stockaxis Market Intelligence (Commentary for May 2019; Outlook for June 2019)

June 04, 2019

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’ is a quick update on the markets for the month gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

Global Trends

- India has rationalized and simplified its visa regime and the number of sub-categories of visas now stand at 65 instead of 104 earlier. The number of visitors using e-visas for tourism purposes has reached 25 lakh.

- 2020s will be the decade of Asian economies with India, Bangladesh, Vietnam, Myanmar and Philippines in the 7% growth club. China meanwhile has seen simmering of growth and is projected to grow at 5.5% in the 2020s.

- MarketsandMarkets report indicates that Payments Processing Solutions market will grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2019-2024 to USD 64.5 billion from USD 39.3 billion. The credit card segment is the largest in the market.

- India’s GDP will grow at 7.1% in FY20 according to the World Economic Situation and Prospects report of the United Nations (UN). Strong domestic consumption and investment will be drivers of growth.

- IMD World Competitiveness Rankings puts India in the 43rd place, while Singapore emerges on the top. India has improved its ranking by one place due to strong economic growth, the size of its market and labour force.

- Artificial Intelligence is set to double innovations and employee productivity gains in India by 2021 according to a study of 200 business leaders and 202 workers in India conducted by Microsoft-IDC.

- The landslide victory for Prime Minister Modi and BJP is likely to improve the flow of foreign capital for corporates in India according to S&P Global Ratings. The increased likelihood of reforms will keep the capital flowing in, according to the rating agency.

Domestic Trends

- GST collection was at its highest in April 2019 since the tax was rolled out in 2017; government reports nearly Rs. 1.4 lakh crore collected in GST in April 2019 as collections show steady rise since August 2018.

- IT/Software sector created maximum jobs in 2019 says Shine.com report. BFSI and education and training industry have also been employing more people.

- Bank lending to Non-Banking Finance Companies (NBFCs) shows an increase with over Rs. 70,000 crore in January-March 2019 period, up by 12.3% over the previous quarter.

- On the back of efforts of the government, LPG use in India will increase to a record 24.9 million tonnes in FY 2018-19, 53% higher than 5 years ago and higher by 6.9% compared with the previous year.

- NetApp and Zinnov announced results of a study that indicates that B2B tech startups have tripled from 900 to more than 3,000 since 2014 due to need for digital transformation of various entities. Investment in B2B startups has reached USD 3.7 billion in 2018, a rise of 364% since 2014.

- FICCI survey shows sentiment in manufacturing sector is positive as overall capacity utilization rose to 80% in Q4 2018-19. Hiring outlook for the sector has also improved marginally.

- India’s forex reserves rose by USD 1.36 billion to USD 420.05 billion as of early-May 2019 due to rise in foreign currency assets. Gold reserves of the country remain unchanged.

- Indian millennials and Gen Z are very optimistic about economic and social outlook according to Deloitte’s 8th Annual Millennial Survey with 59% of millennials and 57% of Gen Z in India expecting economic outlook to improve in coming 12 months.

- A landslide victory of the ruling BJP would improve business sentiment and outlook for private investment according to Fitch ratings. Fitch indicates that it expects the government to stay the course on reforms.

- University Stipend Primer report concludes stipend for IT, construction and real estate followed by financial services sector are the highest. Large businesses pay more to apprentices while the amendments to Apprenticeship Act has resulted in 15% increase in apprenticeships in 2015-16 compared with 2014-15.

- Transport infrastructure will register Rs. 25-30 lakh crore capital outlay in the coming 5 years according to ICRA. The increase will be due to the promises made in the winning party’s manifesto as BJP pushes growth of roads, railways, metro, inland waterways, airports and ports.

- The Indian Rupee marginally weakened vis-à-vis the dollar; it was at INR 69.68 on 31 May 2019 against INR 69.21 on 1 April 2019.

Market Trends

- The rise of Artificial Intelligence and Algorithms in the financial services sector will bring the Algorithmic Trading market size to USD 18.8 billion by 2024 from the current USD 11.1 billion in 2019, growing at a CAGR of 11.1% according to MarketsandMarkets.

- India’s market volatility index or the measure of ‘fear’ for domestic equities, which reached a 3-year high for the previous month due to political uncertainties and higher oil prices, has reduced sharply from its May 22 closing of around 30 to 19.40 on election result day.

- Stock market wealth has risen by Rs. 75 lakh crore with BSE Sensex rising to an all-time high of 40,124.96 points on election result day as NDA was set to form the next government led by Prime Minister Modi.

- FIIs recorded a net outflow of Rs. 2,135.85 crore in May 2019 against a net inflow of Rs 12,749.55 crore in April 2019.

- The Nifty closed at 11,922.80 on 31st May 2019 against 11,748.15 on 30th April 2019, having risen by 174.65 points over the previous month.

- The Nifty 50 P/E ratio was at 29.49 at end-May 2019 against 29.33 at end-April 2019. The average P/E ratio for the past 12 months is 27.05.

Highlights

- The Good: Election outcome, continued thrust on reforms, expected FII inflows, stable rupee

- The Bad: Global trade slowdown, US-China trade war, China debt bubble, US-Iran tensions

stockaxis’ Outlook for June 2019

Financial and Industrial Reforms

Niti Aayog, the primary think tank for policy making headed by PM Modi, has suggested several structural reforms in labour laws, privatization and creation of land banks for new industrial development.

Labour reforms will aim to combine 44 central laws into four codes – wages, industrial relations, social security and welfare, the fourth being - occupational safety, health and working conditions. This is targeted to facilitate companies avoid getting entangled in tortuous disputes with their workers and officials concerning regulations set by authorities at different levels of government and can lead to extended, drawn-out adjudication in various parts of the legal system.

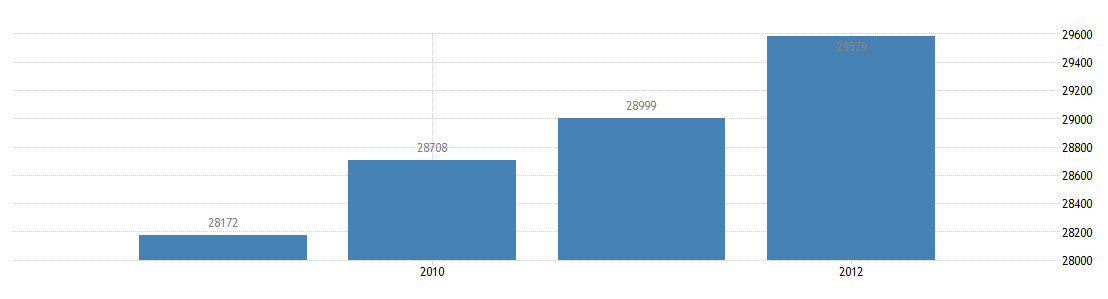

Source: Trading Economics

Privatisation: The government is expected to focus on privatising or closing more than 42 state-controlled companies in the coming months. The government is even mulling lifting the foreign direct investment cap on Air India, the loss-making state-owned flagship carrier, to make it easier to sell. It is also expected that an autonomous holding company will be set-up that would control all state-owned firms and wouldn't be answerable to several different ministries. This would speed up decision making for asset sales, by-passing central government bureaucracy.

Land banks: The government is expected to build an inventory of government land from unutilized land controlled by public sector enterprises and offer large parcels of this land to foreign investors. Getting access to some of the large amounts of unutilised Indian government land would reduce major risks for foreign companies as there would be a lot less risk of legal challenges over ownership and development. A lot of the sites they have used in the past were previously farmlands, opening them up to protests and court action by local communities over land rights, the environment and other issues.

Banking reforms: The government is likely to adopt the recent model of merging Dena Bank and Vijaya Bank with Bank of Baroda on to other public sector banks. This consolidation along with privatization will bring back volume efficiencies and discipline and accountability in lending activities.

Infrastructure

India’s new government is expected to renew its focus on infrastructure. Constrains on the supply side are beleaguered public sector banks and private banks reaching their limits on infra lending. NHAI tendering in FY19 has fallen to Rs. 45,000 crore which is a decrease of 63% YoY. The NDA manifesto promises construction of 60,000 KM of National Highways in 5 years and the launch of Bharatmala Phase 2.0.

In respect of Railways, electrification and conversion of all tracks to broad gauge by FY 2022 and expanded connectivity of high-speed trains across India is expected. The government is also bound by its manifesto to launch an extensive railway station modernization programme. The proposed Mumbai-Ahmedabad Bullet Train project is also likely to gain traction.

In terms of air connectivity, the number of functional airports is expected to be doubled. The government is also likely to make a move towards privatization of six airports. Under the Navnirman policy, the focus of the government would be to cater to 1 billion passengers by year 2040.

There are plans to build metro networks in 50 cities and the focus on building inland waterways for shifting cargo movements to be continued.

For the power sector, NDA promised to achieve a cumulative installed renewable energy capacity of 175GW by 2022. In aggregate, the goal is a USD 1.4 trillion infrastructure spend by the incoming government.

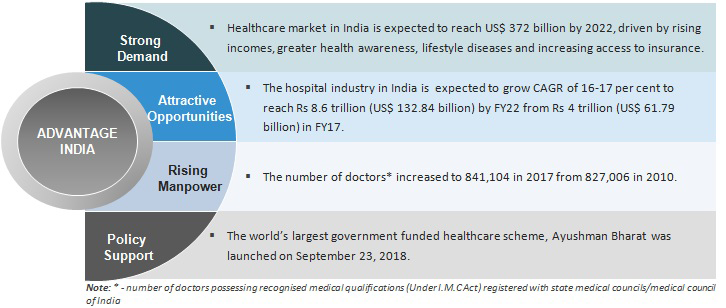

Source: IBEF

Public Health

India currently spends 1.15% of its GDP on healthcare. The government has the target of spending 2.5% by 2025. Increasing expenditure on healthcare would be a significant step by the government. These funds would be used towards strengthening the primary healthcare infrastructure and building up the secondary and tertiary public healthcare model.

Ayushman Bharat has already been launched by the government and is targeted at providing secondary and tertiary care to India’s poor (forming 40% of India’s population). At the same time, India urgently requires institutional level reforms in the pharma, medical and healthcare sectors. This would require creating better regulatory oversight of these sectors. In terms of individual sectors, India is a generic giant and the largest provider of such drugs to the world. The country’s pharma sector was valued at USD 33bn in 2017 and expected to reach US 55 billion by 2020.

The government has already given the go-ahead for amendment of Foreign Direct Investment (FDI) policy in pharma to allow FDI up to 100% under the automatic route for manufacturing of medical devices.

Going forward, government’s push towards health will have cascading effect as schemes like Ayushman Bharat will increase health insurance penetration in the country from 34% to 50%. The scheme is hailed as a gamechanger and will likely change the nature of health insurance itself.

Source: IBEF

We, at stockaxis, are constantly on the lookout for great businesses run by honest promoters that are available at the right price with sufficient margin of safety. Our stringent stock selection guidelines and clearly stipulated entry and exit points make equity investing a ‘rich’ experience for our investors!

Continue with Google

Continue with Google