State Bank Of India

Quarterly Result - Q1FY23

State Bank Of India

Bank - Public

Current

Previous

Stock Info

Shareholding Pattern

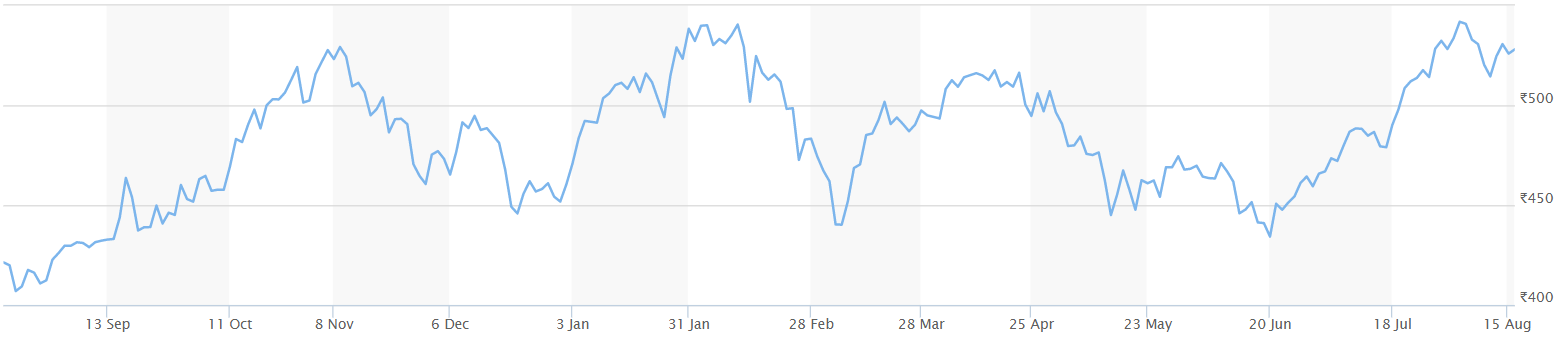

Price performance

Indexed Stock Performance

Quarterly Results

SBIN reported a 7% YoY decline in PAT to INR 6,068.08 Cr in 1QFY23, impacted by adverse MTM losses of INR 6550 Cr. NII grew 13% YoY. Domestic NIM fell 13bp QoQ to 3.23% as there was an interest income of INR 600Cr on an income tax refund in 4QFY22.

Other income fell 80% YoY to INR 2312 Cr, resulting in a total revenue of INR 33,508 cr, due to an adverse MTM. Core fee grew at 18% YoY. OPEX was flat YoY, while PPOP fell 33% YoY to INR 12,752 Cr. Gross advances grew 14.9% YoY and 2.9% QoQ, led by a 9%/3% QoQ growth in international loans/Retail book.

The SME book grew 2.4%, while the Agri and Corporate book was flat QoQ. The growth in international loans was led by syndicated debt and trade finance, while Xpress Credit/Home loans led the show in the Retail portfolio. Deposits grew 9% YoY (flat QoQ), with the CASA mix up 5bp at 45.3%. The bank aspires to increase market share in current account deposits to boost its CASA ratio.

Despite a rise in fresh slippages QoQ to INR 10,100 Cr, the GNPA/NNPA ratio fell marginally (by 6bp/2bp) to 3.91%/1% in 1QFY23, led by recoveries and upgrades of INR52b and write-offs of INR 36.6b. Restructuring loans fell 7% QoQ to INR 28800 Cr (1% of loans), while the SMA 1/2 portfolio grew 97% to INR 6980 Cr. PCR ratio was steady at 75% (90.1% including AUCA)

Concall Highlights

- Total Restructuring stands at Rs.287.85bn vs Rs 309.6bn in Q4FY22. Reduction is on account repayment of Rs. 20bn and balance having slipped to NPA, against which bank has reversed restructured provision to that extent. Outstanding restructured provision stood at Rs. 78bn.

- Credit costs for the quarter was 0.67%, aspiration would be to reduce it to the extent possible.

- The management would continue to focus on credit offtake, maintaining its leadership position and improving CASA ratio (via customer acquisition and strengthening relationship with existing customers). Credit growth guidance at 15% YoY. Margins to witness uptick from Q2 FY23, Q3FY23 onwards.

- Available for Sale (AFS) book was at Rs 6.31 lakh crore with 60% in G-sec & 23% in highly rated corporate bonds. MTM booked until 7.45%. In FY23, the bank has redemption of Rs 83000 crore from AFS book and total redemption of Rs 1.5 lakh crore

- MTM losses impacted RoA which declined by 9bps YoY to 0.48% and RoE declined by 203bps YoY to 10.1%. Excluding MTM impact, notional RoA and RoE would be 2.9% and 18.6% respectively.

- Standard assets provisions negative due to write back Rs 1595 crore on account of Covid restructuring

- Personal loans average ticket size is Rs 5.79 lakh of which 95% is given to customers maintaining salary account (of which 85% is government employees, 5% would be large corporate)

- Total Rs 9700 crore slippages breakup:

- SME Rs 3000 crore, Agri Rs 2700 crore, retail Rs 2353 crore. Of total slippages, Rs 2800 crore has been recovered till now.

- In Q4FY22, the bank had interest on income tax refund of Rs 600 crore, which was not there in Q1FY23. This had an impact on margin trajectory.

- Most of the EBLR loans are linked to repo rate. It gets re priced on first of the following month. Share of BB & below book increased Q-o-Q to 13% as majority of them are state government loans, which are not rated.

Outlook & valuation

SBI is one of the biggest beneficiaries of improving economic recovery. We remain positive on SBI among public sector banks for its sharp improvement in asset quality, strong liability profile, high retail orientation & digital focus, reasonable capital position, and sharply improving return ratios given renewed focus on profitability while maintaining market dominance and portfolio quality. The stock currently trades at 1.4x FY24E P/ABV (standalone) and we maintain Hold on the Stock.

Quarterly Financials

| Particulars (Rs. in cr.) | Q1FY23 | Q1 FY22 | Y-o-Y | Q4FY22 | QoQ % | FY22 | FY21 | YoY |

|---|---|---|---|---|---|---|---|---|

| Interest Earned | 72676.00 | 65564.00 | 11.00% | 70733.00 | 3.00% | 275457.00 | 265151.00 | 4.00% |

| Interest Expended | 41480.00 | 37926.00 | 39535.00 | 154750.00 | 154441.00 | |||

| Net Interest Income | 31196.00 | 27638.00 | 13.00% | 31198.00 | 0.00% | 120708.00 | 110710.00 | 9.00% |

| Other Income | 2312.00 | 11803.00 | 11880.00 | 40564.00 | 41957.00 | |||

| Total Income | 33508.00 | 39441.00 | -15.00% | 43078.00 | -22.00% | 161272.00 | 152667.00 | 6.00% |

| Employee Expense | 12051.00 | 12538.00 | 12556.00 | 50144.00 | 50936.00 | |||

| Other Operating Expense | 8704.00 | 7928.00 | 10805.00 | 35836.00 | 31716.00 | |||

| Total Operating Expense | 20756.00 | 20466.00 | 1.00% | 23361.00 | -11.00% | 85979.00 | 82652.00 | 4.00% |

| Pre-Provisioning Operating Profit | 12753.00 | 18975.00 | -33.00% | 19717.00 | -35.00% | 75292.00 | 70014.00 | 8.00% |

| Provisions | 4392.00 | 10052.00 | 7237.00 | 24452.00 | 44013.00 | |||

| Exceptional items | - | - | - | -7418.00 | 1540.00 | |||

| Profit before Tax | 8360.00 | 8923.00 | -6.00% | 12479.00 | -33.00% | 43422.00 | 27541.00 | 58.00% |

| Tax | 2292.00 | 2419.00 | 3366.00 | 11746.00 | 7131.00 | |||

| Profit after Tax | 6068.00 | 6504.00 | -7.00% | 9114.00 | -33.00% | 31676.00 | 20410.00 | 55.00% |

| Earnings Per Share (EPS) | 6.80 | 7.30 | -0.10 | 10.20 | -0.30 | 35.50 | 22.90 | 0.60 |

| Gross NPA (%) (standalone) | 3.90 | 5.30 | 4.00 | 4.00 | 5.00 | |||

| Net NPA (%) (standalone) | 1.00 | 1.80 | 1.00 | 1.00 | 1.50 |

Source: Company Filings; StockAxis Research

Standalone Financial statements

Profit & Loss statement

| Particulars (Rs. in cr.) | FY2019 | FY2020 | FY2021 | FY2022 | FY2023E | FY2024E |

|---|---|---|---|---|---|---|

| Interest Earned | 242869.00 | 257324.00 | 265151.00 | 275457.00 | 315523.00 | 363080.00 |

| Interest Expended | 154520.00 | 159239.00 | 154441.00 | 154749.70 | 174610.00 | 201157.00 |

| Net Interest Income | 88349.00 | 98085.00 | 110710.00 | 120708.00 | 140913.00 | 161923.00 |

| Other Income | 36775.00 | 45221.00 | 43496.00 | 40563.91 | 44215.00 | 48636.00 |

| Total Income | 125124.00 | 143306.00 | 154206.00 | 161272.00 | 185127.00 | 210559.00 |

| Operating Expense | 69688.00 | 75174.00 | 82652.00 | 85979.00 | 96798.00 | 112286.00 |

| Pre-Provisioning Operating Profit | 55436.00 | 68133.00 | 71554.00 | 75292.00 | 88329.00 | 98274.00 |

| Provisions | 52274.00 | 43291.00 | 44013.00 | 24452.13 | 24890.00 | 26992.00 |

| Exceptional Items & Taxes | 2300.00 | 10353.00 | 7131.00 | 19164.00 | 14890.00 | 18310.00 |

| Net Profit | 862.00 | 14488.00 | 20410.00 | 31676.00 | 48550.00 | 52972.00 |

| Earnings Per Share (EPS) | 1.00 | 16.00 | 23.00 | 35.00 | 50.00 | 59.00 |

Balance Sheet

| Particulars (Rs. in cr.) | FY2019 | FY2020 | FY2021 | FY2022 | FY2023E | FY2024E |

|---|---|---|---|---|---|---|

| Share Capital | 892.00 | 892.00 | 892.00 | 892.00 | 892.00 | 892.00 |

| Reserves | 220021.00 | 231115.00 | 252983.00 | 279196.00 | 298561.00 | 351617.00 |

| Shareholders Fund | 220914.00 | 232007.00 | 253875.00 | 280088.00 | 299453.00 | 352509.00 |

| Deposits | 2911386.00 | 3241621.00 | 3681277.00 | 4051534.00 | 4645607.00 | 5386035.00 |

| Borrowings | 403017.00 | 314656.00 | 417298.00 | 426043.00 | 459456.00 | 468351.00 |

| Other Liabilities and Provisions | 145597.00 | 163110.00 | 181980.00 | 229932.00 | 229320.00 | 223501.00 |

| Total Liabilities | 3680914.00 | 3951394.00 | 4534430.00 | 4987597.00 | 5633835.00 | 6430396.00 |

| Fixed Assers | 39198.00 | 38439.00 | 38419.00 | 37708.00 | 42444.00 | 48435.00 |

| Advances | 2185877.00 | 2325290.00 | 2449498.00 | 2733967.00 | 3144062.00 | 3647111.00 |

| Investments | 967022.00 | 1046955.00 | 1351705.00 | 1481445.00 | 1650927.00 | 1839989.00 |

| Cash & Bank Balance | 222490.00 | 251097.00 | 343039.00 | 394552.00 | 448799.00 | 513579.00 |

| Other Assets | 266328.00 | 289614.00 | 351769.00 | 339925.00 | 373917.00 | 411309.00 |

| Total Assets | 3680914.00 | 3951394.00 | 4534430.00 | 4987597.00 | 5660149.00 | 6460424.00 |

Key Ratios

| Particulars (Rs. in cr.) | FY2019 | FY2020 | FY2021 | FY2022 | FY2023E | FY2024E |

|---|---|---|---|---|---|---|

| Earnings Per Share (EPS) (Rs) | 0.97 | 16.23 | 22.86 | 35.48 | 49.80 | 59.40 |

| Price / EPS | 385.60 | 23.00 | 18.70 | 14.90 | 10.60 | 8.90 |

| Book Value (BV) (Rs) | 247.90 | 256.20 | 266.00 | 287.60 | 335.00 | 395.00 |

| Adj Book value (ABV) | 183.00 | 175.00 | 217.00 | 272.00 | 320.00 | 379.30 |

| Price / BV | 1.50 | 1.50 | 1.60 | 1.80 | 1.50 | 1.30 |

| Price/ABV | 1.80 | 2.80 | 2.20 | 1.60 | 1.60 | 1.40 |

| NIIM (%) | 2.78 | 2.97 | 2.99 | 3.00 | 3.10 | 3.20 |

| ROA (%) | 0.02 | 0.38 | 0.50 | 0.70 | 0.90 | 1.00 |

| ROE (%) | 0.48 | 7.74 | 8.20 | 13.00 | 14.50 | 15.10 |

| GNPA (%) | 7.53 | 6.15 | 4.98 | 4.30 | 4.10 | 3.90 |

| NPA (%) | 3.01 | 2.23 | 1.50 | 1.30 | 1.00 | 0.80 |