Glimpse of June 2021

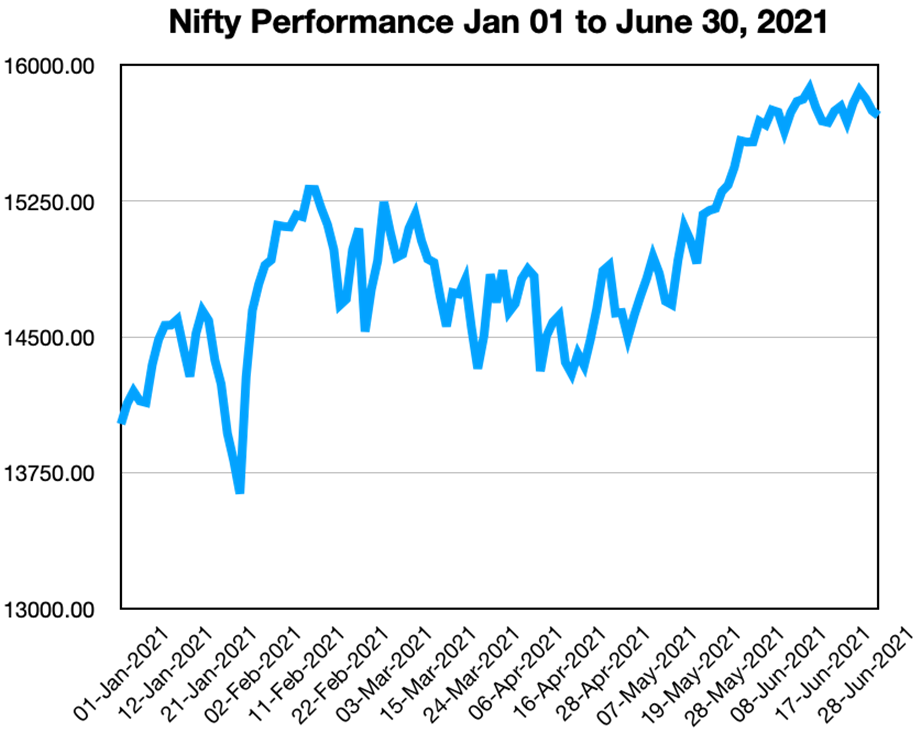

Although Nifty managed to make new high in June but continued to struggle to get past 16000 mark while broad market continued out-performance

Nifty manged to make new high on June 15, 2021 at 15869 aided by strong Q4FY21 corporate performance, decelerating covid cases & benign global cues. Despite making several attempts in next 15 days Nifty was not able to cross the coveted 16000 mark. At the same time the market did not collapse also. For any upside move the concerns on impact of Covid wave 2 on corporate earnings for Q1FY22 weighed on market participants minds while on downside the hopes of unlocking of economy, fast decelerating incremental covid cases & fast pace of vaccination provided comfort. Global cues also remained benign. Any rate action from FED side still remains some time away.

Broad market (mid & small caps) continued significant out-performance driven by specific company’s Q4FY21 results.

Earnings season for Q4FY21 has ended on strong note with consensus upgrading estimates for Nifty EPS mainly due to strong performance of Metals & mining companies.

We believe the market has not yet factored the full impact of second wave of Covid-19 in April & May 2021. In our opinion more clarity will emerge post Q1FY22E results. Management commentary post Q1FY22 results will be critical. Due to imposition of lockdowns in Q1FY22 we expect BFSI, Autos & consumption sectors to be negatively impacted. New Covid variant such as Delta plus continues to eose threat to quick economic recovery.

Important considerations for July 2021

In our view market has not yet factored full impact of demand destruction due to second wave of Covid 19. Management commentary post Q1FY22 results will be most crucial. Key monitorable in Q1FY22 results would be impact of lockdowns on demand (top line) & gross margins (huge inflation in all input costs-raw materials, packaging, distribution, transpiration costs etc). As of now consensus expectations are quite high & any disappointment on corporate earnings may have a major impact.

High frequency macro-economic data like Core sector growth, IIP & inflation are not very encouraging. Inflation is clearly much ahead of estimates. We believe RBI will be cognizant of rising inflation & other input costs but may give it a long rope for the time being. We expect RBI to take policy action in H2FY22.

Going ahead, In our opinion, market is awaiting clarity from Q1FY22 results and full unlocking of economy.

However, the overall market structure continues to remain positive. We believe Sector rotation and the stock-specific approach will be keys for outperformance.

Taking cues from Accenture’s numbers we expect the strong growth momentum to continue in IT sector.

Metals & mining have witnessed significant price uptrends which will help them in clocking superlative performance second time consecutively in Q1FY22.

Despite lockdowns BFSI sector has not witnessed too much of deterioration in asset quality because of large borrowers in commodity sector doing well. However stress is visible in retail, SME & MSME. Resolution of many insolvent cases of the past will also aid the sector through provision write backs.

Cement, Specialty chemicals, agrichemicals , & pharma are other sectors that are likely to remain out performers. Healthcare in particular is likely to remain buoyant on back of near term spurt in earnings from Covid related medications & vaccines.

We expect interest rate sensitive sectors like BFSI, Autos & other consumption/FMCG related stocks to remain under pressure.

In near term re-opening trades via consumption stocks like multiplexes, airlines, travel/tourism, retail like etc may also be in favour

Outlook for July 2021

Market direction will depend on corporate performance in Q1FY22 & management commentary post results

- Q4FY21 & full year FY21 ended on strong note with upgrades in overall Nifty EPS earnings mainly driven by upgrade in metals & mining stocks.

- Full impact of localized lockdowns & demand destruction due to second wave of Covid will reflect in Q1FY22 corporate earnings

- Pace of Vaccination has increased a lot. With approvals for few more vaccines for entry into the country, supply side issues can be resolved further

- Inflation data is clearly much ahead of expectations. Market awaits RBI’s stance on inflation as temporary (Transitory) or sustained

- Government has enhanced total outlay on credit guarantee scheme which will aid small & medium enterprises & some specific sectors

- While Crude prices are consistently rising & reaching near $75 per bbl with OPEC increasing supply & movement towards other sources of energy such as renewable/electric etc may keep a lid on crude prices. High crude prices is definitely a niggling worry for markets

Portfolio Strategy For July 2021

What is our portfolio strategy for the month of July 2021

- We believe market performance in July will be driven by corporate results of Q1FY22 & management commentary following the results

- We will continue to participate in those sectors which show resilience in their earnings & least impact of second wave of Covid induced lockdowns

- Metals & IT sector remains our preferred sectors

- Pharma/Healthcare & Specialty chemicals sectors are likely to come out with good numbers & they remain our sectors of choice

- Economy facing sectors like cement & capital goods are likely to outperform as economy unlocks. We will participate in some stocks in this sector

- We will monitor impact of lockdowns on asset quality of BFSI & if the impact is less than expected, we will participate in this sector. Since last few months BFSI has been under performing sector. Some private banks, large public sector banks & NBFC are available at attractive valuation

Themes to play in July 2021

1. Re-opening trades

- With decline in number of Covid cases since mid May 2021, markets are awaiting unlocking of economy.

- Auto numbers for the month of June are quite encouraging. Before the numbers many analysts were expecting June to be a wash out month but actual sales figures turned out to be much better than expected. While YOY & MoM there is a degrowth but the decline is much lesser.

- Similarly media reports have been suggesting that almost all tourist destinations are witnessing jam packed bookings. Human beings are social animals & many months of covid induced fatigue is likely to further propel growth in hotels/travel, airlines & hospitality sector. We expect all entertainment related sectors to show very strong growth in next few months

- While Malls & cinemas are still not open in many parts of the country but with the Covid cases coming down there is a great chance that these too will reopen soon

- Vaccination drive is going in full throttle. After initial hiccups the speed has increased tremendously. This will again bring confidence in travelers/consumers

2. Play the sectors where many IPO are planned in July

- Historically we have seen that whenever an IPO of any company comes, existing listed players in that sector or peers witness heightened activity.

- In some cases new offerings also re-rate the existing players as markets take cue form new company’s valuation.

- According to media reports there are about 11 companies which are coming with IPO in the month of July itself. These companies together intend to raise about Rs. 23000 cr. There are many more who have filed prospectus with SEBI & awaiting approvals.

- The new issues are coming in varied sectors including shipping, chemicals, financial services, microfinance, infrastructure, cement, real estate, generic pharma, diagnostics, etc.

- Some of these IPOs (Zomato, PayTM) belong to the new age tech businesses which are in scarcity on Indian exchanges as of now. Such new listings can create immense appetite for other digital companies

3. Healthcare & pharma driven by near term gains from Vaccination

- Pace of vaccination has picked up very well. Some new vaccines like Moderna have been given permission to be imported in India. Cadila’s vaccine is likely to get approval soon. Existing players (Serum & Bharat Biotech) have revamped their production capacity significantly. All these factors will result in easing of supply constraints & vaccination numbers can reach the targeted goals.

- Panacea Biotech ahs already got the approval for commercial production of Sputnik for global supplies. 5 other players are in pipeline. We believe vaccine theme can be played for at least next 2-3 quarters till such time vast majority of Indian population is vaccinated.

- Pharma companies like Cadila, Dr Reddys, Gland pharma, Shilpa Medicare, Panacea biotech, Wockhardt are producing vaccines. Vaccine theme can will be played through Hospital chains like Apollo hospital, Max healthcare & Fortis.

- Domestic facing pharma companies like Cipla, Cadila & Dr Reddy’s may show strong Q1FY22 on back of covid related drugs sales. Aurobindo Pharma is a value unlocking play driven by demerger of injectables business in future

4. Cyclicals especially steel & other metals to remain most preferred

- Despite China’s announcements of off-loading inventory of various metals to manage commodity prices the metals continue to rise due to elevated demand

- US government’s aggressive $715 bn infra push is likely to keep demand for various metals at elevated levels.

- After successive 3 months of price hikes there are news reports that large steel companies may decrease steel prices by a few thousand rupees per ton in order to maintain demand. We believe this will be temporary & will not impact their profitability over full year. Also note that some value added products makers like steel for autos have taken a steep price hike recently.

- Other way to play metals theme is through investing in allied stocks like Iron Ore, Graphite, calcined Coke, manganese, alloys producers. Most players in the allied sector have increased production & increased or are on the verge of increasing prices

5. IT sector showed strong growth in Q4FY21 & likely to maintain that over next 2 years

- Taking cues from recently reported numbers by Accenture we expect the strong growth momentum of Indian IT companies to continue.

- Many mid & small IT companies are gaining market share in global arena

- Specialized services providers like Cpaas, Cloud implementation, Product engineering & services, Cyber security, work place automation, digital transformation etc are gaining traction. Global top players in these areas are giving business to Indian players

- We expect this sector to continue robust growth on back of strong tailwind of digitization & work form home

6. Specialty Chemicals / Agro Chemicals / basic chemicals

- India has been gaining market share in this space across the globe with help of its capabilities & supply chain shift theme amongst the multinationals

- The specialty chemicals sector has been a clear beneficiary of China plus 1 strategy of many multinationals. Many of Indian producers have expanded capacities & broaden their capabilities to cater to new demand from global players which is helping these companies in gaining scale & high margins.

- Many chemical companies have changed their working style to cater to increased demand from pharmaceutical sector which helps them in moving up the value chain & provide sticky long term business.

- Many basic chemicals are witnessing increased spreads on back of strong demand by user industry resulting in increased pricing power for these manufacturers

Our preferred Sectors / stocks

1. Metals (Steel, Aluminum, Zinc, Copper)

- Very strong pricing environment on back of high demand (likely to be created by aggressive infra spending by various governments)

- Despite likelihood of reduction in steel prices in July, we expect the impact on profitability to be limited as this decline in prices will be temporary & landed price of imported Steel is still higher than domestic price

- De-leveraging of balance sheets to continue in Q1FY22E also on back of strong expected numbers.

- No major impact on commodity prices witnessed despite China trying to manage prices through inventory off-loading

Metals - allied segments

- Iron ore, Graphite, Calcined Coke, various Alloys are allied sectors to steel, aluminum etc. Demand for these products is directly proportional to demand for metal, hence these companies are also witnessing high demand coupled with strong pricing power.

Stocks we like:

Tata Steel | JSW Steel | SAIL | JSPL | Hindalco | NMDC | Godawari Power | Graphite Inds | HEG | Rain Inds

2. Specialty Chemicals / Agro Chemicals / Basic Chemicals

- Beneficiary of China plus one policy

- Strong proven execution capabilities by Indian companies

- Strong relationships with global major chemical giants

- Few companies in the sector have potential to increase their size multi fold

Stocks we like:

Atul | Astec | Supreme Petrochem | Hikal

3. IT - both large cap as well as mid cap

- Sector likely to deliver strong earnings growth in Q1FY22

- Visibility of high earnings in next couple of years through all time high deal wins

- Many new areas of action opening up which will be revenue driver for the companies

- High margins maintained despite wage hikes due to savings on SGA & travel costs

- User base expanding as every one realize need of IT for Work from Home

Stocks we like:

Intellect Design | KPIT | HCL Tech | Wipro | Mastek | Route Mobile

4. Financials (Banks, NBFCs, intermediaries)

- Sector has been under performer for last several months due to apprehension on asset quality

- Large borrowers repaying in time due to better pricing environment especially in commodities, resources, power etc.

- Stress visible in retail, SME & MSME but government helping through credit guarantees

- Resolution of many past insolvency cases will result in write back of provisions

- Most banks are well equipped to handle asset quality stress through adequate buffer in provisions

Stocks we like:

HDFC Bank | ICICI bank | Axis bank | Kotak Bank | Baja Finance | SBI

5. Pharma – Vaccine, Hospitals, domestic Pharma

- Large near term opportunity in vaccines (next 2-3 quarter)

- Domestic pharma companies likely to show strong Q1FY22 on back of covid related drugs sales

- Strategic play on Aurobindo Pharma (value unlocking - demerger of injectables in future)

Stocks we like:

Cipla | Cadila | Dr. Reddy’s | Shilpa Medicare | Panacea

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.