00 | 2.00 | 2.00 | 1.50 |

| EV/EBITDA | 14.00 | 10.00 | 17.00 | 14.00 | 17.00 | 14.00 | 11.00 |

| Dividend Yield (%) | 1.30% | 2.20% | 2.50% | 0.00% | 0.00% | 0.00% | 0.00% |

| P/Sales | 1.40 | 0.80 | 1.50 | 1.40 | 1.20 | 1.10 | 1.00 |

| Net debt/Equity | 1.40 | 1.50 | 1.00 | 0.50 | 0.70 | 0.60 | 0.40 |

| Net Debt/ EBITDA | 4.60 | 4.90 | 5.20 | 2.40 | 4.60 | 3.30 | 2.30 |

| Sales/Net FA (x) | 8.10 | 5.00 | 3.20 | 3.60 | 3.80 | 3.80 | 4.00 |