Stove Kraft Ltd

Quarterly Result - Q2FY22

Stove Kraft Ltd

Consumer Durables - Domestic Appliances

Current

Previous

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. in Crores) | Q2FY22 | Q2FY21 | YoY | Q1FY22 | QoQ |

|---|---|---|---|---|---|

| Net Revenue from Operations | 362.80 | 236.80 | 53.21% | 214.20 | 69.37% |

| EBIT | 35.80 | 31.80 | 12.58% | 16.10 | 122.36% |

| EBIT Margin | 9.87% | 13.43% | 7.52% | ||

| PAT | 22.90 | 26.90 | -14.87% | 13.50 | 69.63% |

| PAT Margin | 6.31% | 11.36% | 6.30% | ||

| EPS | 6.93 | 10.87 | -36.25% | 4.09 | 69.44% |

Source: Company Filings; StockAxis Research

Quarterly Result Update

Stove Kraft Limited (SKL) reported strong Q2FY22 numbers whereby revenue increased

by 53% YoY to Rs 362 crores driven by growth across all channels – general

trade, modern retail and e-commerce. Ebitda was up ~15% YoY however margins were

down by ~360 bps 11.2% due to higher raw material costs. PAT was down by ~15% YoY

to Rs 23 crores as the company has started providing for income tax after setting

off accumulated losses brought forward from previous years. During the quarter,

the Company introduced Distributor Management System across 100% of its outlets.

This tool helps improve operations and provide effective sales & inventory management

related only to Pigeon products. The Company has also focused on backward integration

of the facilities which will help in reducing costs and improving efficiencies.

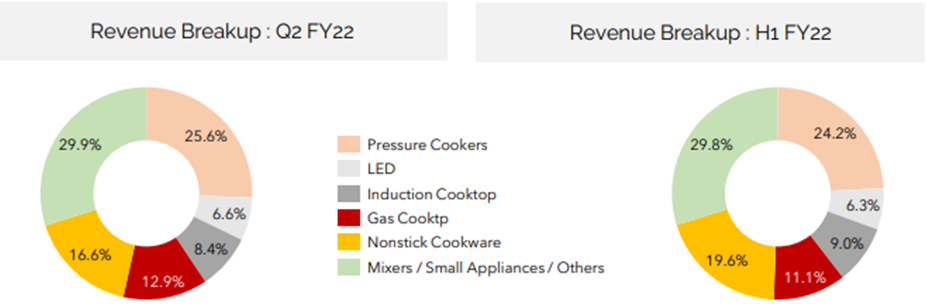

SKL added 8,247 retail outlets in the quarter gone by. In Q2FY22, Pressure Cooker

volume grew by 53% YoY, Gas Cooktop by 31% YoY, Induction Cooktop by 53% YoY, Non-stick

Cookware by 14% YoY, LED by 70% YoY and Small Appliances/Mixer/Others grew by 34%

YoY.

Strong distribution network and spending on advertising & marketing to aid

revenue growth

SKL added 8,247 retail outlets in Q2FY22 taking the total number to 63,428 outlets

as of September 2021. The company is focused on increasing distribution network

across the country and bringing more customers onboard through increasing the number

of retail outlets. During the quarter, the company increased spending on branding

& marketing through focused and consistent initiatives to develop brand awareness.

We believe these initiatives will help the company to deliver consistent growth

going forward.

Key Con-call highlights:

- Witnessing good growth across all channels. Business is moving from unorganized to organized market. Growing at a pace much higher than the industry growth rate.

- SKL hiked prices by ~5% across the product portfolio at the beginning of Q3FY22. Did not take any price hike in Q2FY22.

- More price increases will be taken to stabilize margins as input costs have gone up. Management stated that price gap has increased in appliances as competition has taken more price hikes than SKL.

- Management believes that the volume growth in Q2FY22 is not sustainable. 20-25% volume growth can be achieved going forward. SKL is confident of achieving EBITDA margin guidance of 13-14% as they are focusing more on backward integration.

- The rate of tax for FY22 will be 14%. From FY23 onwards, the normal tax rate of ~25% will be applicable.

- The company has planned Rs 50-60 crore of capex in FY22. They are also investing Rs 30 crore on solar power project in order to meet 70-75% of its total energy requirement.

- In H1FY22, Electric Kettle recorded revenue of Rs 40 crore while Mixer Grinder clocked revenue of Rs 32 crore (+168% YoY). Chopper revenue stood at Rs 26 crore (+65% YoY) and has surprised the management given its high growth.

- The company plans to spend 3-4% of revenue on branding & marketing going forward. Ad spends stood at Rs 15 crore in H1FY22.

- In H1FY22, the company has added over 11,400 retail outlets, which is equal to addition of ~20% of the outlets at the end of FY21. In Pigeon, it has added 7,000 retail outlets (40% in West and 15% in South). In Pigeon LED, it has added 4,400 retail outlets (50% in South, rest in Western region, WB and UP).

- In Q3FY22, SKL is planning to launch Plastic Storage Containers. Also, it will have a full range of LEDs (0.5watt to 50watt) from Q3FY22.

Outlook & Valuation:

We believe the company has taken the right steps towards delivering sustainable growth. It is well placed to reap the benefits of having a strong presence in Tier-2 and Tier-3 cities and is working to establish its presence in Tier-1 cities too. Focus on expanding distribution network will be the key growth driver. Based on our estimates, the stock is currently trading at ~24x FY23 EPS and we maintain Hold rating for the company.

Quarterly Financials

| Particulars (Rs. in Crores) | Q2FY22 | Q2FY21 | YoY | Q1FY22 | QoQ |

|---|---|---|---|---|---|

| Revenue from Operations | 362.80 | 236.80 | 53.21% | 214.20 | 69.37% |

| COGS | 246.00 | 153.40 | 140.80 | ||

| Gross Profit | 116.80 | 83.40 | 40.05% | 73.40 | 59.13% |

| Gross Margin (%) | 32.19% | 35.22% | 34.27% | ||

| Employee Benefit Expenses | 30.30 | 20.30 | 23.80 | ||

| Other Expenses | 45.90 | 27.90 | 29.40 | ||

| EBITDA | 40.60 | 35.20 | 15.34% | 20.20 | 100.99% |

| EBITDA Margin (%) | 11.19% | 14.86% | 9.43% | ||

| Depreciation | 4.80 | 3.40 | 4.10 | ||

| EBIT | 35.80 | 31.80 | 12.58% | 16.10 | 122.36% |

| EBIT Margin (%) | 9.87% | 13.43% | 7.52% | ||

| Finance Cost | 3.90 | 5.40 | 3.00 | ||

| Oher Income | 0.10 | 0.50 | 0.40 | ||

| Profit Before Exceptional Items & Tax | 32.00 | 26.90 | 13.50 | ||

| Exceptional Items | - | - | - | ||

| Profit Before Tax | 32.00 | 26.90 | 18.96% | 13.50 | 137.04% |

| Tax | 9.10 | - | - | ||

| Effective Tax Rate (%) | 28.44% | 0.00% | 0.00% | ||

| Profit After Tax | 22.90 | 26.90 | -14.87% | 13.50 | 69.63% |

| PAT Margin (%) | 6.31% | 11.36% | 6.30% | ||

| Other Comprehensive Income | -0.30 | 1.30 | -0.20 | ||

| Total Comprehensive Income | 22.60 | 28.20 | 13.30 | ||

| Earnings Per Share (Rs.) | 6.93 | 10.87 | -36.25% | 4.09 | 69.44% |

Source: Company Filings; StockAxis Research

Consolidated Financial statements

Profit & Loss statement

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|

| Net Sales | 640.90 | 669.90 | 859.00 | 1154.00 | 1419.40 |

| Growth % | 22.40% | 4.50% | 28.20% | 34.30% | 23.00% |

| Expenditure | |||||

| Material Cost | 438.70 | 441.90 | 558.20 | 763.90 | 922.60 |

| Employee Cost | 68.60 | 82.00 | 80.60 | 108.50 | 134.80 |

| Other Expenses | 103.80 | 112.20 | 106.60 | 152.30 | 181.70 |

| EBITDA | 29.80 | 33.80 | 113.50 | 129.20 | 180.30 |

| Growth % | 199.10% | 13.30% | 235.70% | 13.90% | 39.50% |

| EBITDA Margin | 4.70% | 5.00% | 13.20% | 11.20% | 12.70% |

| Depreciation & Amortization | 12.40 | 12.40 | 14.30 | 17.30 | 20.70 |

| EBIT | 17.40 | 21.40 | 99.20 | 112.00 | 159.60 |

| EBIT Margin % | 2.70% | 3.20% | 11.50% | 9.70% | 11.20% |

| Other Income | 1.70 | 3.10 | 1.50 | 5.00 | 10.00 |

| Interest & Finance Charges | 17.90 | 20.90 | 19.20 | 2.50 | 1.70 |

| Profit Before Tax - Before Exceptional | 1.10 | 3.50 | 81.50 | 114.50 | 167.90 |

| Profit Before Tax | 1.10 | 3.50 | 81.50 | 114.50 | 167.90 |

| Tax Expense | 0.50 | 0.40 | - | 16.00 | 42.00 |

| Effective Tax rate | 43.50% | 10.30% | 0.00% | 14.00% | 25.00% |

| Exceptional Items | - | - | - | - | - |

| Net Profit | 0.60 | 3.20 | 81.50 | 98.50 | 125.90 |

| Growth % | -105.00% | 399.40% | 2468.80% | 20.90% | 27.90% |

| Net Profit Margin | 0.10% | 0.50% | 9.50% | 8.50% | 8.90% |

| Consolidated Net Profit | 0.60 | 3.20 | 81.50 | 98.50 | 125.90 |

| Growth % | -105.00% | 397.80% | 2476.90% | 20.90% | 27.90% |

| Net Profit Margin after MI | 0.10% | 0.50% | 9.50% | 8.50% | 8.90% |

Balance Sheet

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|

| Share Capital | 24.70 | 24.70 | 32.60 | 32.60 | 32.60 |

| Total Reserves | -87.30 | -85.80 | 267.10 | 365.60 | 491.60 |

| Shareholders' Funds | -62.40 | -60.00 | 301.40 | 399.90 | 525.90 |

| Minority Interest | 0.20 | 0.20 | - | - | - |

| Non Current Liabilities | |||||

| Long Term Burrowing | 210.00 | 204.80 | 20.70 | 0.20 | -4.80 |

| Deferred Tax Assets / Liabilities | - | - | - | - | - |

| Long Term Provisions | 4.60 | 6.30 | 7.20 | 5.00 | 4.90 |

| Current Liabilities | |||||

| Short Term Borrowings | 99.90 | 122.10 | 29.80 | 29.80 | 29.80 |

| Trade Payables | 134.10 | 150.90 | 176.60 | 198.50 | 253.80 |

| Other Current Liabilities | 29.20 | 34.30 | 14.80 | 10.00 | 10.00 |

| Short Term Provisions | 2.00 | 2.00 | 2.20 | 2.20 | 2.20 |

| Total Equity & Liabilities | 427.10 | 471.30 | 569.70 | 662.80 | 838.90 |

| Assets | |||||

| Net Block | 180.50 | 193.20 | 219.60 | 266.90 | 300.20 |

| Non Current Investments | - | - | - | - | - |

| Long Term Loans & Advances | 6.70 | 8.60 | 14.80 | 16.00 | 16.00 |

| Current Assets | |||||

| Currents Investments | - | - | - | - | - |

| Inventories | 97.40 | 116.60 | 156.00 | 157.20 | 197.40 |

| Sundry Debtors | 89.70 | 103.00 | 84.70 | 110.30 | 141.00 |

| Cash and Bank | 31.50 | 19.40 | 37.30 | 53.40 | 125.50 |

| Short Term Loans and Advances | 7.50 | 13.90 | 34.00 | 34.40 | 34.30 |

| Total Assets | 427.10 | 471.30 | 569.70 | 662.80 | 838.90 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|

| Profit After Tax | 0.60 | 3.20 | 81.50 | 98.50 | 125.90 |

| Depreciation | 12.40 | 12.40 | 14.30 | 17.30 | 20.70 |

| Changes in Working Capital | -18.00 | -27.50 | -8.10 | -4.80 | -15.70 |

| Cash From Operating Activities | 13.20 | 15.60 | 110.00 | 110.90 | 131.00 |

| Purchase of Fixed Assets | -7.40 | -26.10 | -63.40 | -64.60 | -53.90 |

| Free Cash Flows | 5.70 | -10.50 | 46.60 | 46.40 | 77.10 |

| Cash Flow from Investing Activities | -6.80 | -27.30 | -66.40 | -64.60 | -53.90 |

| Increase / (Decrease) in Loan Funds | 40.30 | 16.30 | -100.80 | -22.40 | -5.00 |

| Equity Dividend Paid | - | - | - | - | - |

| Cash from Financing Activities | 21.80 | -1.80 | -29.10 | -22.40 | -5.00 |

| Net Cash Inflow / Outflow | 28.10 | -13.50 | 14.40 | 24.00 | 72.10 |

| Opening Cash & Cash Equivalents | 0.40 | 28.50 | 15.00 | 29.50 | 53.40 |

| Closing Cash & Cash Equivalent | 28.50 | 15.00 | 29.50 | 53.40 | 125.50 |

Key Ratios

| Yr End March | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|

| Basic EPS | 0.30 | 1.30 | 24.90 | 30.00 | 38.40 |

| Diluted EPS | 0.30 | 1.30 | 24.90 | 30.00 | 38.40 |

| Cash EPS (Rs) | 5.30 | 6.40 | 29.20 | 35.30 | 44.70 |

| DPS | - | - | - | - | - |

| Book value (Rs/share) | -25.20 | -24.60 | 92.00 | 122.00 | 160.40 |

| ROCE (%) Post Tax | 4.70% | 8.50% | 32.50% | 25.70% | 25.90% |

| ROE (%) | -1.00% | -5.30% | 27.00% | 24.60% | 23.90% |

| Inventory Days | 57.70 | 58.30 | 57.90 | 57.00 | 56.00 |

| Receivable Days | 48.20 | 52.50 | 39.90 | 40.00 | 40.00 |

| Payable Days | 79.50 | 77.70 | 69.60 | 72.00 | 72.00 |

| PE | 1783.70 | 358.30 | 18.30 | 30.40 | 23.80 |

| P/BV | -18.20 | -18.60 | 5.00 | 7.50 | 5.70 |

| EV/EBITDA | 47.70 | 42.50 | 13.40 | 23.00 | 16.10 |

| Dividend Yield (%) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| P/Sales | 1.80 | 1.70 | 1.70 | 2.60 | 2.10 |

| Net debt/Equity | - | - | 0.00 | - | - |

| Net Debt/ EBITDA | 9.70 | 9.40 | 0.10 | -0.20 | -0.60 |

| Sales/Net FA (x) | 3.50 | 3.60 | 4.20 | 4.70 | 5.00 |