Perceived Risk v/s Actual Risk Of The Market? Are You Getting It Right?

December 31, 2016

|

Every day, more and more evidence is seen to be emerging that investors have started to doubt their decisions with regards to their stance on equity holdings. There has been an increasing predicament on whether the thrill to buy valuable and growing businesses is actually worth it, as of now? Also, there is a clear ambiguity on how risky the market is given the current state of things! Well, let’s try and put an end to this equivocation and also get to know another aspect of how to look at markets in such volatile scenarios. We shall understand that how high risk perceptions create opportunities for investors, and how to identify catalysts that indicate a reversal.

We, as humans, are very aspirational, and this makes us want things that we cannot have. And, in the very process, we take our first step towards the fatal mistake of misinterpreting the risks involved at every stage of the operation. Its simple human nature: We are often afraid of some risks more than the evidence suggests that we should be, and sometimes, we often ignore the risks which are clearly stated by the evidence, well, due to the euphoria taking over!

From an investor point of view, ‘The biggest risk is the risk of interpreting the risk incorrectly.’ Well, this might sound confusing at first, but this is what we have been doing, for the longest of times in the history of stock market. Let us understand this with the help of a simple real life example:

We always have a tendency of exaggerating dramatic but rare risks and downplaying common risks. That is exactly the reason why we fear more about volcanoes than we do about slipping on the bathroom floor, even though the statistics clearly prove latter kills far more people than the former. Similarly, we ignore hundreds of car crashes that take place every day, and they hardly make front page news, but on the other hand, one airplane crash has the capability to saturate the media for weeks. This is inspite of the fact that the number of people killed in plane crashes, say in a year, is many many times less than the number of people who lose their lives in road accidents.

This puts to light one very simple yet crucial observation: Our inability to perceive the actual risk in most situations. We always end up underestimating or overestimating the gravity of any situation, especially where money is involved. Instead of making rational decisions, we end up succumbing to those first impressions and thereby fall in love with the stocks that are actually going to hurt us big time in the future. The thrill of chase blinds us from the actual risk and makes us perceive the risks as per our desires and emotions.

On the other hand, true and informed long term investors like the Warren Buffets, the Peter Lynchs and many more search for investments where the perceived risk is higher than the actual investment risk. Infact, higher the better. Remember, all stocks have a certain amount of real risk that must be assumed when buying it. It is the perception of that risk that determines whether the price of the investment is higher or lower than the real value. It is the enthusiasm which affects the price of investments. So our goal should be very clear: Take advantage of those mis-priced stocks where the perceived risks have an upper hand over the actual uncertainty. Understand:

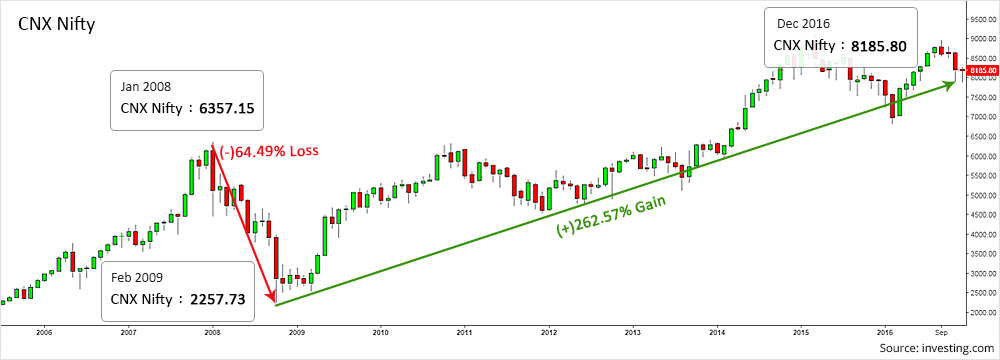

For many speculators, the crash of 2008 was a very big rejection because of the rally that preceded it. Rather than embracing the falling prices as a new opportunity to get in, they drifted towards bonds, gold and cash only to regret their decision later when the upward trend set in post 2009. The same investors who regretted owning stocks during the crash and got out of equities started showing remorse for not owning the same stocks starting 2009. Greed started setting in, and the and since they were the sideliners due to their allocation in non-equity investments, they were now feeling compelled to get into stocks game or increase their current allocations if any; and the same cycle then continued again, with them entering when the perceived risk started to subside and the actual risk of over valuation started kicking in.

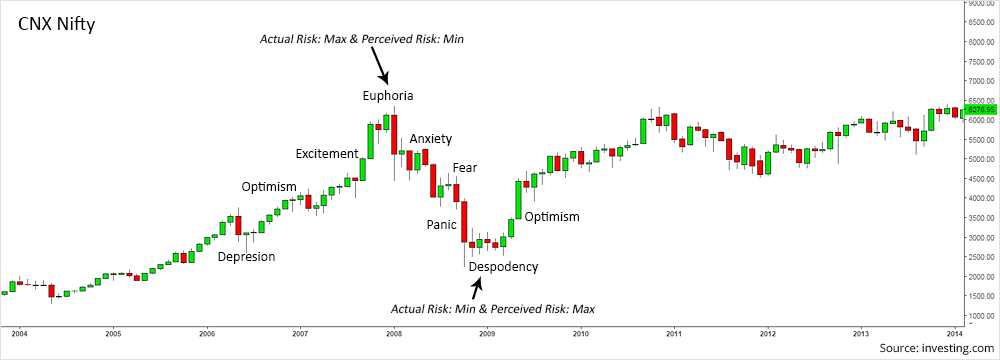

Let us co-relate this theory with behavioral finance. Below given is the chart of the well known 2008 crash of the world financial markets.

As you can see, after the stunning rally starting July 2006, everyone started gaining back their confidence with regards to investment in equities, which was earlier shaken due to the massive fall of more than 25%, just two months ago. The feeling of depression and panic started to fade away which was then replaced by optimism, followed by excitement, followed by thrill, followed by euphoria and which was again finally followed by the same anxiety and fear, which thereby led to one of the biggest crashes the world has ever seen. Putting all these feelings in one single graph with respect to the above mentioned time duration, we get, the following co-relation:

Thus, a 65% fall, in no time translated to a 180% gain, for those who leveraged the despondency phase.

Understanding this with a perceived risk v/s actual risk theory:

- Following the 2001 recession (Depression State), the US Federal reserve substantially cut interest rates, allowing home buyers to borrow at absurdly low interest rates (Start Of Optimism Stage - 2007 Start)

- Also, because of the dotcom crash, money started flowing into the bond market, forcing lenders to find riskier entities to park their funds.

- Newer types of investment vehicles started coming into the picture and due to competitive pressure, the credit rating agencies found it very difficult to provide the real picture and point out to the mounting risky loans.

- With low interest rates and availability of risky borrowers in the form of common men and women, everyone bought a home and prices skyrocketed exponentially. (Excitement Stage - 2007 End)

- With the above mentioned thrill growing and growing, the nature of bank lending changed substantially and risky loans started getting passed like hot potatoes. (Euphoria Stage - 2008 Start)

- Beginning in August 2007, smart money began to realize that the whole market was built on shallow foundation, and the game started to reverse. (Fear Stage - 2008 Mid)

- The Fed & the US Treasury let Lehman Brothers fall into bankruptcy, leading to widespread panic all around the globe, resulting into a massive market crash. (Panic Stage - 2008 End)

- This set off cascading effects throughout the system as levered structures imploded upon themselves and investors worldwide awoke to the fact that they had blindly plowed into credit risk with zero analysis for the previous half decade. (Despodency Stage - 2009 Start)

- Things started to stabilize again following massive government and central bank intervention. The dust started to settle down and markets started recovering. This resulted in a record 140% rally from the base formed during January 2009 until the next crash. (New Cycle Kicking In)

Consider another example where, the perceived risk was far greater than the actual risk, and hence we ended up staying away from the instrument. Pakistan being ranked as one of the most unstable countries in the world is surprisingly home to one of the largest stock index gainers in the financial world. Terrorism and geo-political tension have gripped the country from a long time now. Yet, from after its lows in the 2008 crash, the Karachi Stock Exchange index KSE100 has risen by a colossal 908.78% in just 8 years. Have a look:

What investors fail to understand is that the mood and sentiment of the market is not to be effected by, but to be leveraged. Turnaround specialist and investor Wilbur Ross rightly says, “You get paid for taking a risk that people think is risky, you don’t particularly get paid for taking actual risk.”

So the question that should strike you is how and when to act when a stock is falling?

It is wise to HOLD no matter what happens, through every thick and thin, and hold till the stock achieves desired targets? NO!!!!

Or, is it wise to wait till the dust settles and BUY when the trend changes? But what if it’s too late to act and the market doesn’t give you a chance to enter? NO to this too!!!

Infact, the correct strategy can and should be: One should sense the developing uncertainty in the market, which is most of times evident from some or the other political tensions around the globe. Remember, ours being an emerging economy, is affected by most global events. Hence, any political issue that is even remotely related to India should be a starting point for you to prepare to increase your allocation in equities. This is the time when other investors will want to move to safe havens, which will result in a selloff, which will eventually bring the entire market down. That moment should be used as an opportunity to enter into businesses that you had missed out on earlier, due to the preceding euphoria. If it is a fundamentally sound business that you are after, you can be rest assured that it will be the one that will outperform the market when the index recovers.

Keep in mind that global events are only capable of changing market sentiments and not growth stories of emerging smallcap and midcap companies. Hence, all you have to do in such cases is be able to strike a correct balance between the actual risk in that situation, and the risk that is being perceived by the market. If the difference between the two is sizeable enough, you should not miss out on exploiting it.

In short, the least favorable investing environment is the one with a low perceived risk and a high real risk. Consider the example of Reliance Power and its IPO listing. So what went wrong with the IPO? It was one of the most awaited listings considering the cancellation of Wockhardt and Emaar MGF IPOs. It was the event that caused millions of demat accounts to be opened and was trading at double the offer price in the grey market. Everything was all sunshine and rainbows with regards to this IPO and hence the perceived risk was at its lowest with very little clarity on the actual risk involved.

Then, the HNIs, who had racked up tons of loans for the maximum possible subscription of this IPO, saw that the listing price was hovering in the range of Rs. 400-430, with no signs in sight that could have given a kick start to its price appreciation process. The result being, to cut the heavy interests that they were paying on the loans taken to buy Reliance Power, they started selling their holdings. The selling pressure mounted further when the retails were also dragged by the sentiments. Today, Reliance Power is trading at a meager Rs. 40. Hence, a clear learning from this incident can be, STAY AWAY FROM ANY EUPHORIA, especially when it involves the stock market!!!!

On the other hand, the most favorable investing environment is the one with high perceived risk and low real risk, but should not followed blindly, else you will end up allocating all you money to the Lanco Infratechs, the Unitechs or the Jaiprakash Associates of the space. No one has the capacity to be correct 100% all the time. However, your research and analysis of perceived risk vs. actual risk is just as crucial as your other fundamental and technical factors. Companies like Bajaj Finance, Relaxo Footwear, Astral Poly Technik, Cera Sanitaryware, Kajaria Ceramics, Symphony, Ajanta Pharma, etc, which were lietrally unknown 5-8 years ago, are market leaders in their respective domains today. Hence, one can set a seal on the fact that a company not known to many is not necessarily a laggard, who knows, it can be the next big thing of the industry. Hence, ‘unpopularity’ of a company should not simply increase it perceived risk; the key is to understand the business model and viability of such companies.

Currently, despite all the ‘bothering’ events like US Polls, Demonetization, No RBI Rate Cut, Fed Rate Hike, Possibilities of muted Q3 earnings, etc already having taken place, the weakness has been factored in. But the mood still being on the negative side and investors waiting for something to cheer them up, you as a savvy investor can use this opportunity of anxiety to enjoy the next possible comback rally. Remember, although we cannot understand or anticipate every risk, we can understand when others are going wrong in their assessments and capitalize on them, as this is exactly what the legendary Warren Buffet says, “Be fearful when others are greedy, and be greedy when others are fearful.”

So, what do you plan to do now? Simply sit back and wait for dust to settle, and in the process miss out on great businesses at bargain prices? Or act like a smart and an informed investor and stay one step ahead of the game? The choice is yours…

Do let us know if you think otherwise!!! Happy Investing!

Continue with Google

Continue with Google