Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off on your preferred services! Apply Coupon: INVEST20 | Avail Offer

Prime Offer: Save 20% Off. Avail Offer

May 01, 2022

The Indian equity markets rallied at the beginning of April, but the trend reversed quickly as a sharp rise in U.S. Treasury yields and the U.S. Dollar index took the sheen off the equities. Reported macro data was not encouraging either. US GDP for Q1CY22 contracted 1.4% v/s expectation of an expansion. The minutes of USFED meeting dated March 15, 2022, also pointed towards an aggressive FED eager to control inflation even at the cost of growth. Both these factors lead to an increase in fear of recession in US. Resurgence of Covid cases in China leading to localized shutdowns in important cities of China aggravated the concerns on global growth.

Consequently, there was an all-round sharp sell off in equities all over the globe & major markets closed in the red with Brazil (-10%), Mexico (-9%) and US S&P 500 (-9%) topping the list.

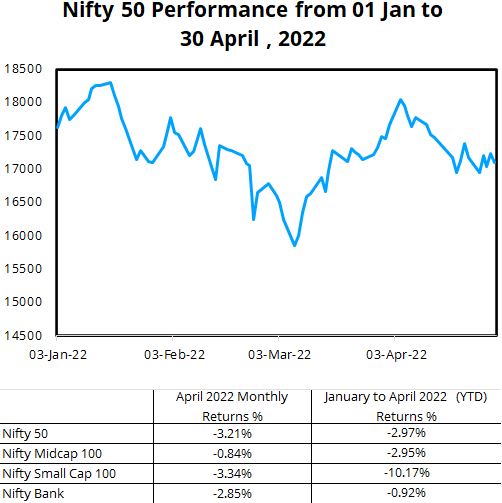

Nifty 50 lost 3% during the month while Nity Midcap & Small Cap lost 0.9% & 3.3% respectively in the same period. Sectors such as Metal, Realty, Capital Goods and IT saw sharp sell offs while, auto, consumer durables, FMCG, Public Sector Banks and healthcare sectors witnessed gains Oil and Gas sector gained majorly due to higher oil prices. Power sector was the biggest gainer with gains of 18% & IT was biggest looser with loss of 12% during the month.

Source: NSE Website

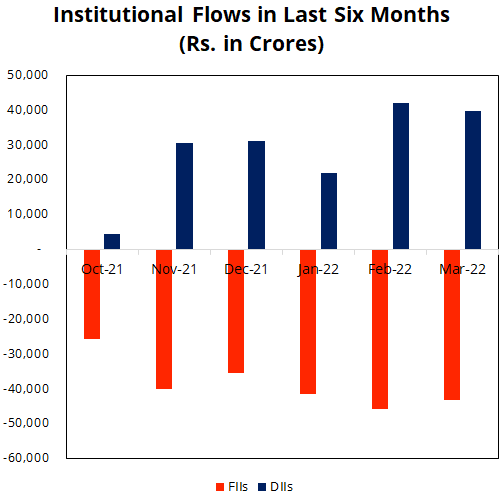

Source: Moneycontrol

A sharp rise in crude prices reignited fears of inflationary pressure on the US economy. Corporate earnings announced so far have failed to cheer the street U.S. stocks dropped as investors weighed fresh inflation data, disappointing results from Amazon and a warning on rising costs from Apple.

Now the expectations are that global economy will expand more slowly than predicted three months ago (US GDP contracted in Q1CT22 v/s expectations of expansion), similarly due to very high energy prices almost all economic activity is negatively impacted in Europe leading, to fears of no growth to negative growth in European region. Chinese growth is under pressure due to resurgence of Covid cases.

Investors are worried that Federal Reserve will tighten the economy into a recession. History indicates that in last 11 of 14 rate tightening cycles (since World War II), US had witnessed a recession within two years of start of tightening cycle. However, we believe it is too early to call out recession in US as corporate and consumer balance sheets are much stronger at this point of time as compared to previous times.

1. Liquidity tightening & start of rate increase cycle by RBI

In India, retail Inflation (CPI) spiked to 7% YoY in March 2022 vs. 6.1% in the previous month. The increase was mainly driven by higher food inflation. Fuel inflation remained lower than last month but is likely to inch up as the impact of increase in LPG prices and auto fuel duties trickle in. Further, core inflation remained at elevated level led by higher clothing and food and household goods & services inflation. The average inflation in Q4FY22 stood at 6.4%, thus crossing the RBI's upper bound of target range (6%). Wholesale Price Index (WPI) increased by 14.6% in March 22. We expect Inflation to inch up further & remain at elevated levels for next few months & taper off only towards the end of current fiscal. Since the CPI, the operating data point for RBI policy action, is above RBI’s mandate of managing inflation within 2% range of 4%, markets are expecting RBI to take aggressive action to tame inflation.

In a surprise move, on May 04, 2022, the RBI increased interest rates by 40 bps & increased CRR by 50 bps as part of its measures to control inflation. This was an action taken outside the scheduled RBI Monetary Policy meeting, showing the urgency on part of RBI. Net effect of both the actions by RBI will increase the cost of capital & reduce liquidity in the system. In its communication to markets the RBI has clarified that it (RBI) is likely to increase interest rates to near pre-covid levels sooner than later implying at least 2 rate hikes of 50 bps each in next 2 meetings. RBI has also changed its stance from accommodative to hawkish & intends to reduce liquidity substantially, though it maintained growth as its priority.

We believe RBI’s actions, have compelled equity markets to realize that era of very low cost of capital are behind us, hence de-rating of high valuation multiples has already started. More impact will seen on all rate sensitive sectors.

Our take on RBI action: while rate sensitives will be negatively impacted in near term, we believe initially rate hikes may not have too much impact on demand since even after increase in rates, we will still have interest rates similar to levels that were seen in Jan-March 2020 (pre-covid times). So, in a way this increase is just reversing the excess support provided to tackle covid.

2. India Q4FY22 corporate results –corporate profitability likely to shrink for third quarter in a row

While revenue momentum is sustained on back of price hikes, operating margin has declined sharply. In some sectors margin shrinkage is in range of 10 percentage points.

A decline in Ebitda margin for the third straight quarter is due to increase in input costs, first because of pandemic-inducted disruption in supply chains and now aggravated by Russia's invasion of Ukraine.

Our take on Q4FY22 earnings & possibility of Nifty 50 EPS downgrade

We believe Indian corporate profitability is likely to remain under pressure for few more quarters because there is very little improvement on supply side disruptions. Stalemate in Ukraine war & Chinese shut-downs of various ports is only aggravating the problem. While demand till now is resilient but it could taper off as benefits of pent-up demand vanish. Rising interest rates in US is likely to increase currency differential leading to weakening of INR thereby impacting imports & widening trade deficit.

We believe risk of Nifty 50 EPS downgrade is low because of the construct of the index. There are many companies in index which are beneficiaries of high commodity prices & size of these companies is very large, hence loss of some companies is more than made up by gains of these companies. Nifty 50 earnings are also driven by sharp improvement in numbers of banks (specially PSU) & these are not impacted by inflation thus risk to Nifty EPS is low. However, we wish to highlight that the pain of lower profitability is much more severe in stocks outside the index. So overall corporate profitability will be impacted negatively but may not show up in headline indices.

While our long-term view on equity continues to remain positive, the medium-term view is cautious due to global headwinds arising out of Monetary tightening by US Fed, rising inflation pressure due to geo-political tensions and moderating growth.

In near term we believe Indian market's performance will continue to be influenced by factors such as

For long term, we believe after about six -plus months into a correction (sharp, sentiment-fueled, small cap near 52 week lows) reacting to bad headlines is one of the most dangerous moves an investor can make. We believe inflation is likely to decelerate over the foreseeable future, albeit, it is impossible to know when and how high the inflation rate will peak.

We believe stocks are reacting to the fear, not pricing themselves at a fundamental level. In fact rising consumer prices can actually be a positive signal for corporate earnings. We believe once that fear works its way through, markets should resume weighing reality against those expectations, and it shouldn’t take much positive surprise to help fuel the strong bounce that usually follows corrections.

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.