Tarsons Products Ltd

Quarterly Result - Q1F23

Tarsons Products Ltd

Plastic Products

Current

Previous

Stock Info

Shareholding Pattern

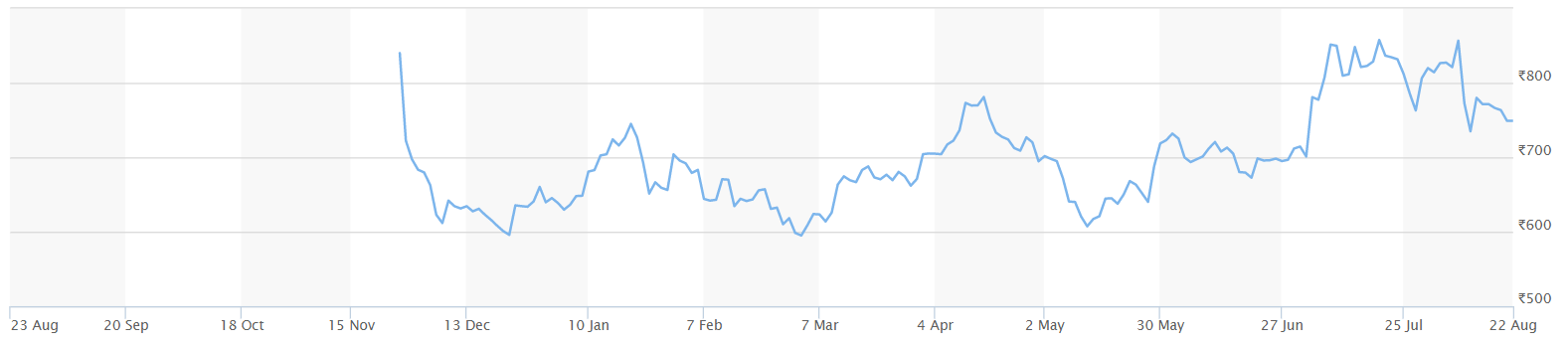

Price performance

Indexed Stock Performance

Quarterly Result Highlights

Tarsons posted revenue of INR69cr (down 1% YoY and 19% QoQ), mainly due to a decline in domestic business with the erosion of Covid business and normalisation of conventional business. Gross margin contracted 290 bps YoY to 79.1% on higher input cost due to geo-political tension and supply chain disruption as well as an adverse change in product mix. However, margin improved 140 bps sequentially. EBITDA at INR31cr (down 15% YoY and 30% QoQ)

EBITDA margin shrank 780 bps YoY and 680 bps QoQ to 45.4%, mainly due to higher employee cost as a result of employee addition to support future growth (up 100 bps YoY) and higher other expense due to increased travel and participation in fairs and exhibitions (up 390 bps YoY). PAT stood at INR20cr down 18% YoY and 31% QoQ.

Concall highlights

- Tarsons is registering steady demand for all its product categories and has been receiving enquiries for its products across industries.

- Tarsons intends to commence the manufacturing of new products PCR and cell culture in its new facilities, which are witnessing increased demand in the domestic as well as export markets.

- Company has imposed price hikes for FY23, implemented with a quarter’s lag. Customers usually accept price hikes after 45–60 days; hence, the total effect will be visible for the remaining nine months of FY23.

- Company is strengthening the senior management team in various areas of sales, production and other important functions, which has led to increased employee cost.

- The export market size is INR50,000cr; Tarsons aims to gain market share and thereby grow export revenue.

- The industry has been receiving significant investor attention and is expected to see more investments in future.

- Tarsons has meticulously laid down plans and strategies for future growth and is well positioned to face intensifying competition in the domestic and international markets.

- EBITDA guidance of mid-to-high 40’s has been maintained.

- Specialised resin prices have been stabilised, whereas packaging and paper costs have started declining.

- Capex

- Expansion of the new facilities is on track at Panchla and Amta.

- Out of the total envisaged capex of INR500cr, Tarsons has incurred INR250cr; INR28cr of this amount was spent in Q1FY23.

- The planned capex is as follows:-

- Panchla:- INR250cr

- Amta:- INR100cr

- Existing facilities:- INR150cr

Outlook & valuation

Tarsons has built a recognized brand in the domestic market with strong market share of 9-12% in India. The company is well placed to capture the growth arising from shift from glassware to plastic ware, growth for end users and, continued gains for domestic manufacturers among others. There is a respectable import market for the company to capture and also a huge export opportunity arising from the “China plus one” strategy. The stock is currently trading at 36.8x FY25E EPS.

Quarterly Financials

| Particulars (Rs. in Crores) | Q1FY23 | Q1FY22 | YoY | Q4FY22 | QoQ | FY22 | FY21 | Y-o-Y |

|---|---|---|---|---|---|---|---|---|

| Revenue from Operations | 68.63 | 69.15 | -0.75% | 84.94 | -19.20% | 300.79 | 228.91 | 31.40% |

| COGS | 14.35 | 12.44 | 18.98 | 62.90 | 61.51 | |||

| Gross Profit | 54.28 | 56.71 | -4.29% | 65.96 | -17.71% | 237.89 | 167.41 | 42.10% |

| Gross Margin (%) | 79.09% | 82.01% | 77.65% | 79.09% | 73.13% | |||

| Employee Benefit Expenses | 8.26 | 7.62 | 8.60 | 31.41 | 24.44 | |||

| Other Expenses | 14.88 | 12.33 | 13.02 | 53.79 | 39.53 | |||

| EBITDA | 31.14 | 36.76 | -15.30% | 44.34 | -29.77% | 152.70 | 103.44 | 47.62% |

| EBITDA Margin (%) | 45.37% | 53.16% | 52.20% | 50.77% | 45.19% | |||

| Depreciation | 6.14 | 4.57 | 7.24 | 21.96 | 13.66 | |||

| EBIT | 25.00 | 32.20 | -22.35% | 37.10 | -32.61% | 130.74 | 89.78 | 45.63% |

| EBIT Margin (%) | 36.43% | 46.56% | 43.68% | 43.46% | 39.22% | |||

| Finance Cost | 0.43 | 0.83 | 0.45 | 4.22 | 2.72 | |||

| Oher Income | 2.69 | 1.98 | 2.58 | 8.47 | 5.38 | |||

| Profit Before Exceptional Items & Tax | 27.26 | 33.34 | 39.22 | 134.99 | 92.43 | |||

| Profit Before Tax | 27.26 | 33.34 | -18.23% | 39.22 | -30.49% | 134.99 | 92.43 | 46.04% |

| Tax | 6.95 | 8.51 | 9.76 | 34.33 | 23.56 | |||

| Effective Tax Rate (%) | 25.50% | 25.51% | 24.89% | 25.43% | 25.49% | |||

| Profit After Tax | 20.31 | 24.84 | -18.22% | 29.46 | -31.07% | 100.66 | 68.87 | 46.17% |

| PAT Margin (%) | 29.59% | 35.91% | 34.69% | 33.47% | 30.09% | |||

| Earnings Per Share (Rs.) | 3.82 | 4.88 | -21.72% | 5.69 | -32.86% | 19.46 | 13.43 | 44.90% |

Source: Company Filings; StockAxis Research

Consolidated Financial statements

Profit & Loss statement

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Net Sales | 178.70 | 175.90 | 228.90 | 300.80 | 320.00 | 355.00 | 405.00 |

| Expenditure | |||||||

| Material Cost | 61.70 | 57.90 | 72.70 | 62.90 | 91.20 | 95.90 | 112.20 |

| Employee Cost | 16.10 | 20.10 | 24.40 | 31.40 | 33.20 | 45.00 | 46.00 |

| Other Expenses | 29.30 | 28.70 | 28.30 | 53.20 | 41.30 | 40.50 | 46.20 |

| EBITDA | 71.70 | 69.30 | 103.40 | 153.20 | 154.30 | 173.70 | 200.60 |

| EBITDA Margin | 40.10% | 39.40% | 45.20% | 50.90% | 48.20% | 48.90% | 50.00% |

| Depreciation & Amortization | 14.60 | 14.20 | 13.70 | 22.00 | 31.00 | 40.00 | 45.00 |

| EBIT | 57.10 | 55.10 | 89.80 | 131.30 | 123.30 | 133.70 | 165.60 |

| EBIT Margin % | 31.90% | 31.30% | 39.20% | 43.60% | 38.50% | 37.70% | 40.90% |

| Other Income | 6.00 | 4.20 | 5.40 | 8.50 | 8.00 | 10.00 | 10.00 |

| Interest & Finance Charges | 7.20 | 6.10 | 2.70 | 4.20 | 3.00 | 2.00 | 2.00 |

| Profit Before Tax - Before Exceptional | 55.80 | 53.10 | 92.40 | 135.50 | 128.30 | 141.70 | 163.60 |

| Profit Before Tax | 55.80 | 53.10 | 92.40 | 135.50 | 128.30 | 141.70 | 164.60 |

| Tax Expense | 16.90 | 12.60 | 23.60 | 34.50 | 33.10 | 35.70 | 41.20 |

| Effective Tax rate | 30.20% | 23.70% | 25.50% | 25.40% | 25.80% | 25.20% | 25.00% |

| Net Profit | 39.00 | 40.50 | 68.90 | 101.10 | 95.20 | 106.00 | 123.40 |

| Net Profit Margin | 21.80% | 23.00% | 30.10% | 33.60% | 29.80% | 29.90% | 30.00% |

Balance Sheet

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Share Capital | 0.20 | 0.20 | 0.20 | 10.60 | 10.60 | 10.60 | 10.60 |

| Total Reserves | 135.10 | 197.40 | 244.10 | 479.20 | 567.70 | 666.30 | 781.20 |

| Shareholders' Funds | 135.30 | 197.60 | 244.30 | 489.80 | 578.40 | 677.00 | 791.80 |

| Non Current Liabilities | |||||||

| Long Term Burrowing | 18.70 | 5.90 | 3.30 | 9.30 | 20.30 | 30.30 | 42.30 |

| Deferred Tax Assets / Liabilities | 3.90 | 3.20 | 3.30 | 4.40 | 4.40 | 4.40 | 4.40 |

| Current Liabilities | - | ||||||

| Short Term Borrowings | 36.30 | 18.80 | 23.10 | 12.30 | 12.30 | 12.30 | 12.30 |

| Trade Payables | 2.00 | 5.90 | 6.00 | 13.00 | 6.00 | 15.70 | 9.40 |

| Other Current Liabilities | 13.50 | 14.70 | 11.20 | 8.20 | 8.20 | 8.20 | 8.20 |

| Short Term Provisions | 2.20 | 1.10 | 1.50 | 1.50 | 1.50 | 1.50 | 1.50 |

| Total Equity & Liabilities | 212.00 | 248.70 | 296.00 | 544.20 | 636.80 | 755.10 | 875.60 |

| Assets | - | ||||||

| Net Block | 89.00 | 92.00 | 120.40 | 188.50 | 407.50 | 467.50 | 572.50 |

| Non Current Investments | - | - | - | - | - | - | - |

| Long Term Loans & Advances | 18.80 | 17.50 | 40.40 | 8.40 | 8.40 | 8.40 | 8.40 |

| Current Assets | |||||||

| Currents Investments | - | - | - | - | - | - | - |

| Inventories | 46.40 | 48.70 | 46.70 | 82.40 | 51.00 | 97.10 | 70.80 |

| Sundry Debtors | 44.60 | 38.20 | 47.00 | 65.20 | 45.10 | 67.50 | 61.40 |

| Cash and Bank | 0.90 | 26.30 | 3.10 | 85.80 | 11.10 | 1.00 | 50.80 |

| Short Term Loans and Advances | 3.50 | 4.80 | 9.80 | 0.10 | 0.10 | 0.10 | 0.10 |

| Total Assets | 212.00 | 248.70 | 296.00 | 544.20 | 636.70 | 755.00 | 875.60 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Profit After Tax | 39.00 | 40.50 | 68.90 | 101.10 | 95.20 | 106.00 | 123.40 |

| Depreciation | 14.60 | 14.20 | 13.70 | 22.00 | 31.00 | 40.00 | 45.00 |

| Changes in Working Capital | -8.80 | 6.40 | -16.00 | -46.80 | 44.50 | -58.70 | 27.00 |

| Cash From Operating Activities | 51.30 | 64.20 | 68.20 | 76.20 | 170.70 | 87.30 | 196.40 |

| Purchase of Fixed Assets | -33.90 | -26.00 | -61.90 | -90.00 | -250.00 | -100.00 | -150.00 |

| Free Cash Flows | 17.40 | 38.20 | 6.30 | -13.80 | -79.30 | -12.70 | 46.40 |

| Cash Flow from Investing Activities | -33.60 | -25.40 | -63.90 | -90.00 | -250.00 | -100.00 | -150.00 |

| Increase / (Decrease) in Loan Funds | -29.50 | -11.40 | -6.80 | -11.80 | 11.00 | 10.00 | 11.00 |

| Equity Dividend Paid | - | - | - | -7.10 | -6.70 | -7.40 | -8.60 |

| Cash from Financing Activities | -18.20 | -13.80 | -27.20 | -18.90 | 13.40 | 2.60 | 3.40 |

| Net Cash Inflow / Outflow | -0.50 | 25.00 | -23.00 | -32.70 | -65.90 | -10.10 | 49.90 |

| Opening Cash & Cash Equivalents | 1.00 | 0.50 | 25.30 | 2.30 | 174.10 | 230.60 | 1.00 |

| Closing Cash & Cash Equivalent | 0.50 | 25.30 | 2.30 | 174.10 | 230.60 | 317.00 | 50.80 |

Key Ratios

| Yr End March | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E |

|---|---|---|---|---|---|---|---|

| Basic EPS | 2029.10 | 2026.60 | 13.50 | 19.00 | 17.90 | 19.90 | 23.20 |

| Diluted EPS | 2029.10 | 2026.60 | 13.50 | 19.00 | 17.90 | 19.90 | 23.20 |

| Cash EPS (Rs) | 2787.60 | 2735.10 | 16.20 | 23.10 | 23.70 | 27.40 | 31.50 |

| DPS | - | - | - | 1.30 | 1.30 | 1.40 | 1.60 |

| Book value (Rs/share) | 7045.50 | 9878.50 | 48.00 | 92.10 | 108.70 | 127.20 | 148.80 |

| ROCE (%) Post Tax | 46.30% | 21.90% | 28.80% | 26.60% | 17.40% | 16.20% | 16.00% |

| ROE (%) | 28.80% | 20.50% | 28.20% | 20.60% | 16.50% | 16.90% | 17.00% |

| Inventory Days | 47.00 | 99.00 | 76.00 | 78.00 | 76.00 | 76.00 | 76.00 |

| Receivable Days | 46.00 | 86.00 | 68.00 | 68.00 | 63.00 | 58.00 | 58.00 |

| Payable Days | 2.00 | 8.00 | 9.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| PE | - | - | 57.70 | 36.30 | 47.70 | 42.90 | 36.80 |

| P/BV | - | - | 16.30 | 7.50 | 7.90 | 6.70 | 5.70 |

| EV/EBITDA | 0.90 | 0.10 | 38.70 | 23.50 | 29.60 | 26.40 | 22.70 |

| Dividend Yield (%) | - | - | 0.00% | 0.20% | 0.10% | 0.20% | 0.20% |

| P/Sales | - | - | 17.40 | 12.20 | 14.20 | 12.80 | 11.20 |

| Net debt/Equity | 0.50 | 0.00 | 0.10 | - | 0.00 | 0.10 | 0.00 |

| Net Debt/ EBITDA | 0.90 | 0.10 | 0.30 | -0.40 | 0.10 | 0.20 | 0.00 |

| Sales/Net FA (x) | 4.00 | 1.90 | 2.20 | 1.90 | 1.10 | 0.80 | 0.80 |